- Poland

- /

- Capital Markets

- /

- WSE:GNS

Investors ignore increasing losses at Grupa Niewiadów - PGM (WSE:GNS) as stock jumps 10% this past week

It hasn't been the best quarter for Grupa Niewiadów - PGM S.A. (WSE:GNS) shareholders, since the share price has fallen 16% in that time. But that doesn't displace its brilliant performance over three years. In fact, the share price has taken off in that time, up 948%. As long term investors the recent fall doesn't detract all that much from the longer term story. The only way to form a view of whether the current price is justified is to consider the merits of the business itself. We love happy stories like this one. The company should be really proud of that performance!

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Grupa Niewiadów - PGM wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years Grupa Niewiadów - PGM has grown its revenue at 134% annually. That's well above most pre-profit companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 119% per year, over the same period. Despite the strong run, top performers like Grupa Niewiadów - PGM have been known to go on winning for decades. So we'd recommend you take a closer look at this one, or even put it on your watchlist.

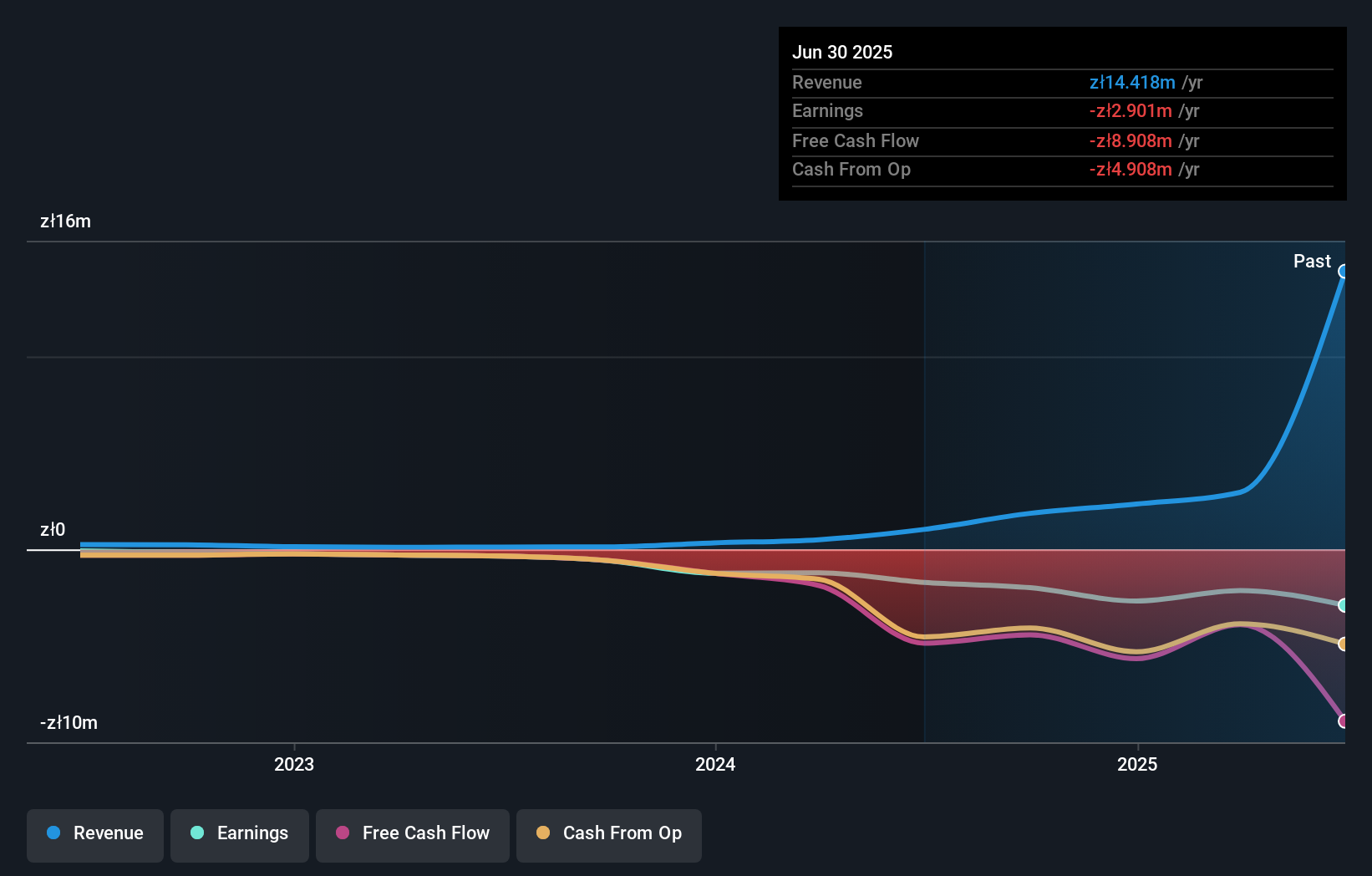

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Grupa Niewiadów - PGM's financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Grupa Niewiadów - PGM shareholders have received a total shareholder return of 829% over one year. That's better than the annualised return of 34% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Grupa Niewiadów - PGM (2 are significant) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:GNS

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026