Amid renewed concerns over inflated AI stock valuations and receding expectations for a U.S. interest rate cut, European markets have experienced notable declines, with the STOXX Europe 600 Index dropping by 2.21%. Despite this downturn, the eurozone's business activity continues to expand steadily, providing a backdrop for investors seeking stability through dividend stocks. In such a climate, choosing stocks that offer consistent dividends can be an effective strategy to enhance portfolio resilience and generate income amidst market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.41% | ★★★★★★ |

| Sulzer (SWX:SUN) | 3.12% | ★★★★★☆ |

| Sonae SGPS (ENXTLS:SON) | 4.05% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.16% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.93% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.56% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.84% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.19% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.62% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.67% | ★★★★★★ |

Click here to see the full list of 217 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

HEXPOL (OM:HPOL B)

Simply Wall St Dividend Rating: ★★★★★★

Overview: HEXPOL AB (publ) is a company that develops, manufactures, and sells polymer compounds and engineered products such as gaskets, seals, and wheels across Sweden, Europe, the United States, the Americas, and Asia with a market cap of approximately SEK29.35 billion.

Operations: HEXPOL AB's revenue is primarily derived from its HEXPOL Compounding segment, which generated SEK18.65 billion, and its HEXPOL Engineered Products segment, contributing SEK1.70 billion.

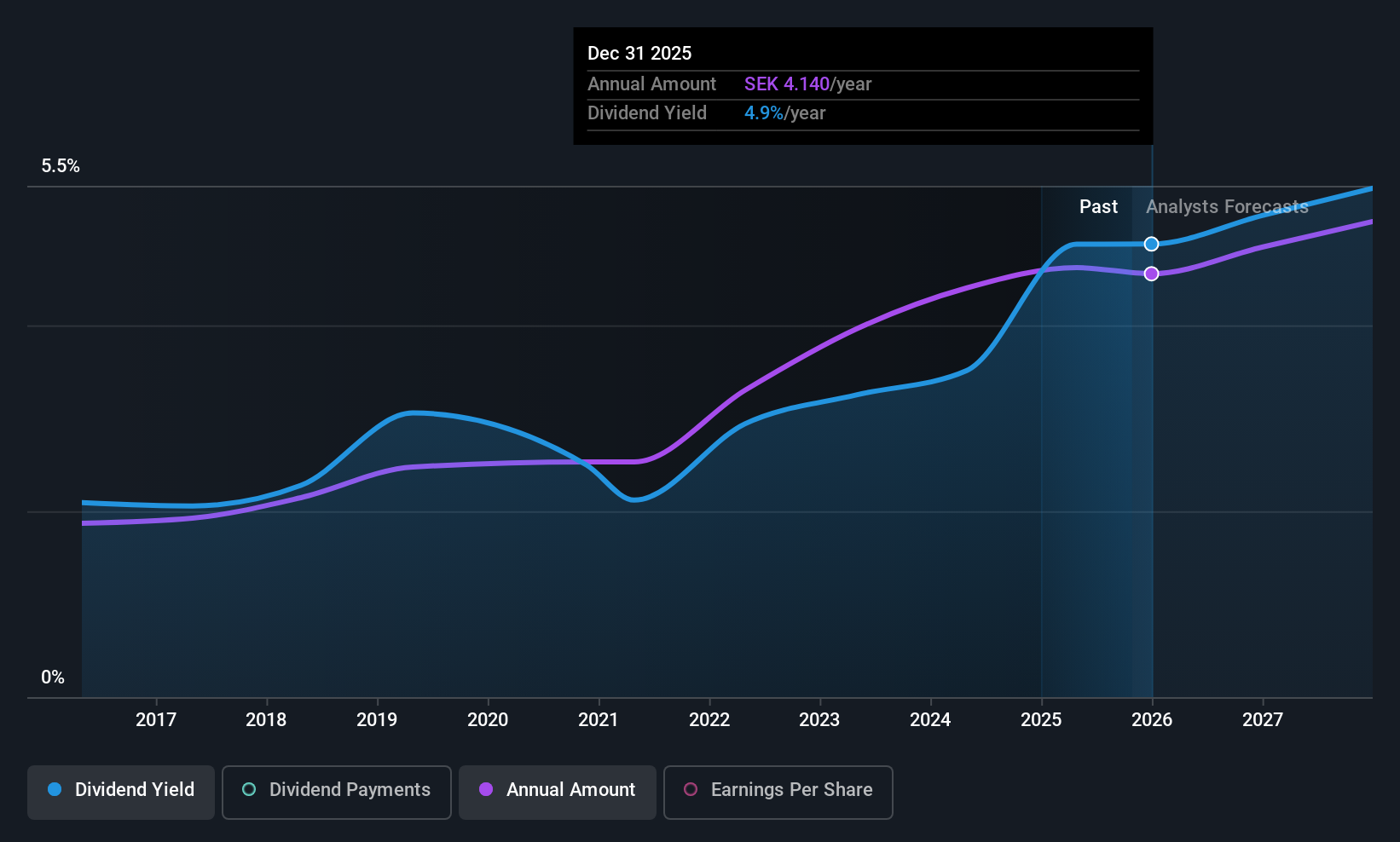

Dividend Yield: 4.9%

HEXPOL's dividends are well-supported by both earnings and cash flows, with a payout ratio of 73.9%. The company has consistently increased its dividend payments over the past decade, maintaining stability and reliability. Despite recent declines in sales and net income, HEXPOL remains committed to growth through M&A activities, supported by a strong balance sheet. Its dividend yield of 4.93% places it in the top tier among Swedish market dividend payers.

- Navigate through the intricacies of HEXPOL with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of HEXPOL shares in the market.

DKSH Holding (SWX:DKSH)

Simply Wall St Dividend Rating: ★★★★★★

Overview: DKSH Holding AG offers market expansion services across Thailand, Greater China, Malaysia, Singapore, and the Asia Pacific region with a market cap of CHF3.65 billion.

Operations: DKSH Holding AG generates revenue through its segments in Healthcare (CHF5.81 billion), Consumer Goods (CHF3.43 billion), Performance Materials (CHF1.39 billion), and Technology (CHF543.30 million).

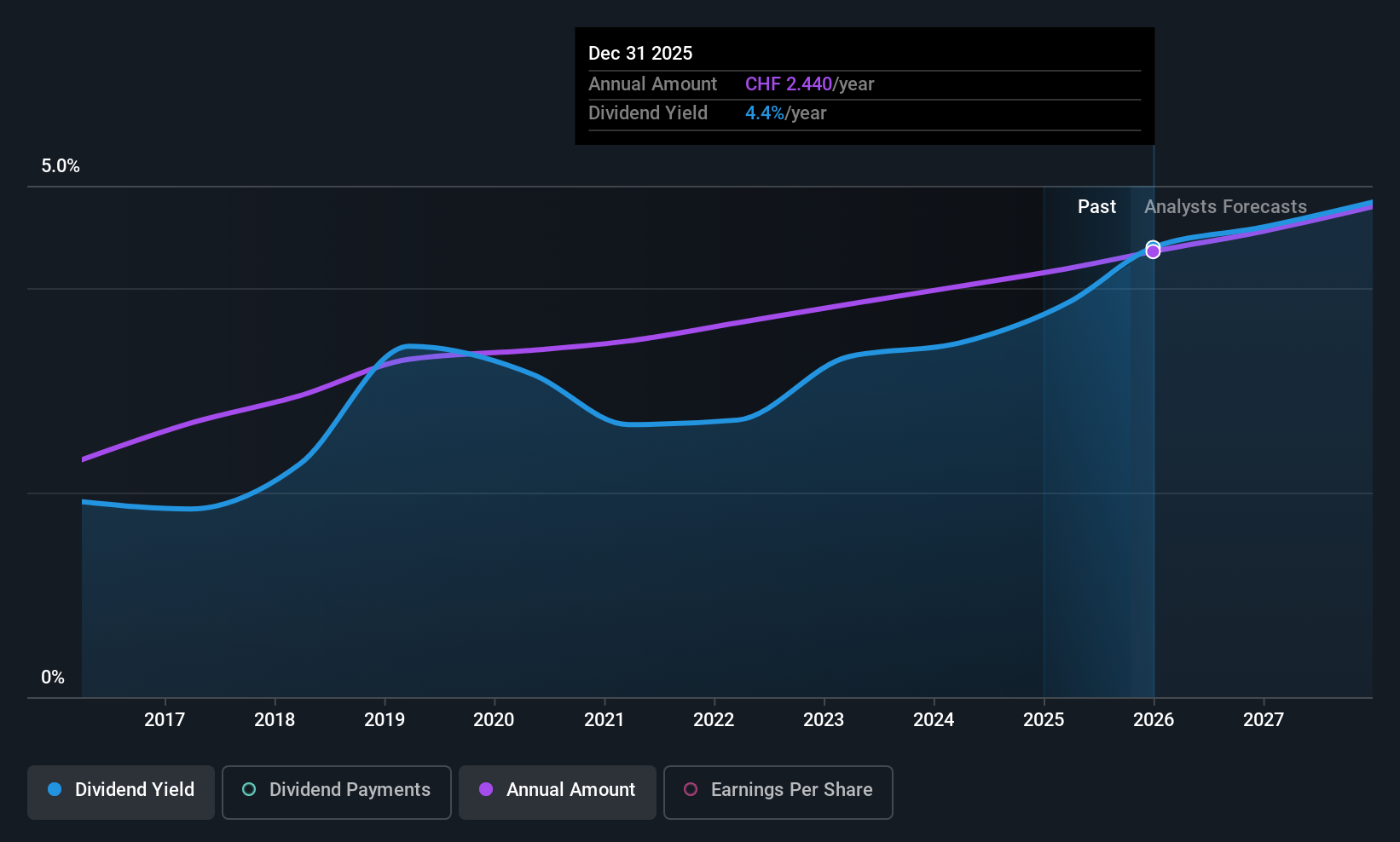

Dividend Yield: 4.2%

DKSH Holding's dividends have been stable and growing over the past decade, supported by a cash payout ratio of 54.5% and an earnings payout ratio of 78.2%. Trading at 44.1% below its estimated fair value, DKSH offers a dividend yield of 4.19%, ranking in the top quartile in Switzerland. Recent strategic moves include exploring an acquisition of Swixx Biopharma and expanding partnerships in consumer goods, reflecting ongoing efforts to enhance market presence and operational capabilities.

- Click here to discover the nuances of DKSH Holding with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that DKSH Holding is priced lower than what may be justified by its financials.

Santander Bank Polska (WSE:SPL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Santander Bank Polska S.A. offers a range of banking products and services to individuals, SMEs, corporate clients, and public sector institutions, with a market cap of PLN52.14 billion.

Operations: Santander Bank Polska S.A.'s revenue is primarily derived from Retail Banking (PLN10.18 billion), Business and Corporate Banking (PLN2.92 billion), and Corporate & Investment Banking (PLN1.53 billion).

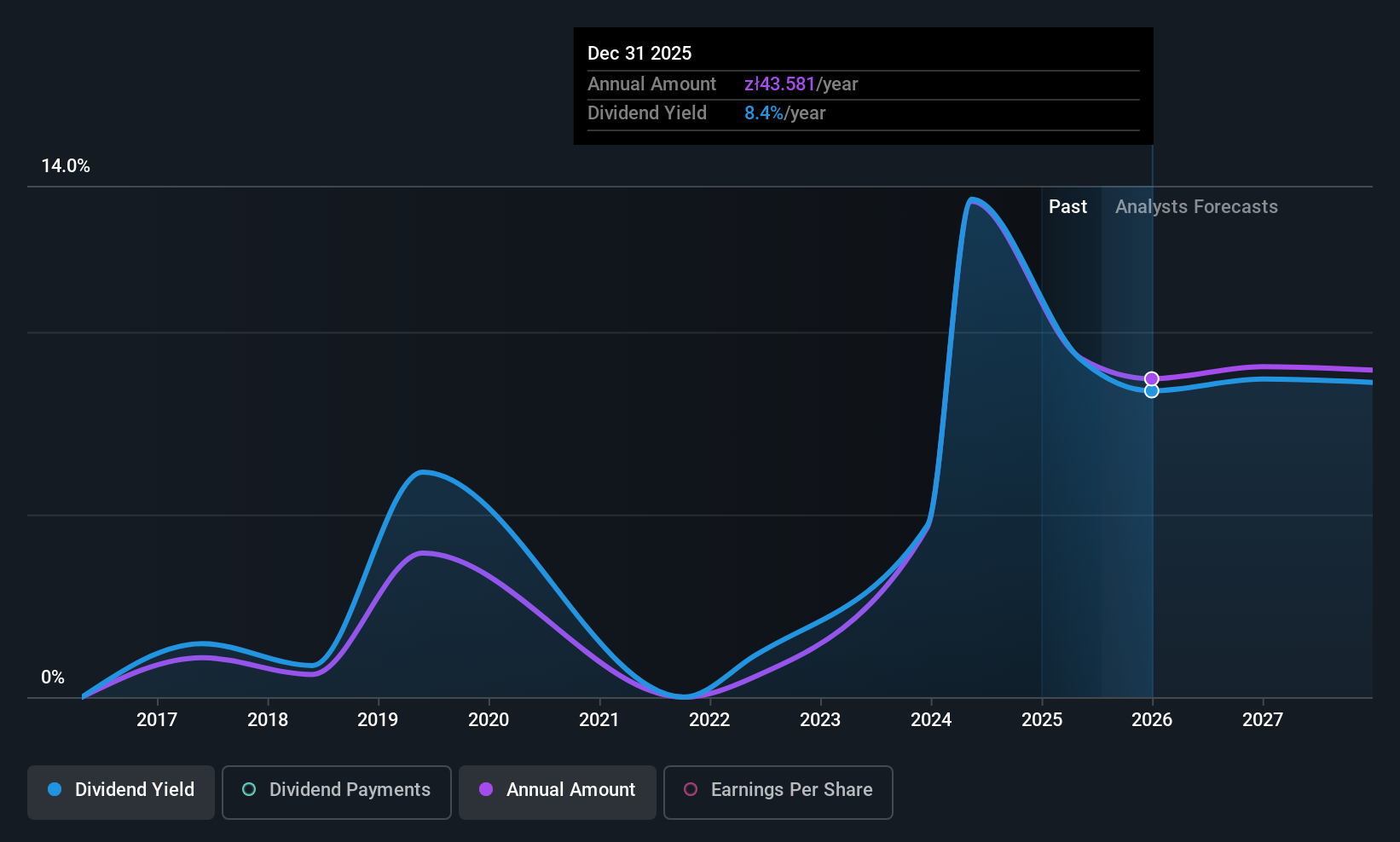

Dividend Yield: 9.1%

Santander Bank Polska offers a high dividend yield of 9.09%, placing it in the top quartile among Polish dividend payers, though its historical payouts have been volatile. Despite trading at a discount to estimated fair value, concerns include a high bad loans ratio of 4.1% and large one-off items affecting earnings quality. Recent earnings showed stable net interest income growth, with dividends currently covered by an 84.1% payout ratio and forecasted coverage improving to 74.8%.

- Unlock comprehensive insights into our analysis of Santander Bank Polska stock in this dividend report.

- The valuation report we've compiled suggests that Santander Bank Polska's current price could be quite moderate.

Turning Ideas Into Actions

- Reveal the 217 hidden gems among our Top European Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HEXPOL might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HPOL B

HEXPOL

Develops, manufactures, and sells various polymer compounds and engineered gaskets, seals, and wheels in Sweden, rest of Europe, the United States, rest of the Americas, and Asia.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success