- Poland

- /

- Life Sciences

- /

- WSE:RVU

Slammed 25% Ryvu Therapeutics S.A. (WSE:RVU) Screens Well Here But There Might Be A Catch

Unfortunately for some shareholders, the Ryvu Therapeutics S.A. (WSE:RVU) share price has dived 25% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

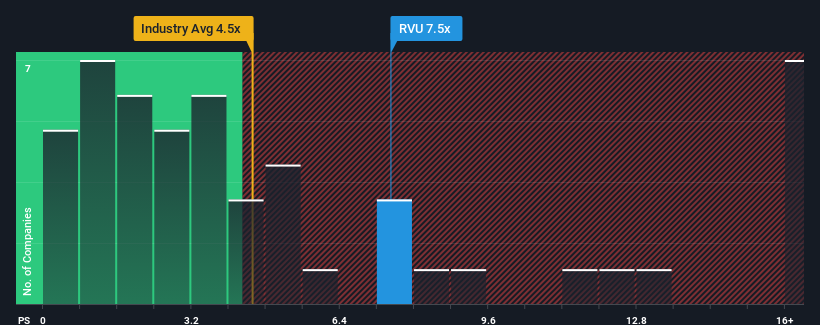

Following the heavy fall in price, Ryvu Therapeutics' price-to-sales (or "P/S") ratio of 7.5x might make it look like a strong buy right now compared to the wider Life Sciences industry in Poland, where around half of the companies have P/S ratios above 23.3x and even P/S above 250x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Ryvu Therapeutics

What Does Ryvu Therapeutics' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Ryvu Therapeutics has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ryvu Therapeutics.How Is Ryvu Therapeutics' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Ryvu Therapeutics' is when the company's growth is on track to lag the industry decidedly.

If we review the last year of revenue growth, the company posted a worthy increase of 8.3%. The latest three year period has also seen an excellent 250% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 9.6% each year as estimated by the three analysts watching the company. With the industry predicted to deliver 11% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's peculiar that Ryvu Therapeutics' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Ryvu Therapeutics' P/S Mean For Investors?

Having almost fallen off a cliff, Ryvu Therapeutics' share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Ryvu Therapeutics currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 3 warning signs for Ryvu Therapeutics (1 can't be ignored!) that you need to take into consideration.

If you're unsure about the strength of Ryvu Therapeutics' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:RVU

Ryvu Therapeutics

A clinical-stage drug discovery and development company, engages in developing of small molecule therapies for treatment in oncology in Poland, European Union, and internationally.

Good value with very low risk.

Market Insights

Community Narratives