- Poland

- /

- Commercial Services

- /

- WSE:SUL

Investors Shouldn't Be Too Comfortable With Summa Linguae's (WSE:SUL) Robust Earnings

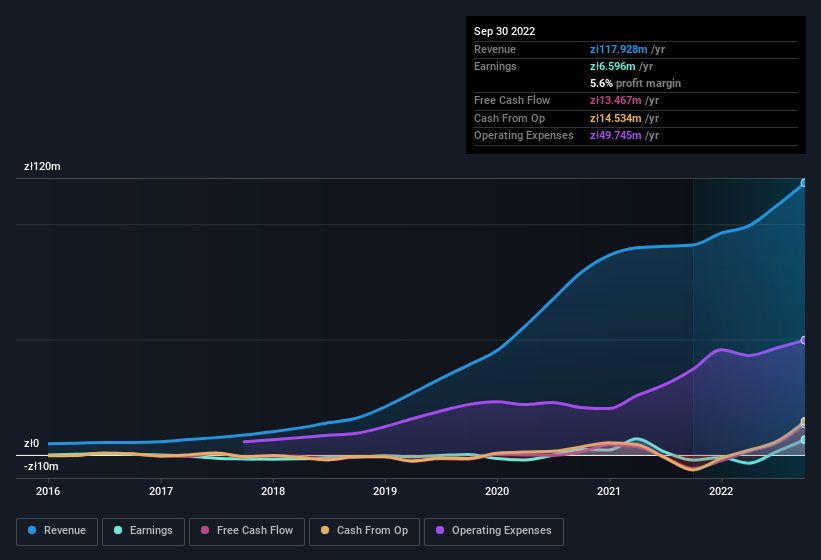

Summa Linguae S.A. (WSE:SUL) announced strong profits, but the stock was stagnant. We did some digging, and we found some concerning factors in the details.

Check out the opportunities and risks within the PL Commercial Services industry.

To understand the value of a company's earnings growth, it is imperative to consider any dilution of shareholders' interests. As it happens, Summa Linguae issued 18% more new shares over the last year. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Summa Linguae's EPS by clicking here.

How Is Dilution Impacting Summa Linguae's Earnings Per Share (EPS)?

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. Even looking at the last year, profit was still down . Sadly, earnings per share fell further, down a full 9.9% in that time. Therefore, the dilution is having a noteworthy influence on shareholder returns.

If Summa Linguae's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Summa Linguae.

How Do Unusual Items Influence Profit?

On top of the dilution, we should also consider the zł2.1m impact of unusual items in the last year, which had the effect of suppressing profit. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. If Summa Linguae doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Summa Linguae's Profit Performance

Summa Linguae suffered from unusual items which depressed its profit in its last report; if that is not repeated then profit should be higher, all else being equal. But on the other hand, the company issued more shares, so without buying more shares each shareholder will end up with a smaller part of the profit. Given the contrasting considerations, we don't have a strong view as to whether Summa Linguae's profits are an apt reflection of its underlying potential for profit. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. You'd be interested to know, that we found 3 warning signs for Summa Linguae and you'll want to know about these.

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:SUL

Summa Linguae

Summa Linguae S.A. primarily provides data, translation, and managed services in Poland.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives