- Poland

- /

- Electrical

- /

- WSE:ELQ

ELQ S.A.'s (WSE:ELQ) P/S Is Still On The Mark Following 119% Share Price Bounce

ELQ S.A. (WSE:ELQ) shareholders would be excited to see that the share price has had a great month, posting a 119% gain and recovering from prior weakness. The last month tops off a massive increase of 111% in the last year.

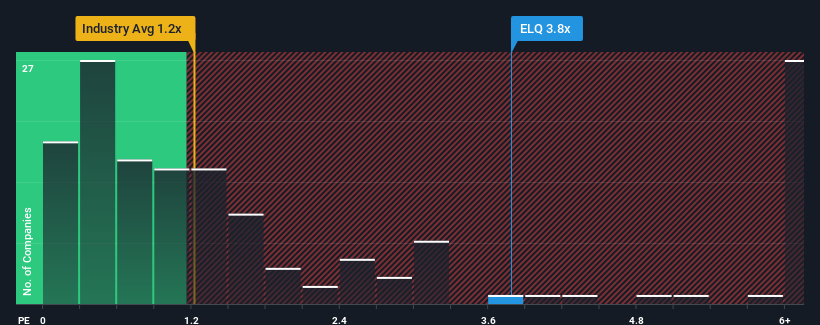

After such a large jump in price, when almost half of the companies in Poland's Electrical industry have price-to-sales ratios (or "P/S") below 1x, you may consider ELQ as a stock not worth researching with its 3.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for ELQ

How ELQ Has Been Performing

With revenue growth that's inferior to most other companies of late, ELQ has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on ELQ will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For ELQ?

In order to justify its P/S ratio, ELQ would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The amazing performance means it was also able to grow revenue by 258% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 80% each year during the coming three years according to the one analyst following the company. With the industry only predicted to deliver 8.7% each year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that ELQ's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On ELQ's P/S

ELQ's P/S has grown nicely over the last month thanks to a handy boost in the share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that ELQ maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electrical industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for ELQ (2 are a bit unpleasant!) that you should be aware of.

If you're unsure about the strength of ELQ's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade ELQ, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ELQ might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ELQ

ELQ

Produces and sells transformer substations for renewable energy sources in Poland.

Excellent balance sheet slight.

Market Insights

Community Narratives