- Philippines

- /

- Beverage

- /

- PSE:GSMI

Undiscovered Gems And 2 Other Hidden Small Caps With Strong Fundamentals

Reviewed by Simply Wall St

Amidst a backdrop of rising U.S. inflation and small-cap stocks lagging behind their larger counterparts, the global market landscape remains dynamic with key indices like the Russell 2000 trailing the S&P 500 by notable margins. As investors navigate these conditions, identifying stocks with strong fundamentals becomes crucial, especially within the small-cap sector where opportunities can often be overlooked yet offer potential for growth when aligned with sound economic indicators.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Akmerkez Gayrimenkul Yatirim Ortakligi | NA | 43.32% | 27.57% | ★★★★★★ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| Kerevitas Gida Sanayi ve Ticaret | 48.40% | 45.75% | 37.51% | ★★★★☆☆ |

| Malam - Team | 102.85% | 10.82% | -10.47% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Konya Kagit Sanayi ve Ticaret | 0.67% | 24.97% | 7.82% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Ginebra San Miguel (PSE:GSMI)

Simply Wall St Value Rating: ★★★★★★

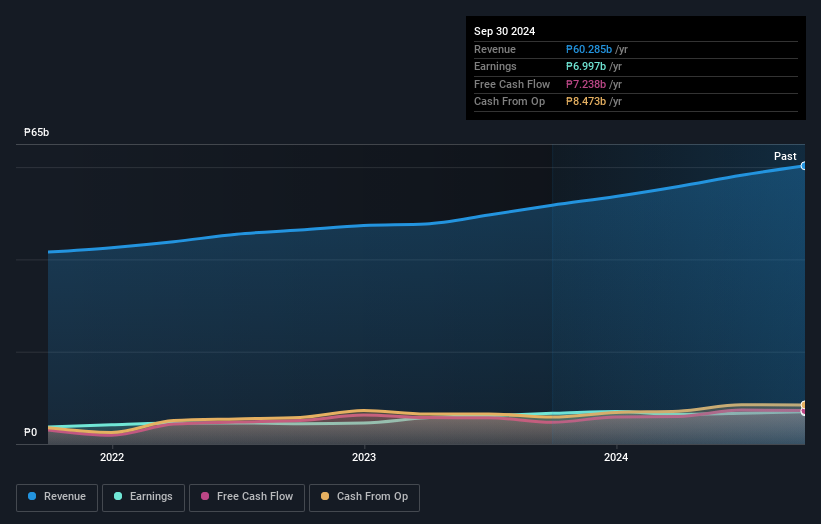

Overview: Ginebra San Miguel Inc., along with its subsidiaries, is involved in the production and distribution of alcoholic beverages both within the Philippines and internationally, with a market capitalization of approximately ₱79.83 billion.

Operations: Ginebra San Miguel generates revenue primarily from its alcoholic beverages segment, amounting to approximately ₱60.28 billion. The company's market capitalization is around ₱79.83 billion.

Ginebra San Miguel, a nimble player in the beverage sector, has shown robust earnings growth of 28% annually over the past five years. Despite trading at 57.4% below its estimated fair value, it boasts high-quality earnings and remains debt-free, a significant shift from its previous debt-to-equity ratio of 17.6%. The company is free cash flow positive with recent figures at US$5.96 billion as of June 2024. While it trails behind industry growth rates recently, its financial health and undervaluation suggest potential for future gains amidst recent board changes affecting governance dynamics.

Innuovo Technology (SZSE:000795)

Simply Wall St Value Rating: ★★★★★☆

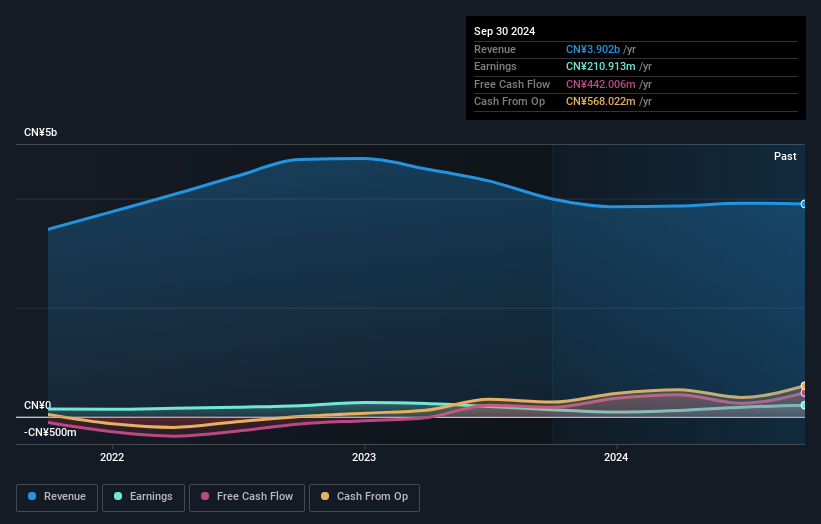

Overview: Innuovo Technology Co., Ltd. is involved in the research, development, production, and sale of rare earth permanent magnet materials both in China and internationally, with a market capitalization of CN¥12.93 billion.

Operations: Innuovo Technology generates revenue primarily from the sale of rare earth permanent magnet materials. The company has a market capitalization of CN¥12.93 billion, indicating its substantial presence in the industry.

Innuovo Technology, a smaller player in its field, seems to be trading at 66.4% below the estimated fair value, offering potential for investors looking for undervalued stocks. Over the past year, earnings have surged by 62.5%, significantly outpacing the -2.3% seen in the broader Metals and Mining industry. The company's debt-to-equity ratio has risen from 7.9% to 10.9% over five years, suggesting increased leverage but not necessarily alarming given it earns more interest than it pays out and has cash exceeding total debt obligations. In recent developments, Innuovo completed a share buyback of nearly 18 million shares for CNY 106 million as part of its strategic financial maneuvers announced earlier in March 2024.

- Dive into the specifics of Innuovo Technology here with our thorough health report.

Understand Innuovo Technology's track record by examining our Past report.

Solar Applied Materials Technology (TPEX:1785)

Simply Wall St Value Rating: ★★★★☆☆

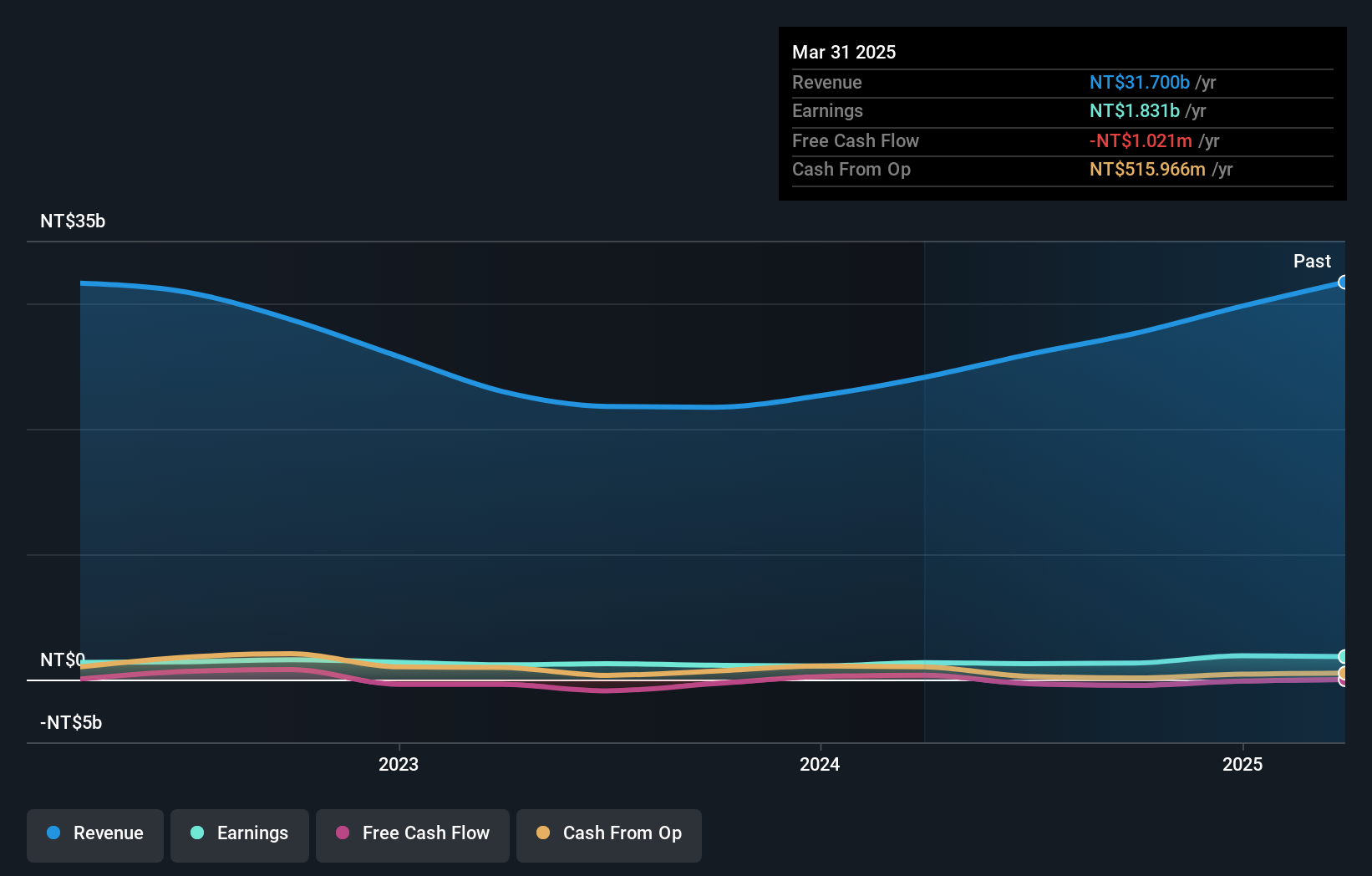

Overview: Solar Applied Materials Technology Corporation engages in the manufacturing, processing, recycling, refining, and trading of sputtering targets for thin film, precious metal materials, and specialty chemicals for automobiles across Taiwan, China, and international markets with a market cap of NT$35.17 billion.

Operations: Solar Applied Materials Technology generates revenue primarily from its Taiwan SOLAR and Kunshan Solar segments, contributing NT$10.51 billion and NT$15.37 billion, respectively.

Solar Applied Materials Technology, a nimble player in the materials sector, exhibits some intriguing financial dynamics. Over the past year, earnings surged by 14%, outpacing the broader chemicals industry growth of 13%. The company boasts high-quality earnings and its interest payments are comfortably covered by EBIT at a ratio of 10.5 times. However, its net debt to equity ratio stands at a hefty 78%, which is considered high despite reducing from 168% over five years. While free cash flow remains negative, Solar Applied's profitability suggests that cash runway isn't an immediate concern for this small yet promising entity.

Where To Now?

- Click here to access our complete index of 4747 Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:GSMI

Ginebra San Miguel

Engages in the manufacture and sale of alcoholic beverages in the Philippines.The company offers gins, brandies, wines, and distilled spirits, as well as vodka and rum.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives