As European markets navigate the complexities of U.S. trade policy and economic uncertainties, the pan-European STOXX Europe 600 Index recently snapped a 10-week winning streak, reflecting investor caution. Amidst this backdrop, dividend stocks can offer a measure of stability and income potential, making them an appealing choice for investors seeking to balance risk with returns in today's fluctuating market environment.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.26% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.15% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.80% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.81% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.78% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.09% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.15% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.30% | ★★★★★★ |

| VERBUND (WBAG:VER) | 5.88% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

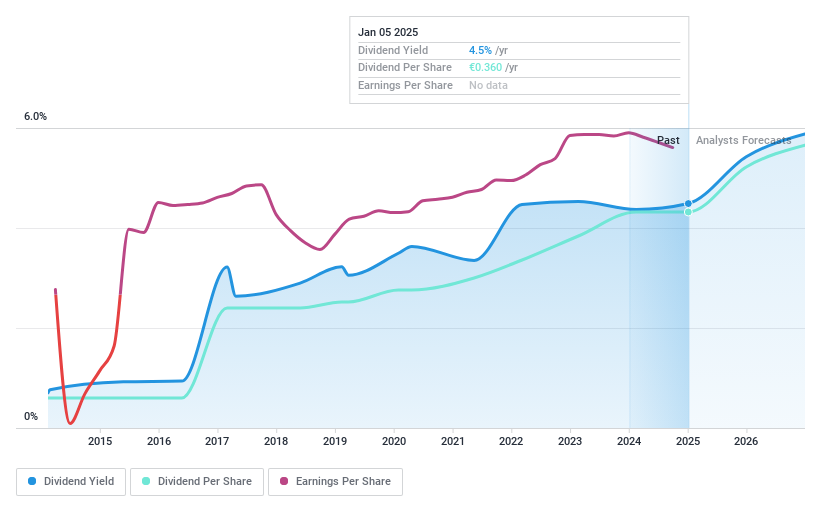

Telekom Austria (WBAG:TKA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Telekom Austria AG, with a market cap of €5.78 billion, offers fixed-line and mobile communications solutions across Austria and several Eastern European countries including Belarus, Bulgaria, Croatia, North Macedonia, Serbia, and Slovenia.

Operations: Telekom Austria AG generates its revenue primarily from Wireless Communications Services, which amounted to €5.32 billion.

Dividend Yield: 4.6%

Telekom Austria's dividend stability and growth over the past decade, with a proposed 11% increase to €0.40 per share, indicate a commitment to rewarding shareholders. While its 4.59% yield is below top-tier Austrian payers, dividends are well-covered by earnings (42.4% payout ratio) and cash flows (28.7%). Recent financials show stable revenue growth and consistent earnings, supporting sustainable dividend payments despite trading at a significant discount to estimated fair value.

- Dive into the specifics of Telekom Austria here with our thorough dividend report.

- Our valuation report unveils the possibility Telekom Austria's shares may be trading at a discount.

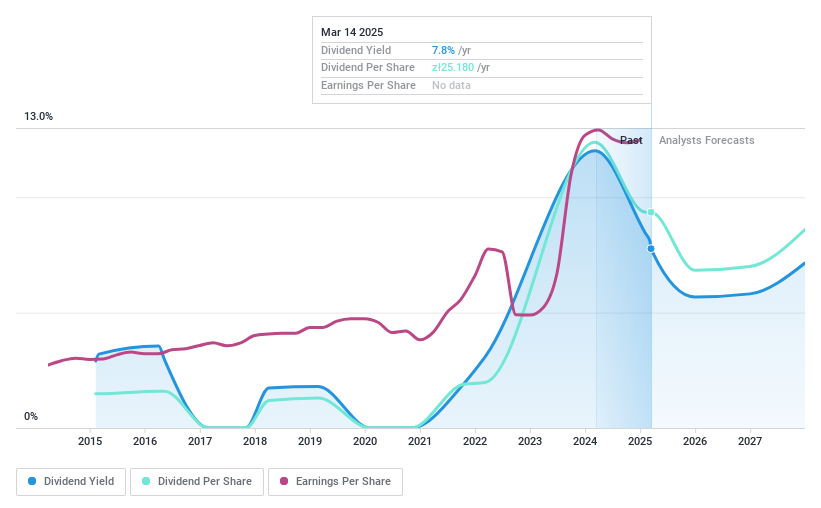

ING Bank Slaski (WSE:ING)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ING Bank Slaski S.A. operates in Poland, offering a range of banking products and services to retail clients and businesses, with a market cap of PLN41.57 billion.

Operations: ING Bank Slaski S.A. generates revenue through its Retail Banking segment, which accounts for PLN4.74 billion, and its Corporate Banking segment, contributing PLN5.01 billion.

Dividend Yield: 7.9%

ING Bank Slaski's dividend yield ranks in the top 25% of Polish payers, although its track record is marked by volatility and recent decreases. Current dividends are covered by a 75% payout ratio, with future coverage expected to improve slightly. Despite earnings forecasted to decline, revenue growth is anticipated at 6.75% annually. However, high bad loans (3.4%) and low allowance (66%) pose risks to financial stability and dividend reliability. Recent earnings show modest income growth year-on-year.

- Get an in-depth perspective on ING Bank Slaski's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that ING Bank Slaski is trading behind its estimated value.

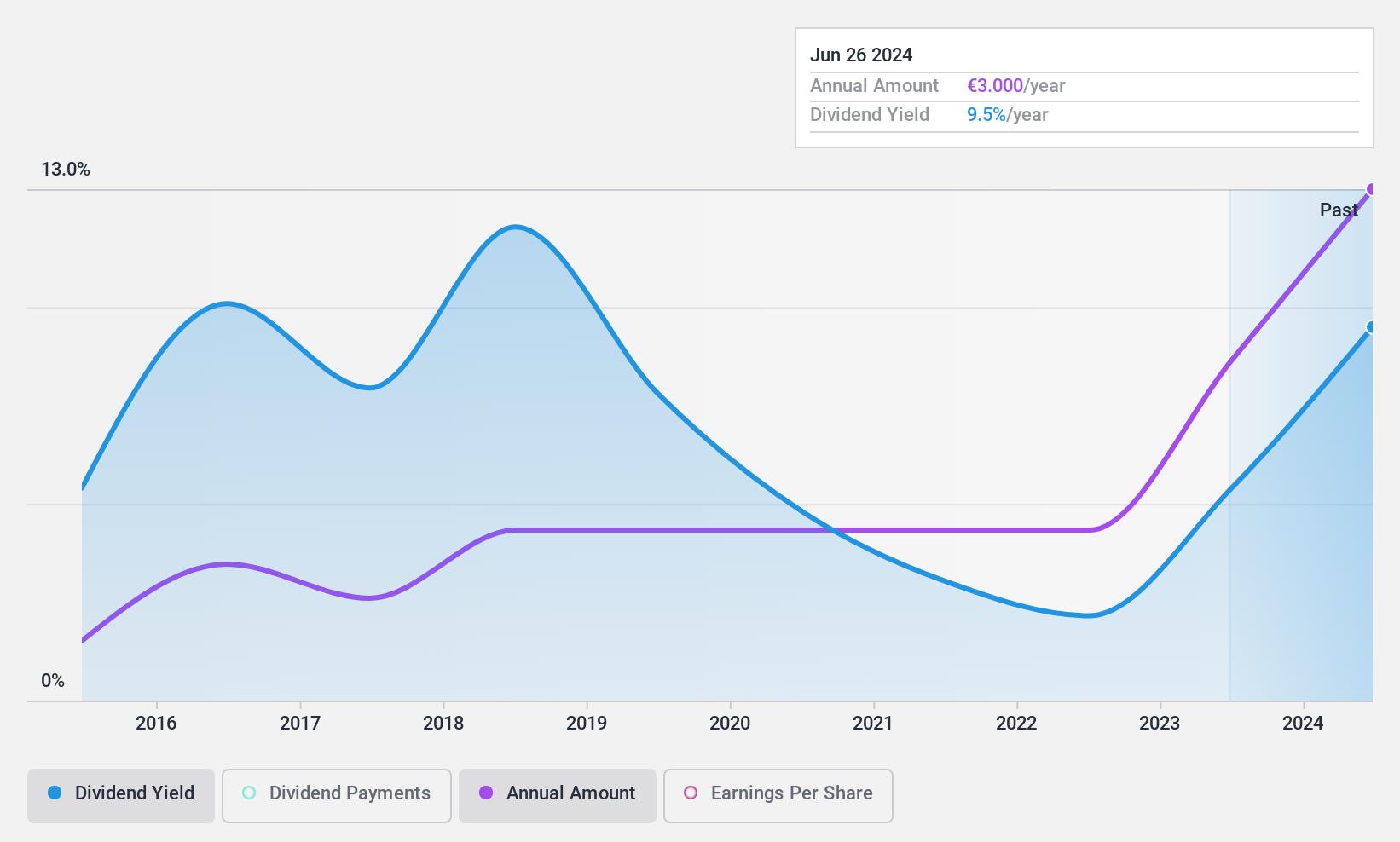

EnviTec Biogas (XTRA:ETG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EnviTec Biogas AG manufactures and operates biogas and biomethane plants across various countries, with a market cap of €458.87 million.

Operations: EnviTec Biogas AG generates revenue through the manufacturing and operation of biogas and biomethane plants in multiple international markets, including Germany, Italy, Great Britain, the Czech Republic, France, Denmark, the United States, China, Greece, and Estonia.

Dividend Yield: 9.7%

EnviTec Biogas offers a high dividend yield, ranking in the top 25% of German dividend payers. However, its dividend history is marked by volatility and unreliability over the past decade, with significant annual drops. Currently, dividends are covered by a 76.2% payout ratio from earnings, though insufficient data prevents assessment of coverage by cash flows. Trading at €0.56 below estimated fair value suggests potential undervaluation despite an unstable dividend track record.

- Delve into the full analysis dividend report here for a deeper understanding of EnviTec Biogas.

- Our expertly prepared valuation report EnviTec Biogas implies its share price may be lower than expected.

Make It Happen

- Explore the 229 names from our Top European Dividend Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ING Bank Slaski, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ING

ING Bank Slaski

Together with our subsidiaries, provides various banking products and services for retail clients and businesses in Poland.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives