- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:2411

Asian Undervalued Small Caps With Insider Buying For September 2025

Reviewed by Simply Wall St

In recent weeks, the Asian markets have been navigating a complex landscape, marked by mixed signals from global economic indicators and regional policy shifts. As investors assess these dynamics, there is growing interest in small-cap stocks that may offer potential value opportunities amid broader market fluctuations. Identifying such stocks often involves looking for companies with solid fundamentals and strategic insider buying, which can suggest confidence in the company's prospects despite current market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Consun Pharmaceutical Group | 12.3x | 3.8x | 41.87% | ★★★★★☆ |

| Magellan Financial Group | 9.9x | 5.1x | 27.84% | ★★★★★☆ |

| Growthpoint Properties Australia | NA | 6.0x | 27.91% | ★★★★★☆ |

| Southern Cross Electrical Engineering | 16.9x | 0.7x | 31.19% | ★★★★☆☆ |

| NobleOak Life | 19.7x | 1.1x | 28.52% | ★★★★☆☆ |

| East West Banking | 3.2x | 0.8x | 17.69% | ★★★★☆☆ |

| BWP Trust | 10.0x | 13.0x | 13.74% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 45.01% | ★★★★☆☆ |

| Cettire | NA | 0.4x | 16.03% | ★★★☆☆☆ |

| Far East Orchard | 10.6x | 3.4x | 9.06% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

Southern Cross Electrical Engineering (ASX:SXE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Southern Cross Electrical Engineering is a company that provides electrical services, with a market capitalization of A$0.26 billion.

Operations: Southern Cross Electrical Engineering derives its revenue primarily from the provision of electrical services, with recent figures showing revenue at A$801.45 million. The company's cost structure is heavily influenced by the cost of goods sold (COGS), which amounted to A$695.54 million in the latest period. Operating expenses, including general and administrative costs, reached A$60.03 million, impacting overall profitability. The net income margin has shown variability over time but was recorded at 3.95% in the most recent period analyzed, reflecting an improvement from previous years where it experienced fluctuations due to varying levels of non-operating expenses and other financial factors.

PE: 16.9x

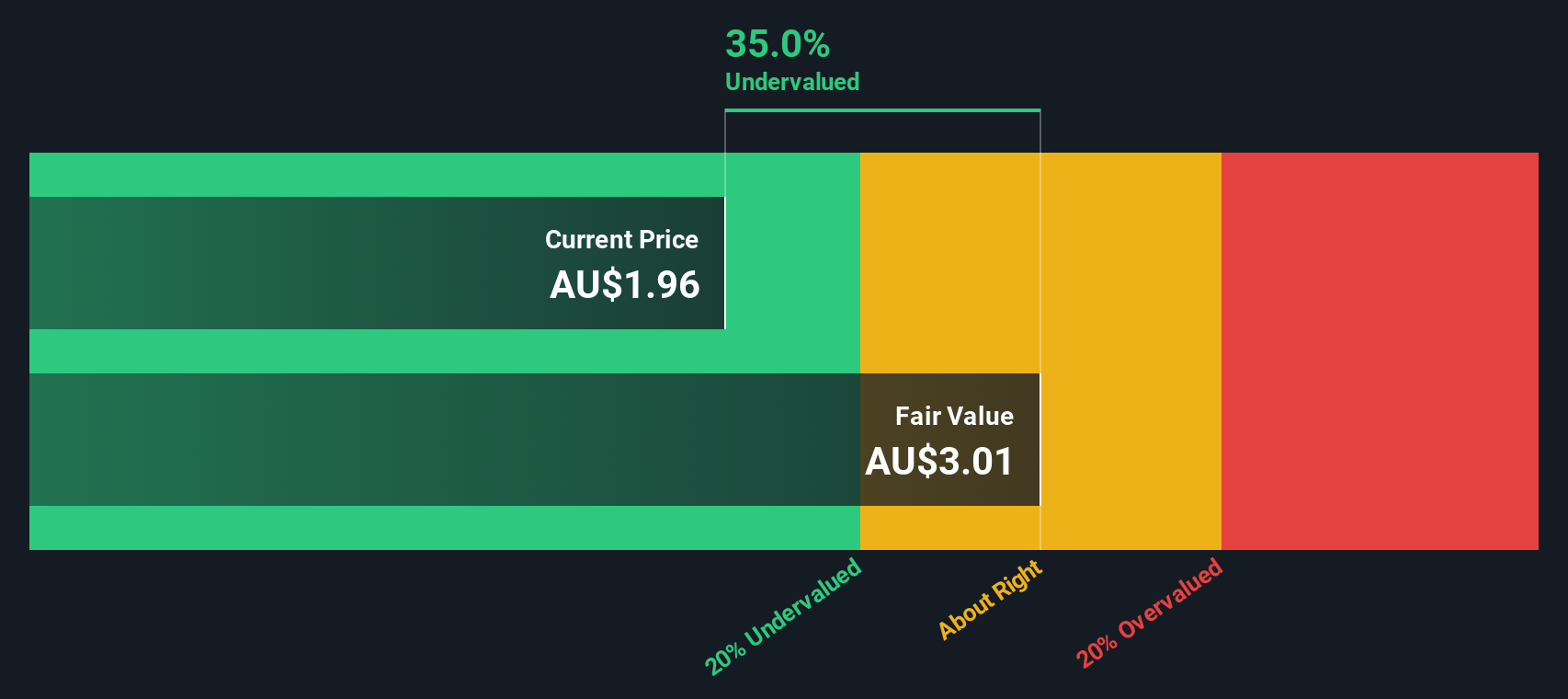

Southern Cross Electrical Engineering, a company with a focus on infrastructure and resources sectors, reported impressive growth with sales reaching A$801.45 million for the year ending June 2025, up from A$551.87 million previously. Their net income also increased to A$31.67 million. Insider confidence is evident as they seek acquisitions to diversify geographically and enhance capabilities. With earnings projected to grow annually by 9.8%, Southern Cross presents potential for future expansion despite relying solely on external borrowing for funding.

- Navigate through the intricacies of Southern Cross Electrical Engineering with our comprehensive valuation report here.

Learn about Southern Cross Electrical Engineering's historical performance.

RFM (PSE:RFM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: RFM is a company engaged in the consumer and institutional business sectors, with operations generating significant revenue from these segments, and it has a market capitalization of ₱16.74 billion.

Operations: The company's revenue primarily comes from its Consumer Business and Institutional Business segments. Over recent periods, the gross profit margin has shown variability, reaching 35.31% in September 2024 and adjusting to 33.25% by September 2025. Operating expenses are largely driven by sales and marketing activities, with significant allocations also towards general and administrative expenses.

PE: 9.6x

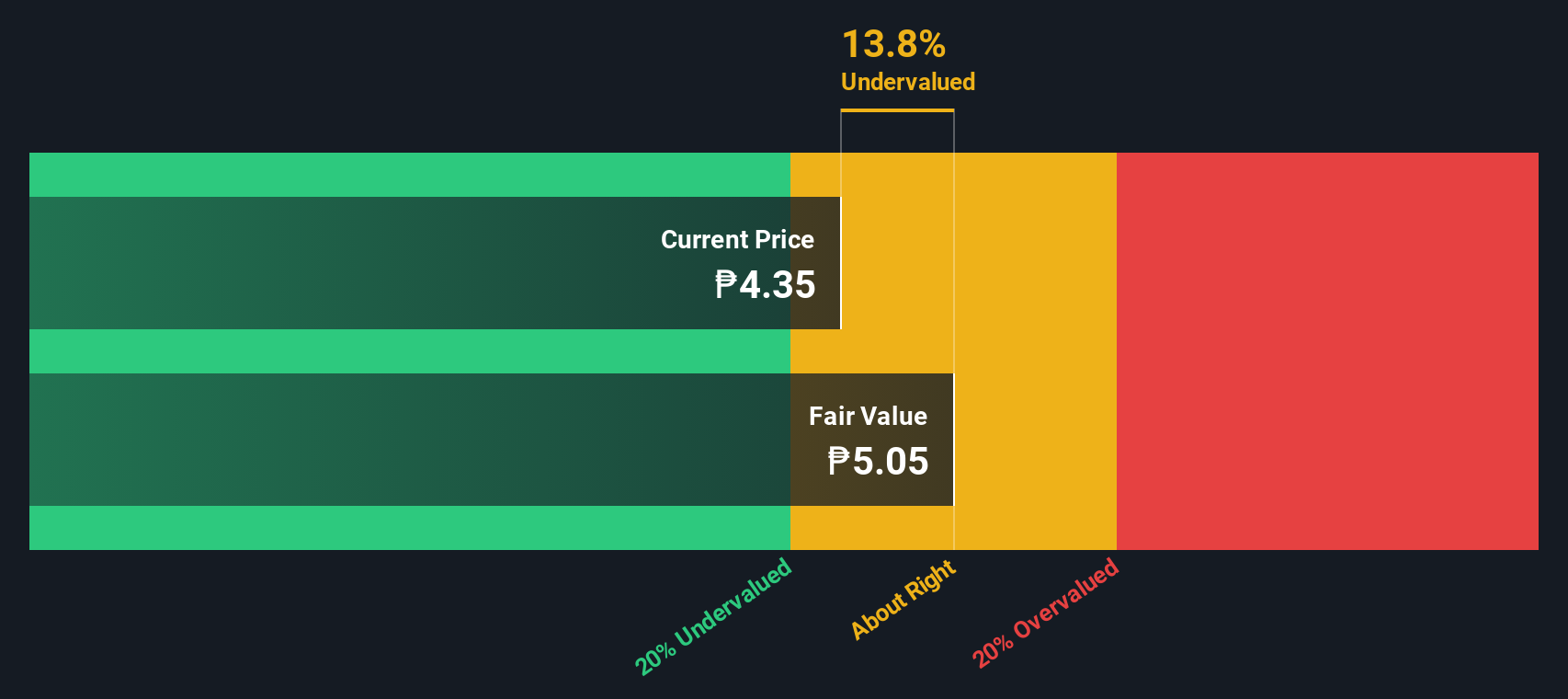

RFM Corporation, a smaller player in Asia, shows potential with its recent financial performance. Despite relying solely on external borrowing for funding, which carries higher risk without customer deposits, RFM's earnings reveal resilience. For the second quarter of 2025, sales reached PHP 5.26 billion and net income was PHP 463 million. Insider confidence is evident as they continue to purchase shares, suggesting optimism about future prospects. The company declared dividends totaling PHP 700 million this year alone, indicating a commitment to shareholder returns amidst steady growth.

- Delve into the full analysis valuation report here for a deeper understanding of RFM.

Assess RFM's past performance with our detailed historical performance reports.

Shenzhen Pagoda Industrial (Group) (SEHK:2411)

Simply Wall St Value Rating: ★★★☆☆☆

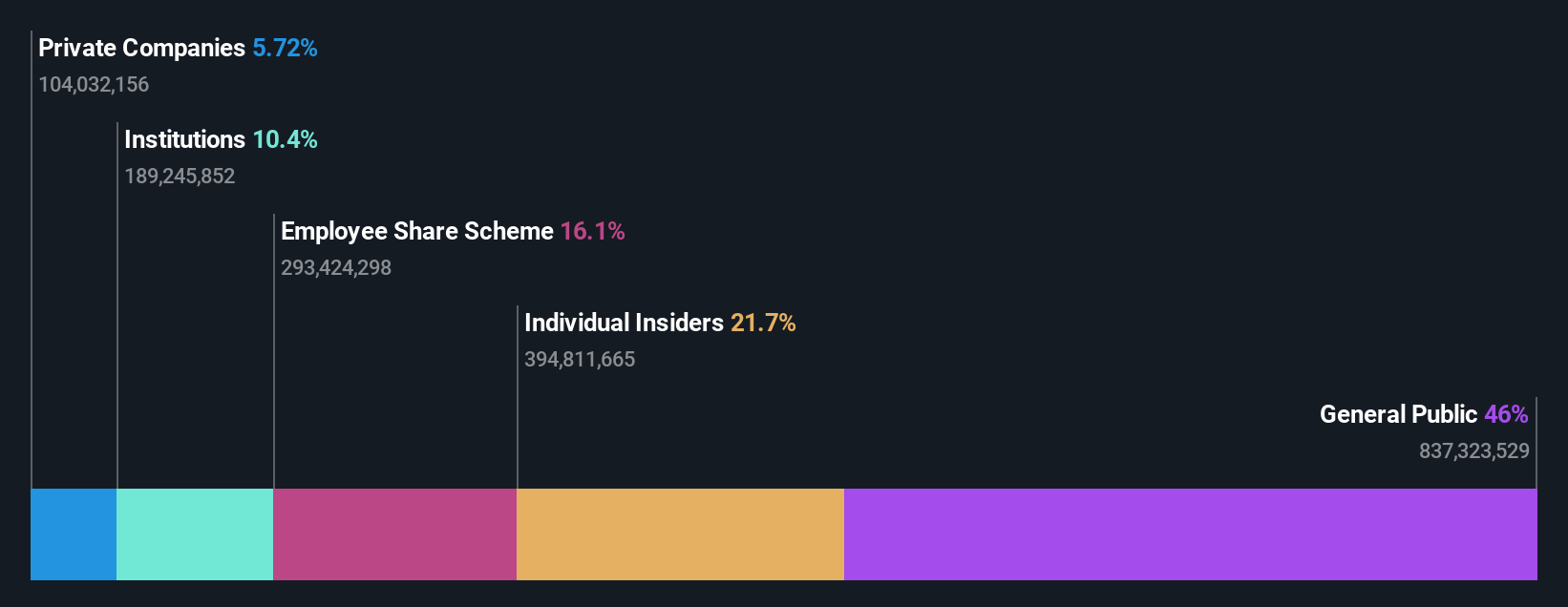

Overview: Shenzhen Pagoda Industrial (Group) operates as a leading fruit retail and distribution company with diverse revenue streams including trading, franchising, and other segments, boasting a market cap of CN¥14.47 billion.

Operations: The company generates revenue primarily through its franchising segment, amounting to CN¥8.02 billion, and trading activities contributing CN¥1.29 billion. Over recent periods, the gross profit margin has shown a downward trend from 11.63% in December 2022 to 3.94% by September 2025, indicating increasing cost pressures or pricing challenges.

PE: -3.1x

Shenzhen Pagoda Industrial (Group), a small company in Asia, has been navigating challenges with strategic shifts. Despite a net loss of CNY 342.05 million for the first half of 2025, down from a profit last year, they are actively optimizing their store network and product offerings to enhance profitability. Recently filing a follow-on equity offering worth HK$327 million indicates efforts to bolster financial positioning. With revenue forecasted to grow annually by 10.71%, they aim for long-term growth through operational efficiency and market expansion strategies.

Seize The Opportunity

- Dive into all 43 of the Undervalued Asian Small Caps With Insider Buying we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2411

Shenzhen Pagoda Industrial (Group)

Operates as a fruit retailer in China, Indonesia, Singapore, Hong Kong, and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives