- Saudi Arabia

- /

- Specialty Stores

- /

- SASE:4165

Exploring Undiscovered Gems with Three Promising Small Caps

Reviewed by Simply Wall St

Amidst a backdrop of geopolitical tensions and fluctuating economic indicators, global markets have been experiencing mixed movements, with large-cap stocks showing resilience while small-cap indices like the S&P 600 face challenges. In such an environment, identifying promising small-cap stocks requires a focus on companies with strong fundamentals and growth potential that can withstand broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Payton Industries | NA | 9.38% | 14.12% | ★★★★★★ |

| Al Sagr Cooperative Insurance | NA | 9.35% | 37.73% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| United Wire Factories | NA | 4.86% | 0.19% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Y.D. More Investments | 67.03% | 30.67% | 24.98% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| TopGum Industries | 30.51% | 15.69% | 33.91% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Pakistan Petroleum (KASE:PPL)

Simply Wall St Value Rating: ★★★★★★

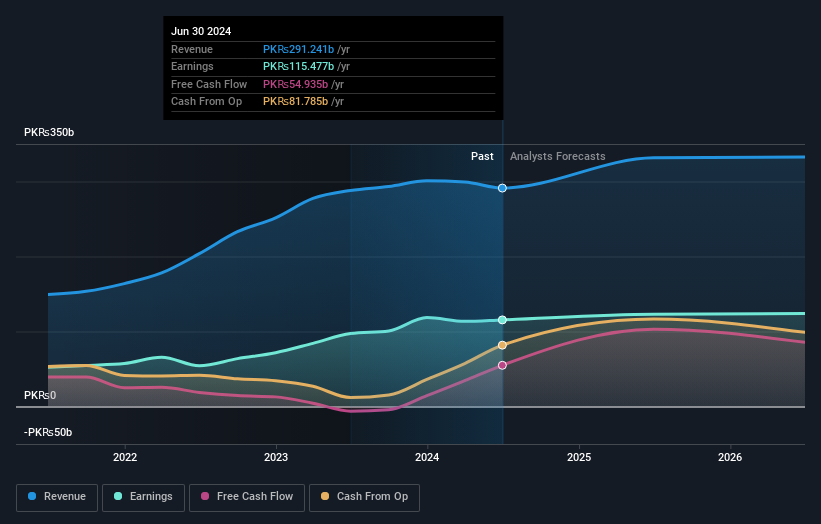

Overview: Pakistan Petroleum Limited, along with its subsidiaries, is involved in the exploration, development, and production of oil and natural gas resources across Pakistan, the United Arab Emirates, Iraq, and Yemen with a market capitalization of PKR 322.71 billion.

Operations: PPL generates revenue primarily from the exploration, development, and production of oil, gas, and barytes, totaling PKR 291.24 billion.

Pakistan Petroleum has shown impressive financial performance with earnings growing by 18.8% over the past year, outpacing the Oil and Gas industry's 10.9%. The company reported net income of PKR 115.48 billion for the fiscal year ending June 2024, up from PKR 97.22 billion previously, while sales reached PKR 291.24 billion. Trading at about 3.9% below its estimated fair value and being debt-free for five years underscores its strong position in a competitive market landscape.

Al Majed for Oud (SASE:4165)

Simply Wall St Value Rating: ★★★★★★

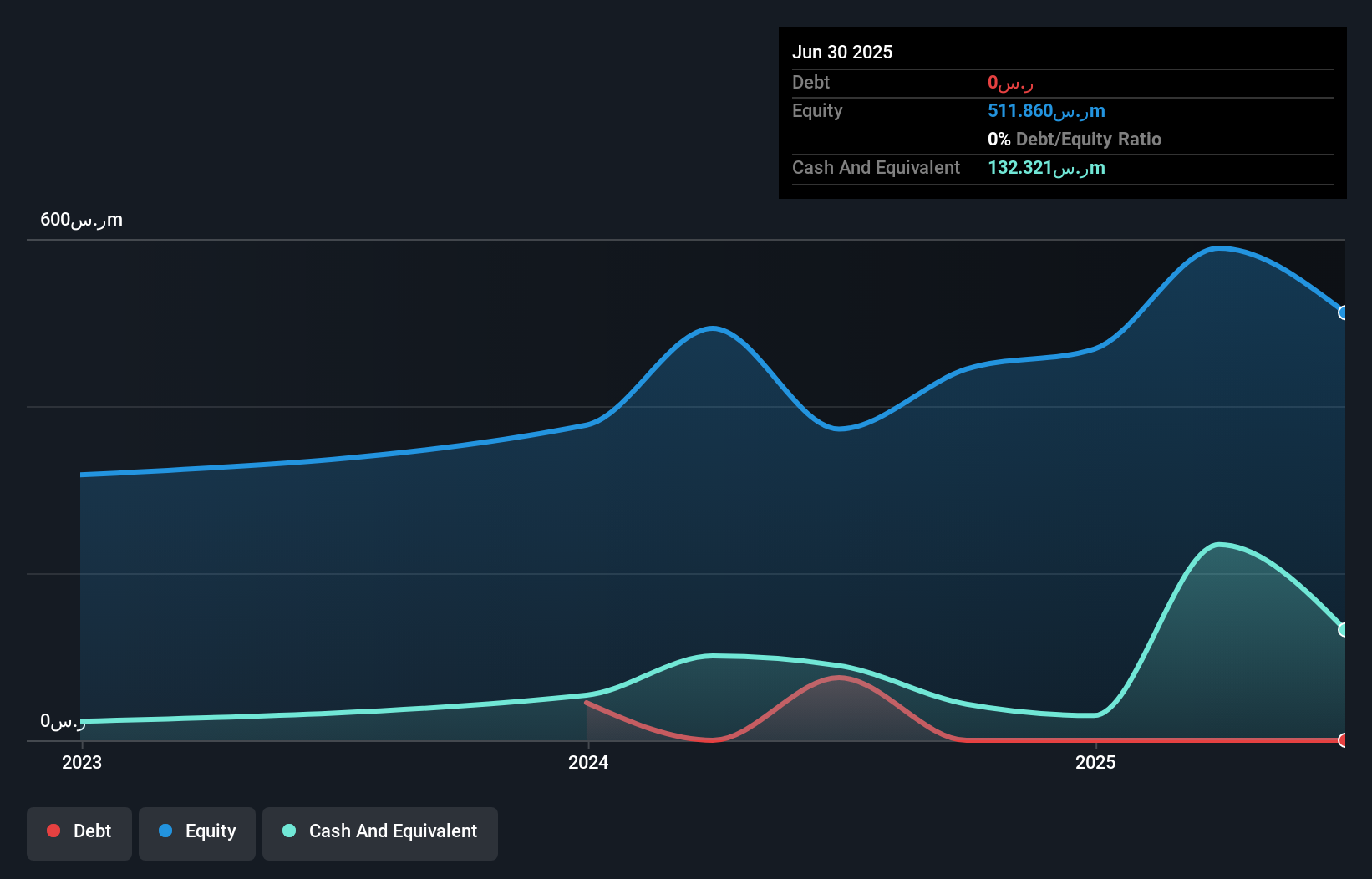

Overview: Al Majed for Oud Company operates in the wholesale and retail trade of perfumes across Saudi Arabia and the Gulf countries, with a market capitalization of SAR2.35 billion.

Operations: The company's primary revenue stream is derived from retail trade in perfumes, amounting to SAR842.48 million. The business operates within the Kingdom of Saudi Arabia and the Gulf countries, contributing to its market presence in the region.

Al Majed for Oud, a relatively small player in the specialty retail sector, recently completed an IPO raising SAR 705 million. The company has shown impressive earnings growth of 39.3% over the past year, outpacing the industry average of 9.3%. With no debt on its books and trading at 48.3% below estimated fair value, it presents a compelling opportunity despite its highly illiquid shares and limited financial history of less than three years.

- Unlock comprehensive insights into our analysis of Al Majed for Oud stock in this health report.

Understand Al Majed for Oud's track record by examining our Past report.

Raiffeisen Bank JSC (UKR:BAVL)

Simply Wall St Value Rating: ★★★★★☆

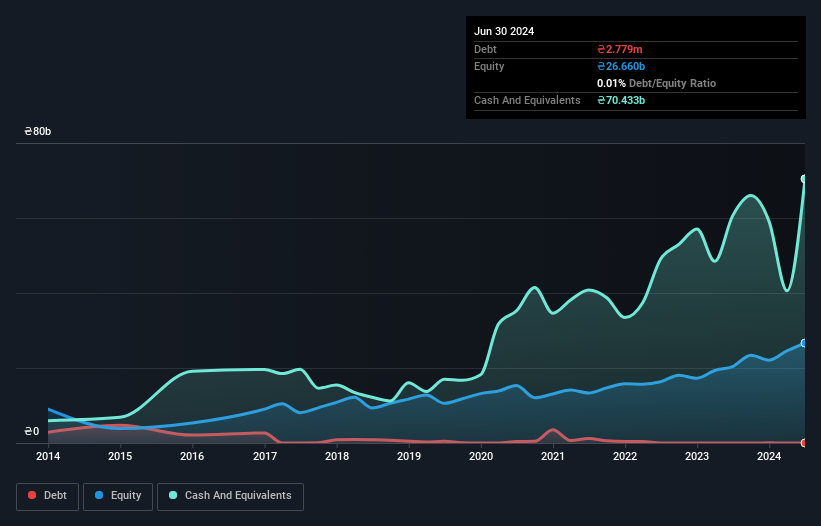

Overview: Raiffeisen Bank JSC offers a range of banking products and services to private clients, corporate clients, and businesses in Ukraine, with a market capitalization of UAH19.68 billion.

Operations: Revenue primarily comes from large and small enterprises (UAH9.42 billion), followed by micro-enterprises and individuals (UAH7.78 billion). Asset management contributes UAH2.50 billion, while financial institutions add UAH610.87 million to the revenue stream.

Raiffeisen Bank JSC, a small player in the financial sector, shows intriguing aspects with total assets of UAH209.1 billion and equity at UAH26.7 billion. Despite a high bad loans ratio of 12.6%, the bank has a sufficient allowance for these loans at 123%. Impressively, earnings grew by 46.6% over the past year, outpacing industry growth rates significantly. The bank's liabilities are primarily low-risk due to customer deposits making up 97% of funding sources, indicating stability amidst challenges.

Where To Now?

- Unlock our comprehensive list of 4771 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Al Majed for Oud, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4165

Al Majed for Oud

Engages in the wholesale and retail trade of perfumes in the Kingdom of Saudi Arabia and the Gulf countries.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives