- Poland

- /

- Consumer Durables

- /

- WSE:DOM

European Dividend Stocks To Watch In May 2025

Reviewed by Simply Wall St

As European markets face renewed volatility due to proposed U.S. tariffs, the pan-European STOXX Europe 600 Index has snapped a five-week streak of gains, reflecting broader economic uncertainties. Despite these challenges, dividend stocks remain an attractive option for investors seeking steady income and potential resilience in fluctuating market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.33% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.82% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.37% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.34% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.95% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.09% | ★★★★★★ |

| ERG (BIT:ERG) | 5.60% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.74% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.46% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.48% | ★★★★★★ |

Click here to see the full list of 231 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Sodexo (ENXTPA:SW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sodexo S.A. is a global company offering food services and facilities management, with a market cap of €8.89 billion.

Operations: Sodexo S.A. generates its revenue from Europe (€8.53 billion), North America (€11.33 billion), and the Rest of the World (€4.31 billion) through its diverse range of services.

Dividend Yield: 4.4%

Sodexo's dividend payments have been volatile over the past decade, with a payout ratio of 57.3% and cash payout ratio of 58.1%, suggesting dividends are covered by earnings and cash flows. Despite this, its dividend yield of 4.36% is lower than the top quartile in France. The company recently initiated a share buyback program worth up to €1.6 billion, potentially impacting future dividend stability as it manages high debt levels while pursuing growth opportunities like its partnership with AtlantiCare.

- Dive into the specifics of Sodexo here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Sodexo is priced lower than what may be justified by its financials.

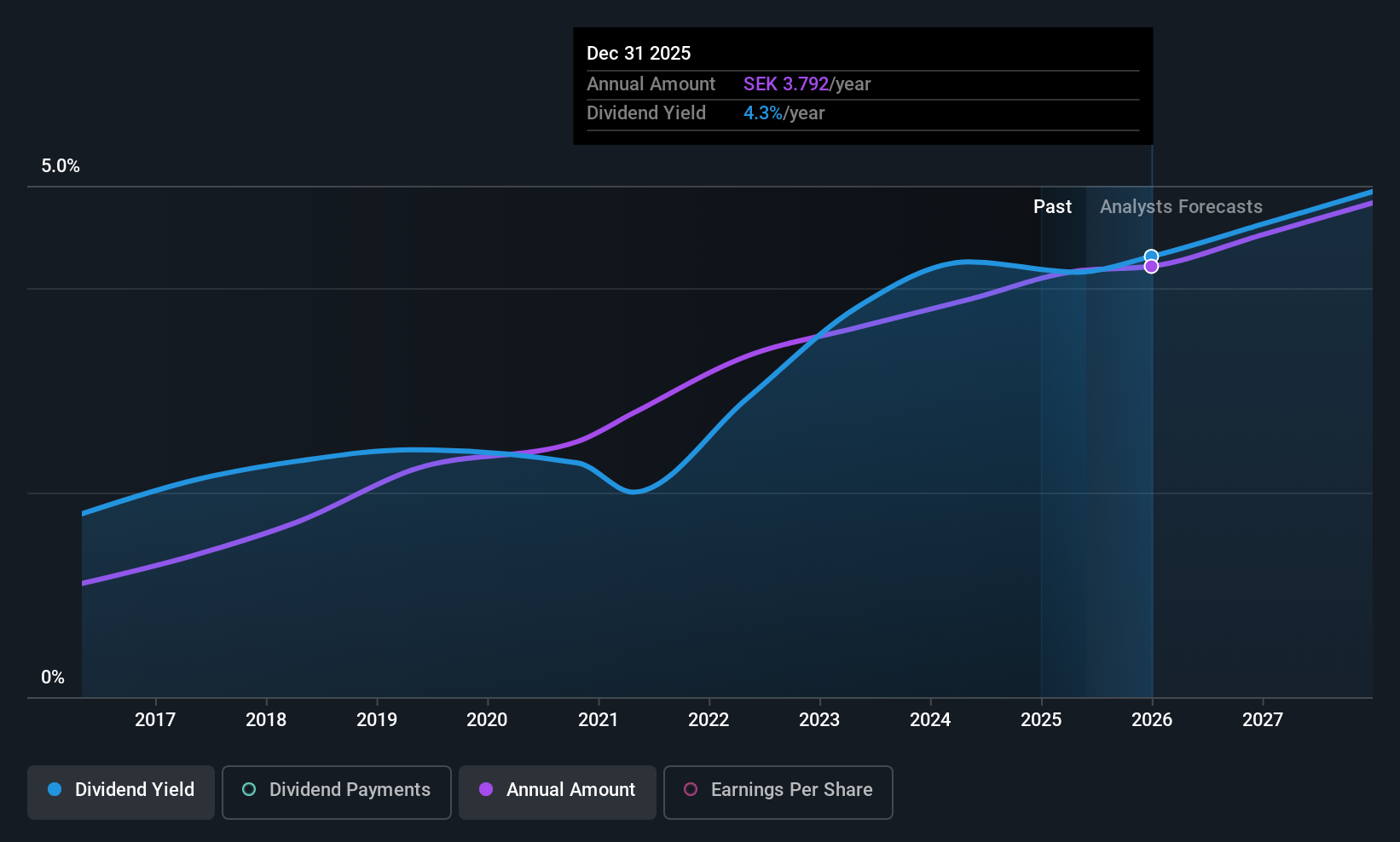

Bravida Holding (OM:BRAV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bravida Holding AB (publ) offers technical services and installations for buildings and industrial facilities across Sweden, Norway, Denmark, and Finland with a market cap of SEK18.09 billion.

Operations: Bravida Holding AB (publ) generates revenue from providing technical services and installations for buildings and industrial facilities in Sweden, Norway, Denmark, and Finland.

Dividend Yield: 4.2%

Bravida Holding's dividend yield of 4.24% ranks in the top 25% among Swedish dividend payers, supported by a sustainable payout ratio of 70.8%. Despite a decline in Q1 sales to SEK 6.89 billion, net income rose to SEK 227 million, reflecting earnings growth potential. The company's dividends are well-covered by cash flows with a cash payout ratio of 44.5%, although it has paid dividends for less than a decade, indicating limited historical reliability.

- Take a closer look at Bravida Holding's potential here in our dividend report.

- According our valuation report, there's an indication that Bravida Holding's share price might be on the cheaper side.

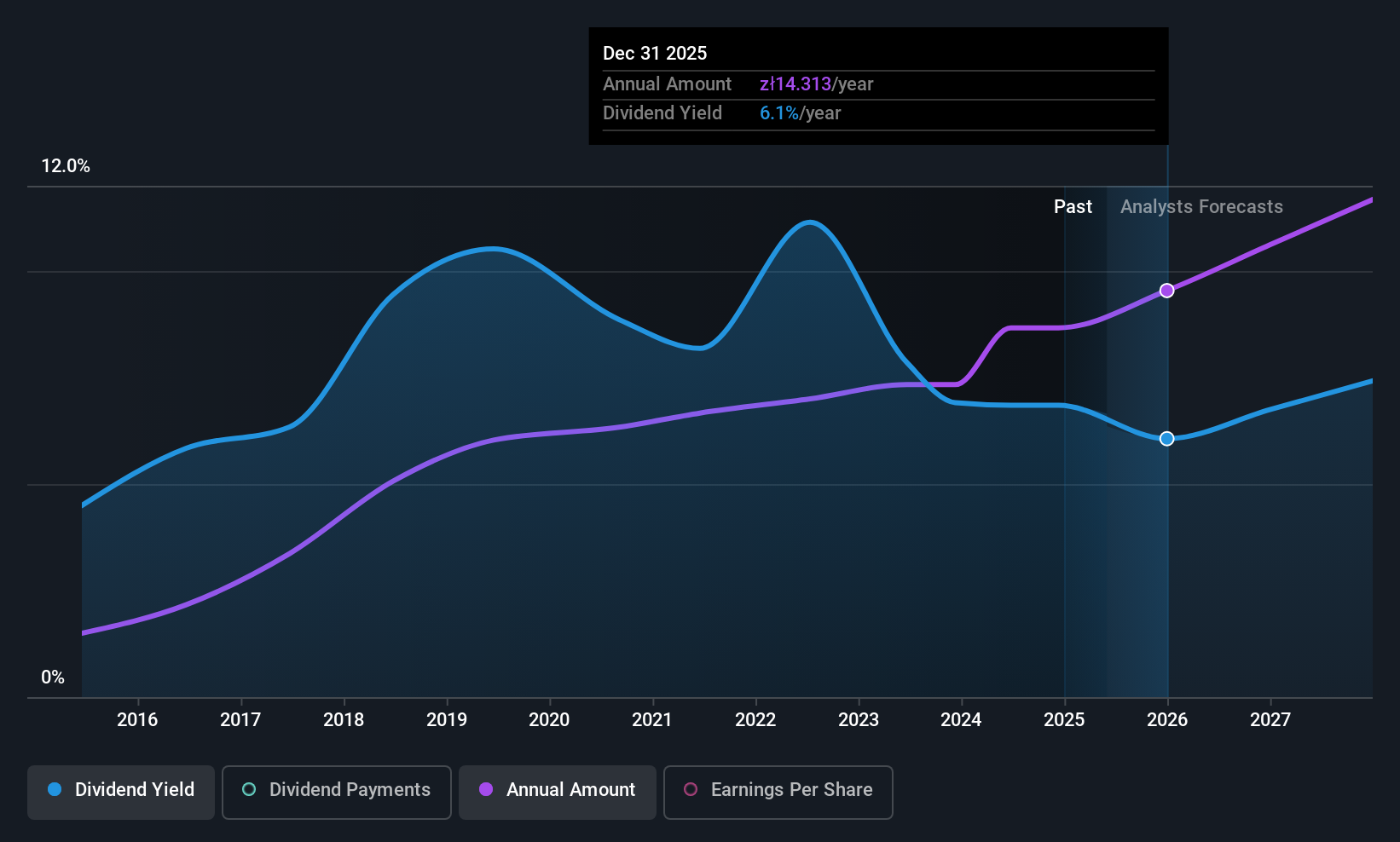

Dom Development (WSE:DOM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dom Development S.A. operates in Poland, focusing on the development and sale of residential and commercial real estate properties, with a market cap of PLN6.27 billion.

Operations: Dom Development S.A.'s revenue is primarily derived from its activities in the development and sale of residential and commercial real estate properties in Poland.

Dividend Yield: 5.3%

Dom Development's dividend yield of 5.35% is lower than the top 25% of Polish dividend payers, and its high cash payout ratio (103.3%) suggests dividends are not well-covered by free cash flow, although earnings coverage is reasonable with a payout ratio of 65%. Despite stable and reliable dividends over the past decade, recent earnings growth—32.3% last year—highlights potential sustainability challenges if cash flow issues persist. The stock trades at a discount to estimated fair value.

- Unlock comprehensive insights into our analysis of Dom Development stock in this dividend report.

- In light of our recent valuation report, it seems possible that Dom Development is trading behind its estimated value.

Next Steps

- Click this link to deep-dive into the 231 companies within our Top European Dividend Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:DOM

Dom Development

Engages in the development and sale of residential and commercial real estate properties, and related support activities in Poland.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives