The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Lubelski Wegiel Bogdanka S.A. (WSE:LWB) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Lubelski Wegiel Bogdanka

What Is Lubelski Wegiel Bogdanka's Debt?

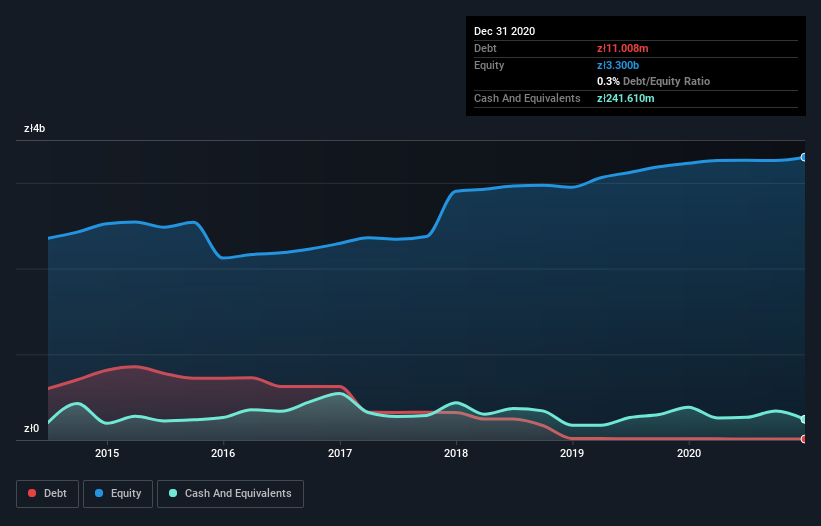

As you can see below, Lubelski Wegiel Bogdanka had zł11.0m of debt at December 2020, down from zł13.3m a year prior. However, it does have zł241.6m in cash offsetting this, leading to net cash of zł230.6m.

How Strong Is Lubelski Wegiel Bogdanka's Balance Sheet?

We can see from the most recent balance sheet that Lubelski Wegiel Bogdanka had liabilities of zł360.4m falling due within a year, and liabilities of zł715.1m due beyond that. On the other hand, it had cash of zł241.6m and zł278.6m worth of receivables due within a year. So its liabilities total zł555.2m more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of zł824.8m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. Despite its noteworthy liabilities, Lubelski Wegiel Bogdanka boasts net cash, so it's fair to say it does not have a heavy debt load!

In fact Lubelski Wegiel Bogdanka's saving grace is its low debt levels, because its EBIT has tanked 74% in the last twelve months. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Lubelski Wegiel Bogdanka can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While Lubelski Wegiel Bogdanka has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Lubelski Wegiel Bogdanka reported free cash flow worth 18% of its EBIT, which is really quite low. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Summing up

While Lubelski Wegiel Bogdanka does have more liabilities than liquid assets, it also has net cash of zł230.6m. So although we see some areas for improvement, we're not too worried about Lubelski Wegiel Bogdanka's balance sheet. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 1 warning sign with Lubelski Wegiel Bogdanka , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Lubelski Wegiel Bogdanka, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:LWB

Lubelski Wegiel Bogdanka

Engages in the hard coal mining business in Poland.

Flawless balance sheet and good value.