- Taiwan

- /

- Construction

- /

- TWSE:2597

Global Dividend Stocks And 2 More Top Picks

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and the impacts of a prolonged U.S. government shutdown, investors are turning their attention to dividend stocks as a potential source of stability amid uncertainty. In such volatile conditions, stocks that offer consistent dividend payouts can provide investors with a reliable income stream, making them an attractive option for those seeking to navigate the current economic landscape.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.82% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.23% | ★★★★★★ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.79% | ★★★★★★ |

| NCD (TSE:4783) | 4.44% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.79% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.99% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.49% | ★★★★★★ |

| Daicel (TSE:4202) | 4.58% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.70% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.37% | ★★★★★★ |

Click here to see the full list of 1398 stocks from our Top Global Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

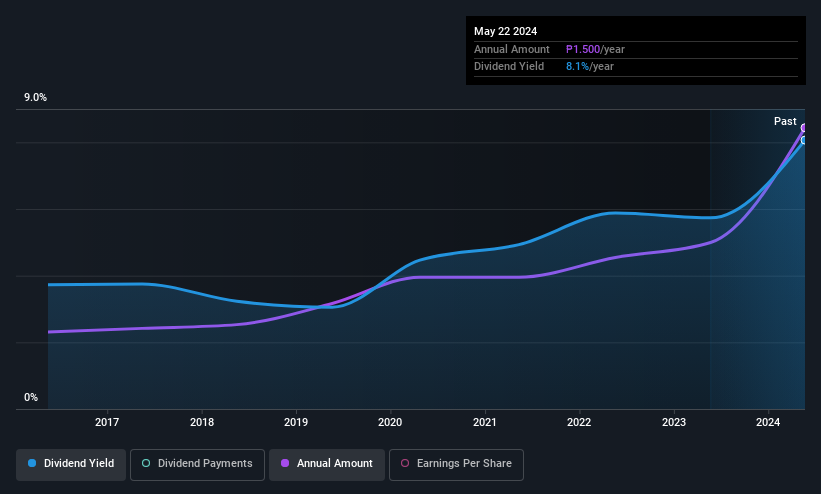

Asian Terminals (PSE:ATI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asian Terminals, Inc. operates and manages key port facilities in the Philippines, including the South Harbor Port of Manila and the Port of Batangas, with a market cap of ₱63.53 billion.

Operations: Asian Terminals, Inc.'s revenue primarily comes from its Ports Business segment, generating ₱17.92 billion.

Dividend Yield: 4.3%

Asian Terminals has consistently increased its dividends over the past decade, maintaining stability and reliability with minimal volatility. The company's dividend payments are well-covered by earnings, with a payout ratio of 37.8%, and cash flows, at a 75.4% cash payout ratio. Despite being lower than the top 25% of PH market dividend payers, ATI's yield remains attractive at 4.28%. Recent earnings growth supports continued dividend sustainability and potential future increases in payouts.

- Take a closer look at Asian Terminals' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Asian Terminals is trading beyond its estimated value.

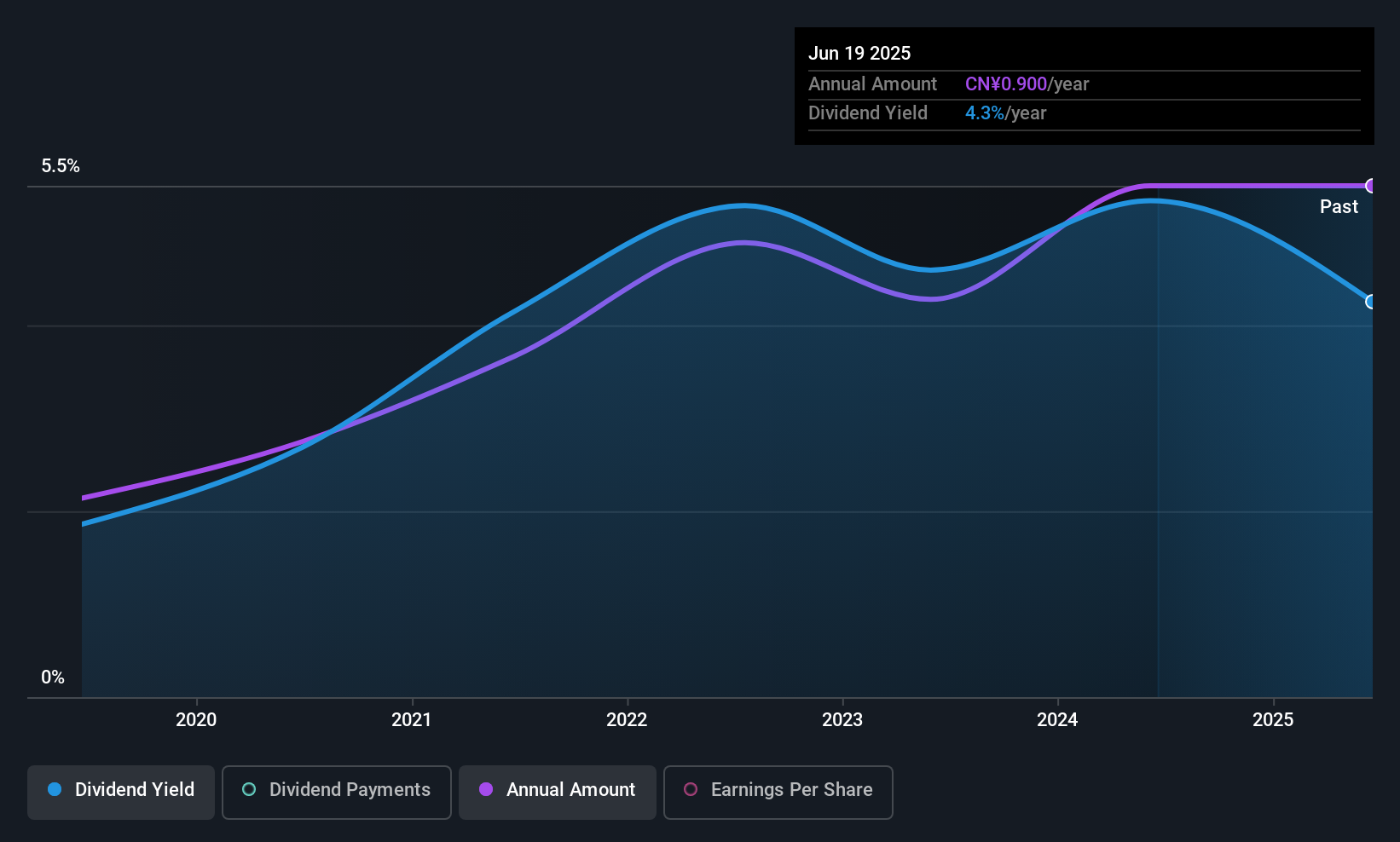

Xinjiang East Universe GasLtd (SHSE:603706)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinjiang East Universe Gas Co. Ltd. operates in the natural gas sector, focusing on sales, facility equipment installation, and heating services, with a market cap of CN¥4.16 billion.

Operations: Xinjiang East Universe Gas Co. Ltd. generates its revenue from three main segments: natural gas sales, facility equipment installation, and heating services.

Dividend Yield: 3.9%

Xinjiang East Universe Gas Ltd.'s dividends are well-supported by earnings and cash flows, with payout ratios of 83.3% and 87.5%, respectively, indicating sustainability. Although the company has only a six-year history of paying dividends, these payments have been stable and growing without significant volatility. With a dividend yield of 3.95%, it ranks in the top quartile among CN market dividend payers, offering an attractive option for income-focused investors despite its shorter track record.

- Click here and access our complete dividend analysis report to understand the dynamics of Xinjiang East Universe GasLtd.

- Insights from our recent valuation report point to the potential overvaluation of Xinjiang East Universe GasLtd shares in the market.

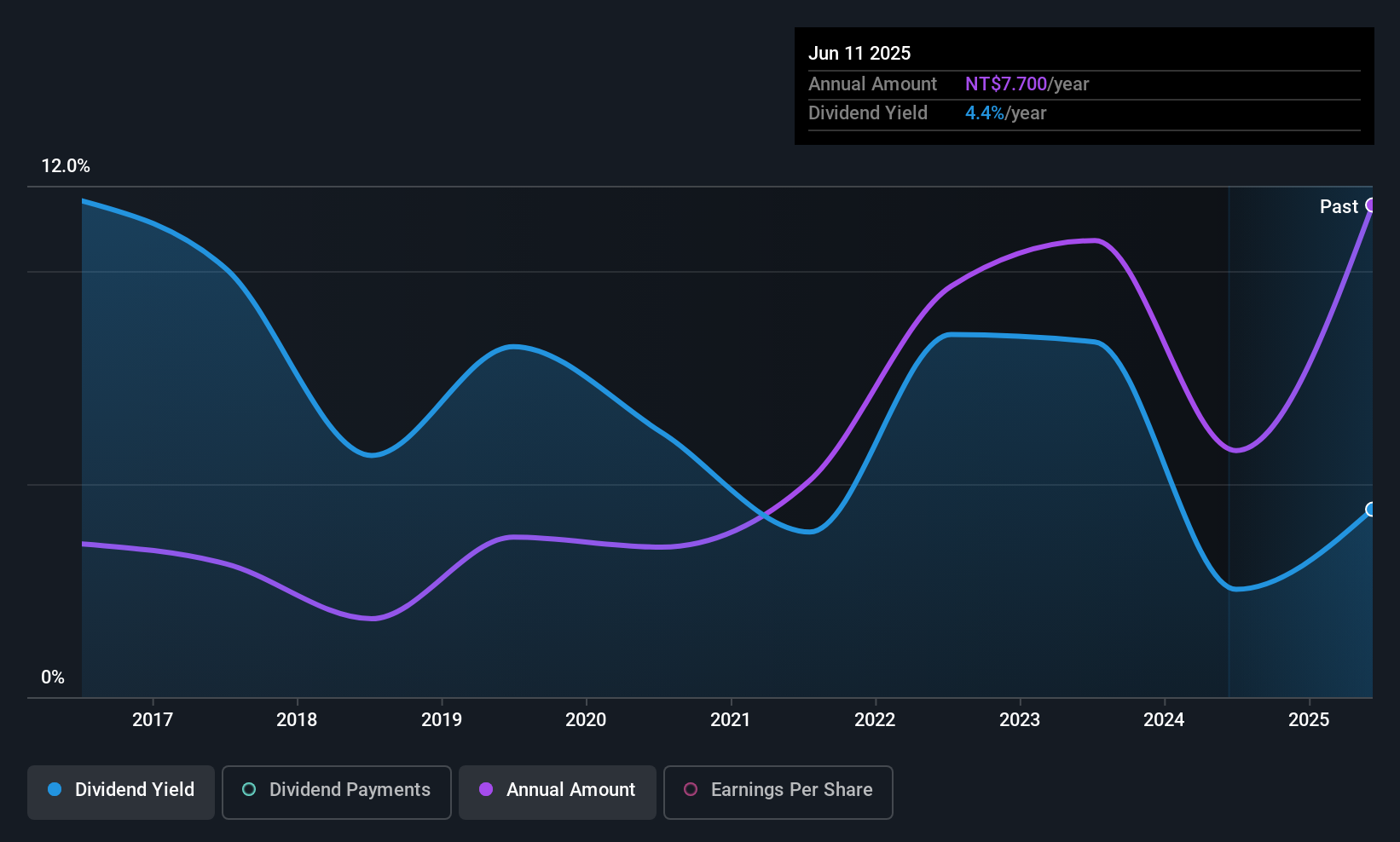

Ruentex Engineering & Construction (TWSE:2597)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ruentex Engineering & Construction Co., Ltd. operates in the construction industry, focusing on engineering and construction services, with a market cap of NT$40.78 billion.

Operations: Ruentex Engineering & Construction Co., Ltd. generates revenue through its Interior Decoration Design Segment (NT$2.32 billion), Construction Materials Business Segment (NT$4.82 billion), and Construction Division excluding the Interior Design Department (NT$21.56 billion).

Dividend Yield: 3.9%

Ruentex Engineering & Construction's dividends are backed by a 65.5% earnings payout ratio and a 49.4% cash payout ratio, suggesting sustainability despite an unstable dividend history over the past decade. The company trades at 39.4% below its estimated fair value, offering potential value for investors. Recent earnings growth of TWD 745.79 million in Q2 reflects strong financial performance, though its dividend yield of 3.92% lags behind top-tier TW market payers at 5.36%.

- Navigate through the intricacies of Ruentex Engineering & Construction with our comprehensive dividend report here.

- Our valuation report unveils the possibility Ruentex Engineering & Construction's shares may be trading at a discount.

Taking Advantage

- Get an in-depth perspective on all 1398 Top Global Dividend Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2597

Ruentex Engineering & Construction

Ruentex Engineering & Construction Co., Ltd.

Outstanding track record, good value and pays a dividend.

Market Insights

Community Narratives