- Poland

- /

- Food and Staples Retail

- /

- WSE:BIP

Investors Still Aren't Entirely Convinced By Bio Planet S.A.'s (WSE:BIP) Revenues Despite 38% Price Jump

Bio Planet S.A. (WSE:BIP) shareholders have had their patience rewarded with a 38% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 35%.

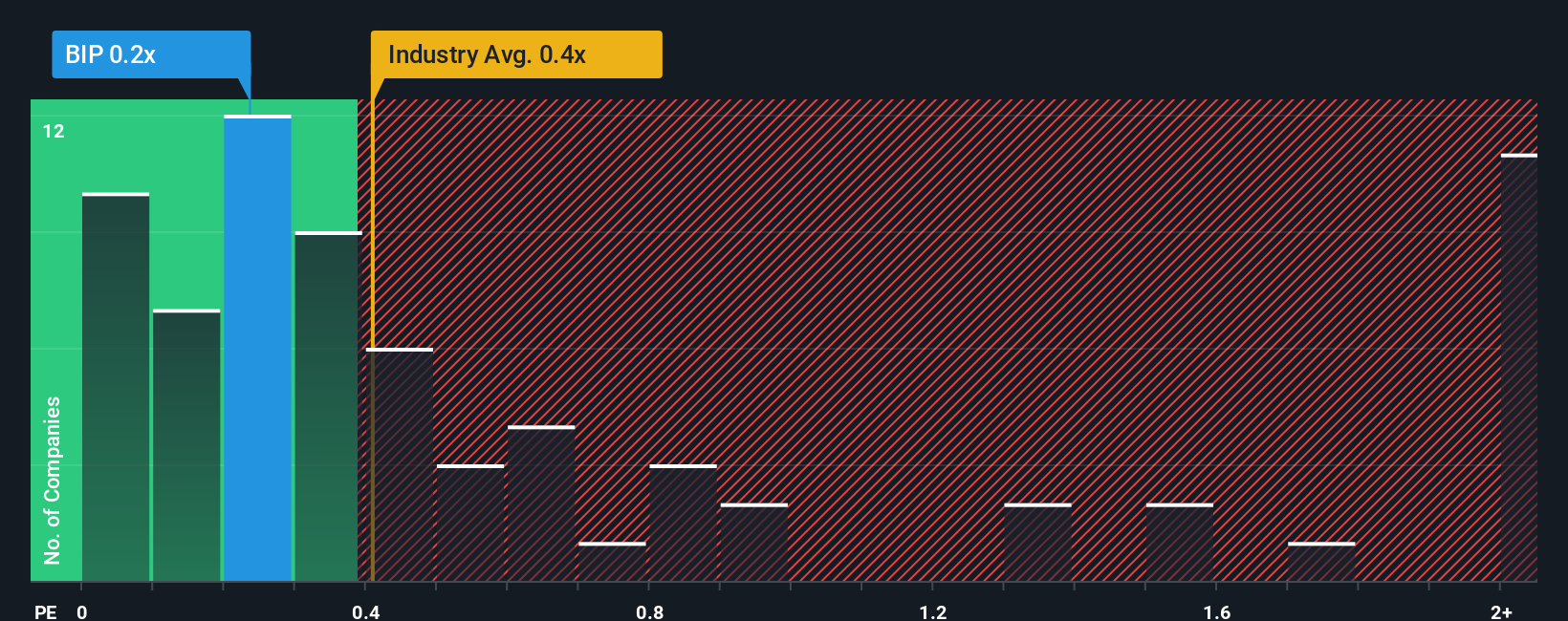

Although its price has surged higher, you could still be forgiven for feeling indifferent about Bio Planet's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Consumer Retailing industry in Poland is also close to 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Bio Planet

What Does Bio Planet's Recent Performance Look Like?

The revenue growth achieved at Bio Planet over the last year would be more than acceptable for most companies. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Bio Planet will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Bio Planet, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Bio Planet would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. Pleasingly, revenue has also lifted 46% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 4.8%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Bio Planet's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Its shares have lifted substantially and now Bio Planet's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To our surprise, Bio Planet revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

You need to take note of risks, for example - Bio Planet has 4 warning signs (and 1 which is a bit concerning) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bio Planet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:BIP

Bio Planet

Produces and distributes organic food products in Poland and internationally.

Proven track record with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)