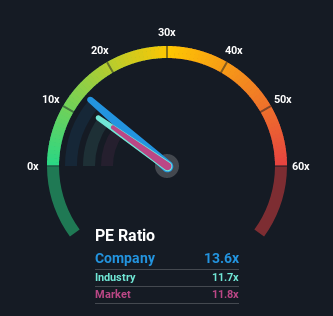

With a median price-to-earnings (or "P/E") ratio of close to 12x in Poland, you could be forgiven for feeling indifferent about Remor Solar Polska S.A.'s (WSE:RSP) P/E ratio of 13.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Recent times have been quite advantageous for Remor Solar Polska as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Remor Solar Polska

Is There Some Growth For Remor Solar Polska?

Remor Solar Polska's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings growth, the company posted a terrific increase of 106%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

In contrast to the company, the rest of the market is expected to decline by 6.1% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we find it odd that Remor Solar Polska is trading at a fairly similar P/E to the market. It looks like most investors are not convinced the company can maintain its recent positive growth rate in the face of a shrinking broader market.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Remor Solar Polska currently trades on a lower than expected P/E since its recent three-year earnings growth is beating forecasts for a struggling market. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. One major risk is whether its earnings trajectory can keep outperforming under these tough market conditions. It appears some are indeed anticipating earnings instability, because this relative performance should normally provide a boost to the share price.

Plus, you should also learn about these 4 warning signs we've spotted with Remor Solar Polska (including 2 which are concerning).

If these risks are making you reconsider your opinion on Remor Solar Polska, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:RSP

Remor Solar Polska

Engages in design and implementation of projects to install photovoltaic ground and roof structure systems in Poland.

Flawless balance sheet and good value.

Market Insights

Community Narratives