Remor Solar Polska S.A. (WSE:RSP) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 39% in that time.

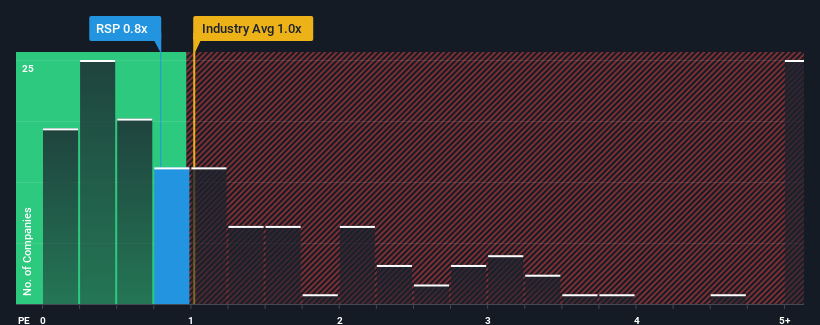

Even after such a large drop in price, there still wouldn't be many who think Remor Solar Polska's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when it essentially matches the median P/S in Poland's Electrical industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Remor Solar Polska

How Remor Solar Polska Has Been Performing

Revenue has risen firmly for Remor Solar Polska recently, which is pleasing to see. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Remor Solar Polska will help you shine a light on its historical performance.How Is Remor Solar Polska's Revenue Growth Trending?

Remor Solar Polska's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 15% gain to the company's top line. Pleasingly, revenue has also lifted 297% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 8.6% shows it's noticeably more attractive.

With this information, we find it interesting that Remor Solar Polska is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Bottom Line On Remor Solar Polska's P/S

Remor Solar Polska's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't quite envision Remor Solar Polska's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Before you take the next step, you should know about the 4 warning signs for Remor Solar Polska (1 is potentially serious!) that we have uncovered.

If these risks are making you reconsider your opinion on Remor Solar Polska, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Remor Solar Polska, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:RSP

Remor Solar Polska

Engages in design and implementation of projects to install photovoltaic ground and roof structure systems in Poland.

Flawless balance sheet and good value.

Market Insights

Community Narratives