- Philippines

- /

- Infrastructure

- /

- PSE:ICT

Top Growth Companies With Insider Ownership February 2025

Reviewed by Simply Wall St

As global markets continue to navigate a landscape of rising inflation and interest rate uncertainties, U.S. stock indexes are climbing toward record highs, with growth stocks leading the charge over value shares. In this environment, companies with high insider ownership can be particularly appealing to investors seeking stability and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 38.5% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

Here's a peek at a few of the choices from the screener.

Openedges Technology (KOSDAQ:A394280)

Simply Wall St Growth Rating: ★★★★★★

Overview: Openedges Technology, Inc. develops AI computing IP solutions and memory systems in South Korea, with a market cap of approximately ₩386.10 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to ₩26.97 billion.

Insider Ownership: 30.8%

Earnings Growth Forecast: 125% p.a.

Openedges Technology is poised for significant growth, with earnings expected to increase by 124.98% annually and revenue projected to rise at 57.7% per year, outpacing the KR market's 8.9%. The company is anticipated to achieve profitability within three years, with a high forecasted return on equity of 37%. Despite its volatile share price recently, insider trading activity has been minimal over the past three months.

- Click here and access our complete growth analysis report to understand the dynamics of Openedges Technology.

- Our valuation report here indicates Openedges Technology may be overvalued.

International Container Terminal Services (PSE:ICT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Container Terminal Services, Inc. operates and manages container ports and terminals across Asia, Europe, the Middle East, Africa, and the Americas with a market capitalization of approximately ₱709.05 billion.

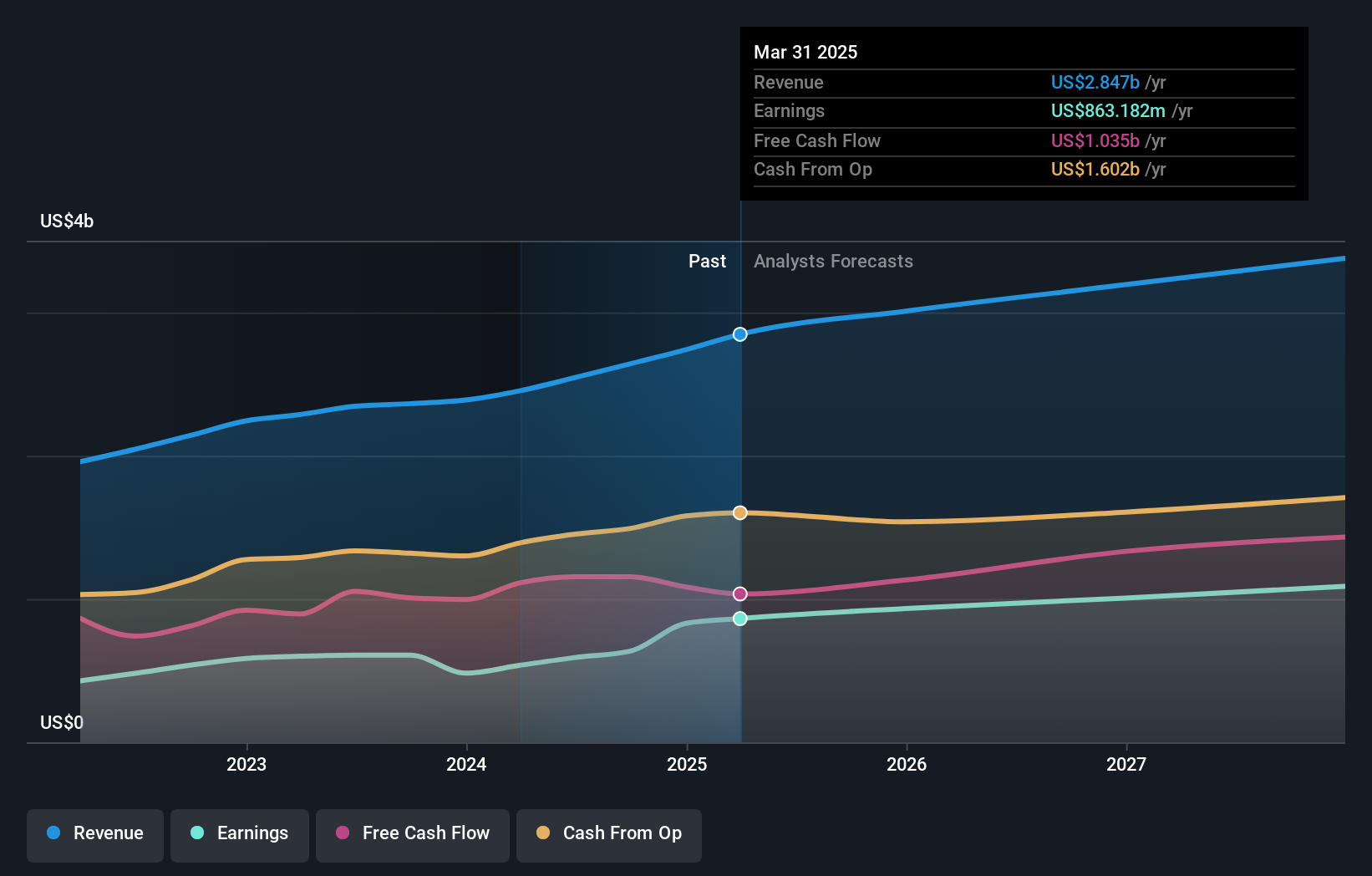

Operations: The company generates revenue primarily from Cargo Handling and Related Services, amounting to $2.64 billion.

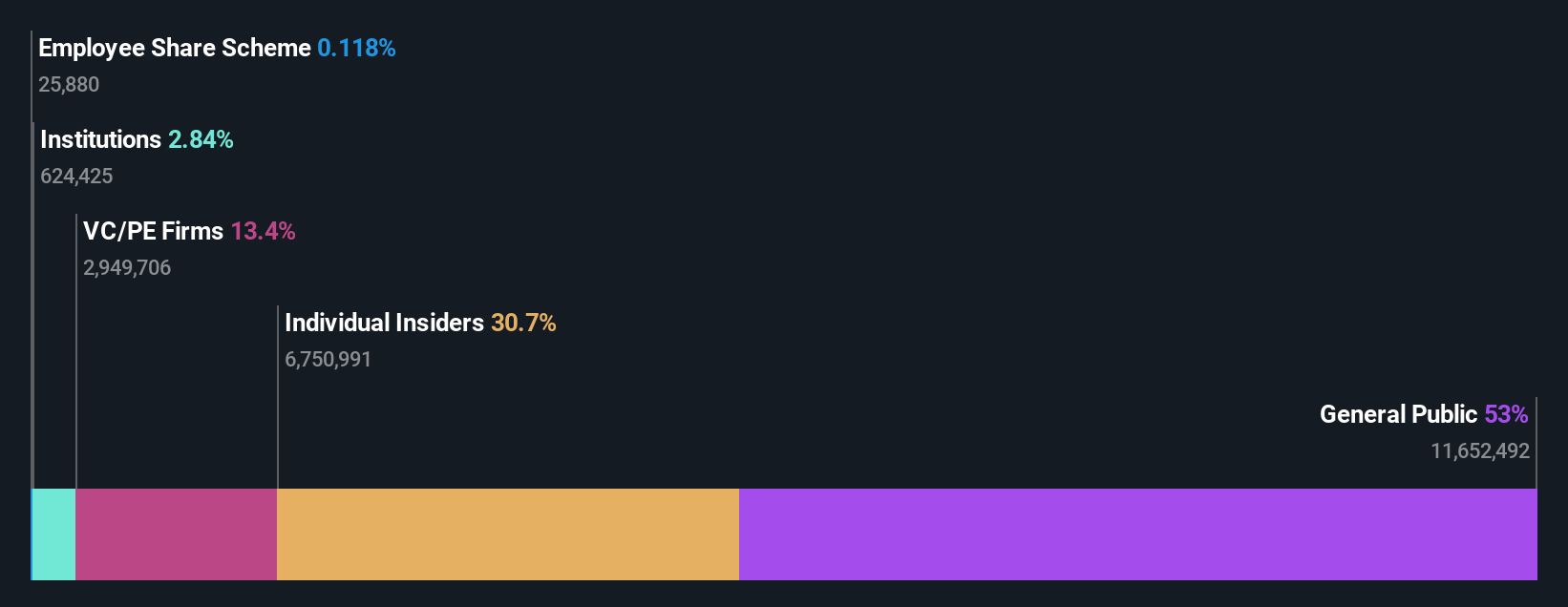

Insider Ownership: 36.7%

Earnings Growth Forecast: 16.8% p.a.

International Container Terminal Services is positioned for growth with earnings anticipated to rise 16.78% annually, surpassing the Philippine market's average. Despite a high debt level and an unstable dividend history, the stock trades at a discount of 14.2% below its estimated fair value. While insider trading has been modest recently, analysts predict a 27.9% price increase and a very high return on equity of 46.5% in three years, highlighting potential investment appeal amidst mixed financials.

- Navigate through the intricacies of International Container Terminal Services with our comprehensive analyst estimates report here.

- The analysis detailed in our International Container Terminal Services valuation report hints at an inflated share price compared to its estimated value.

Gold Circuit Electronics (TWSE:2368)

Simply Wall St Growth Rating: ★★★★★☆

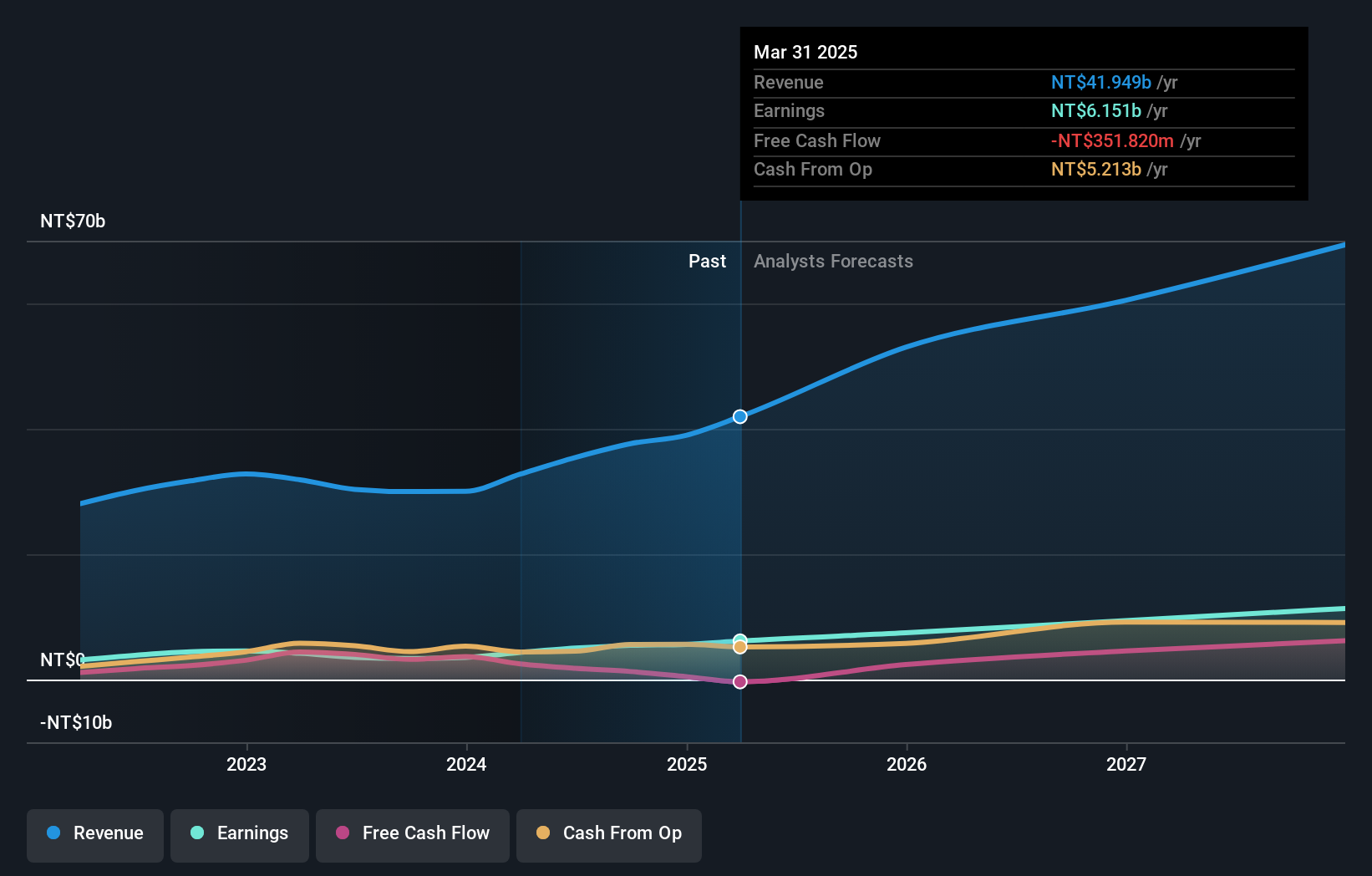

Overview: Gold Circuit Electronics Ltd. designs, manufactures, processes, and distributes multilayer printed circuit boards in Taiwan with a market cap of NT$109.50 billion.

Operations: The company generates revenue of NT$37.63 billion from its manufacturing and sales of printed circuit boards.

Insider Ownership: 31.4%

Earnings Growth Forecast: 22.1% p.a.

Gold Circuit Electronics is poised for significant growth, with earnings expected to increase 22.1% annually, outpacing the Taiwan market's average. The stock trades at a favorable price-to-earnings ratio of 20.1x compared to the market's 21.3x, despite recent share price volatility. Analysts project a 23.2% rise in stock price, supported by high-quality earnings and robust return on equity forecasted at 29.3%. Recent conference participation underscores its strategic focus amidst stable insider activity.

- Click here to discover the nuances of Gold Circuit Electronics with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Gold Circuit Electronics is trading behind its estimated value.

Taking Advantage

- Discover the full array of 1465 Fast Growing Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:ICT

International Container Terminal Services

Acquires, develops, manages, and operates container ports and terminals for container shipping industry in Asia, Europe, the Middle East, Africa, and the Americas.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives