- Poland

- /

- Consumer Finance

- /

- WSE:KRU

Does KRUK Spólka Akcyjna (WSE:KRU) Have A Place In Your Dividend Portfolio?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Could KRUK Spólka Akcyjna (WSE:KRU) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

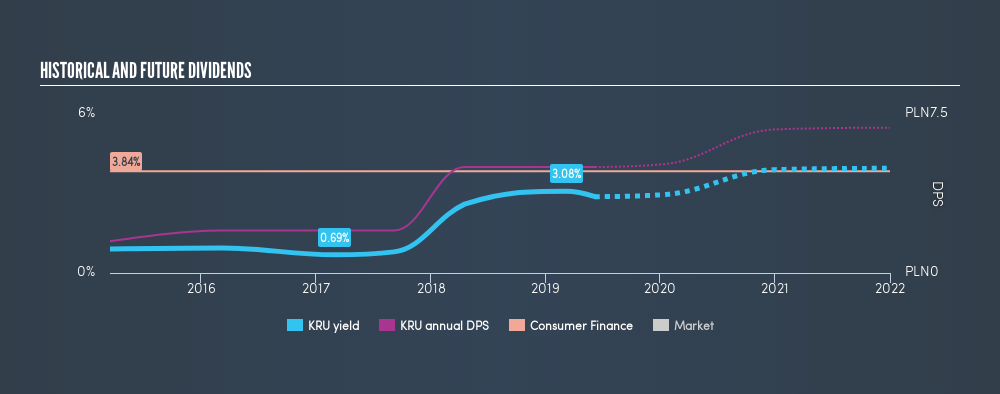

Investors might not know much about KRUK Spólka Akcyjna's dividend prospects, even though it has been paying dividends for the last four years and offers a 2.9% yield. A 2.9% yield is not inspiring, but the longer payment history has some appeal. Some simple research can reduce the risk of buying KRUK Spólka Akcyjna for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Looking at the data, we can see that 28% of KRUK Spólka Akcyjna's profits were paid out as dividends in the last 12 months. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

Remember, you can always get a snapshot of KRUK Spólka Akcyjna's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. KRUK Spólka Akcyjna has been paying a dividend for the past four years. The company has been paying a stable dividend for a few years now, but we'd like to see more evidence of consistency over a longer period. During the past four-year period, the first annual payment was zł1.50 in 2015, compared to zł5.00 last year. Dividends per share have grown at approximately 35% per year over this time.

We're not overly excited about the relatively short history of dividend payments, however the dividend is growing at a nice rate and we might take a closer look.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see KRUK Spólka Akcyjna has grown its earnings per share at 25% per annum over the past five years. Earnings per share have rocketed in recent times, and we like that the company is retaining more than half of its earnings to reinvest. However, always remember that very few companies can grow at double digit rates forever.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Firstly, we like that KRUK Spólka Akcyjna has a low and conservative payout ratio. Next, earnings growth has been good, but unfortunately the company has not been paying dividends as long as we'd like. KRUK Spólka Akcyjna has a number of positive attributes, but falls short of our ideal dividend company. It may be worth a look at the right price, though.

Companies that are growing earnings tend to be the best dividend stocks over the long term. See what the 7 analysts we track are forecasting for KRUK Spólka Akcyjna for free with public analyst estimates for the company.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About WSE:KRU

KRUK Spólka Akcyjna

Engages in the management of debt in Poland, Romania, Italy, the Czech Republic, Slovakia, Germany, Spain, and internationally.

Very undervalued second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives