- Philippines

- /

- Hospitality

- /

- PSE:LOTO

3 Promising Penny Stocks With Market Caps Over US$100M

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with U.S. stocks ending a strong year despite recent slumps and economic indicators showing varied signals, investors are exploring diverse opportunities. Penny stocks, often linked to smaller or emerging companies, remain an intriguing segment for those seeking growth potential at lower entry points. Despite being considered a niche area today, these investments can still offer compelling opportunities when supported by robust financial health and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.71 | £434.2M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.01 | £770.58M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.84 | HK$533.22M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.565 | A$66.23M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.51M | ★★★★☆☆ |

Click here to see the full list of 5,817 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Pacific Online Systems (PSE:LOTO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Pacific Online Systems Corporation, with a market cap of ₱2.95 billion, designs, develops, and manages online computer systems, terminals, and software for the gaming industry in the Philippines.

Operations: The company generates revenue from leasing activities amounting to ₱520.19 million.

Market Cap: ₱2.95B

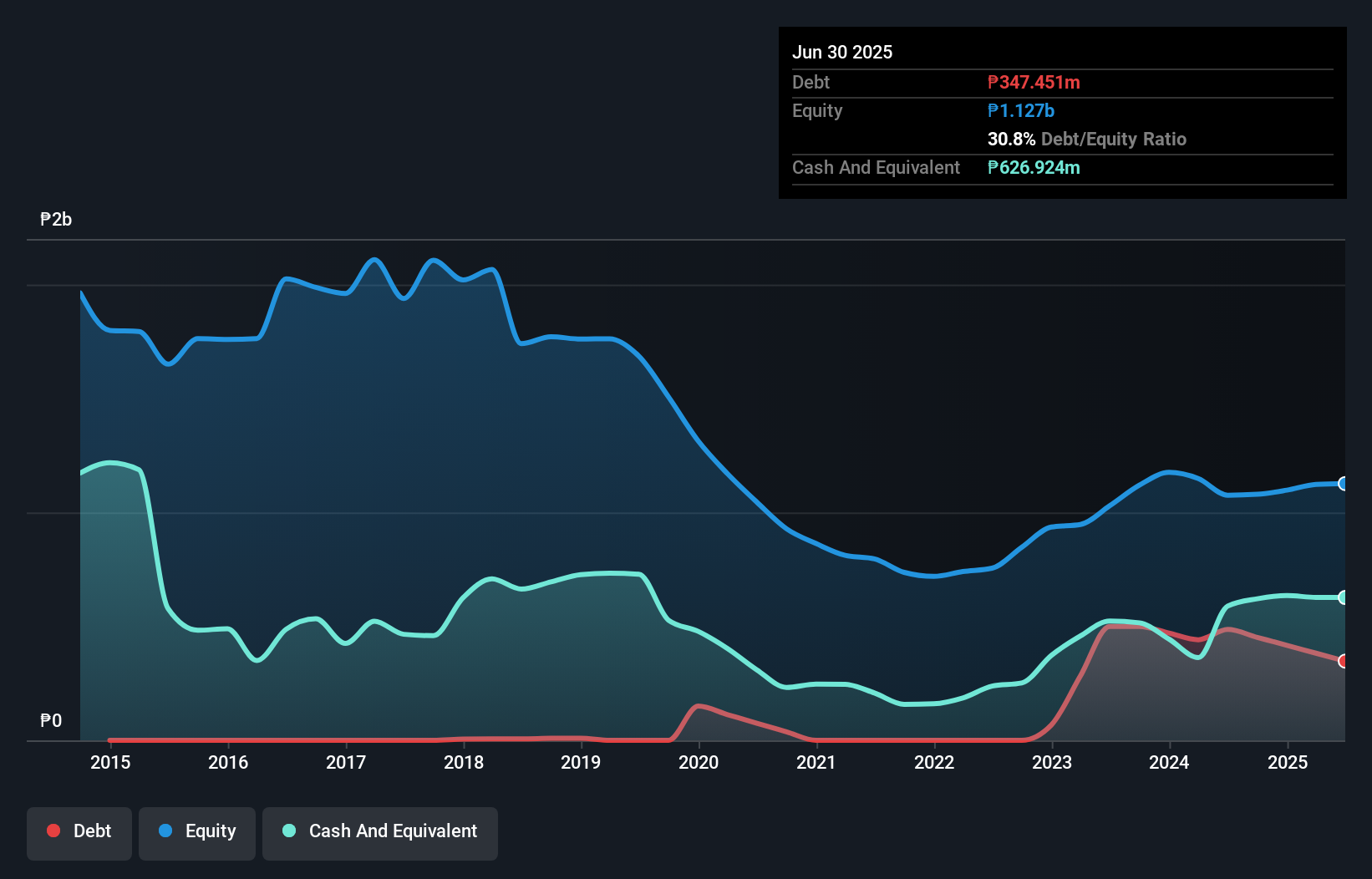

Pacific Online Systems Corporation, with a market cap of ₱2.95 billion, is trading significantly below its estimated fair value. Despite stable weekly volatility, it remains higher than most Philippine stocks. The company's short-term assets comfortably cover both short and long-term liabilities, and it has more cash than total debt. However, recent earnings have declined sharply with net income dropping to ₱5.07 million in Q3 2024 from ₱81.83 million the previous year due to large one-off gains previously impacting results. Management changes include the appointment of Ms. Dioville M. Villarias as permanent CFO and Treasurer amidst board adjustments following a director's passing.

- Take a closer look at Pacific Online Systems' potential here in our financial health report.

- Examine Pacific Online Systems' past performance report to understand how it has performed in prior years.

Tongda Group Holdings (SEHK:698)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tongda Group Holdings Limited is an investment holding company that supplies high-precision structural parts for smart mobile communications and consumer electronic products globally, with a market cap of approximately HK$847 million.

Operations: The company's revenue is primarily derived from Consumer Electronics Structural Components, generating HK$5.58 billion, and Household and Sports Goods, contributing HK$951.23 million.

Market Cap: HK$847M

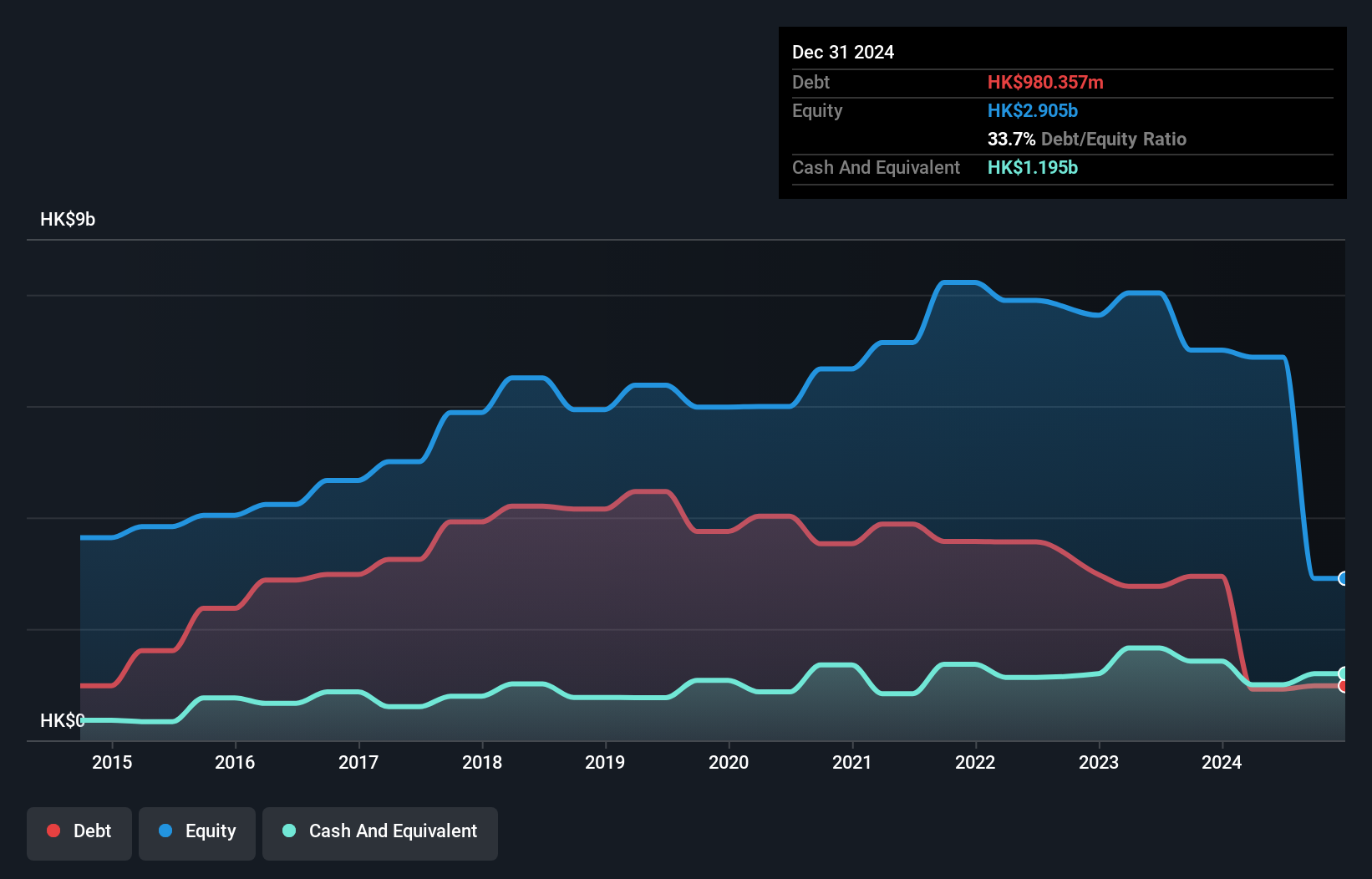

Tongda Group Holdings, with a market cap of HK$847 million, derives substantial revenue from its Consumer Electronics Structural Components and Household and Sports Goods segments. Despite being unprofitable with a negative return on equity of -17.46%, the company maintains a strong financial position as short-term assets exceed both short and long-term liabilities. Its debt is well covered by operating cash flow, and the company has more cash than total debt. The management team is seasoned, contributing to stability amidst challenges, while earnings are forecasted to grow significantly at over 100% per year.

- Get an in-depth perspective on Tongda Group Holdings' performance by reading our balance sheet health report here.

- Examine Tongda Group Holdings' earnings growth report to understand how analysts expect it to perform.

Shenzhen DivisionLtd (SZSE:300167)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Shenzhen Division Co.,Ltd. focuses on the research, development, and sale of smart video and IoT core technology products and solutions mainly in China, with a market cap of CN¥791.62 million.

Operations: The company's revenue is primarily derived from its operations in China, amounting to CN¥593.32 million.

Market Cap: CN¥791.62M

Shenzhen Division Co., Ltd., with a market cap of CN¥791.62 million, focuses on smart video and IoT technology in China. Despite being unprofitable, it reported sales of CN¥327.34 million for the nine months ending September 2024, an increase from CN¥169.96 million the previous year. The net loss narrowed to CN¥28.89 million from CN¥125.8 million a year earlier, indicating some operational improvement. The company has more cash than debt and a sufficient cash runway for over three years even if free cash flow shrinks by 22% annually, though its share price remains highly volatile and trades below fair value estimates.

- Unlock comprehensive insights into our analysis of Shenzhen DivisionLtd stock in this financial health report.

- Learn about Shenzhen DivisionLtd's historical performance here.

Where To Now?

- Navigate through the entire inventory of 5,817 Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:LOTO

Pacific Online Systems

Designs, develops, and manages online computer systems, terminals, and software for the gaming industry in the Philippines.

Moderate with adequate balance sheet.