- Philippines

- /

- Real Estate

- /

- PSE:SHNG

3 Dividend Stocks Offering Up To 7.2% Yield For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate mixed signals with U.S. stocks closing a strong year despite recent underperformance and economic uncertainties highlighted by declining PMI figures, investors are increasingly seeking stability and income through dividend stocks. In such an environment, finding stocks that offer attractive yields can be a prudent strategy to balance risk while potentially benefiting from consistent cash flow.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.89% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.06% | ★★★★★★ |

Click here to see the full list of 1971 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

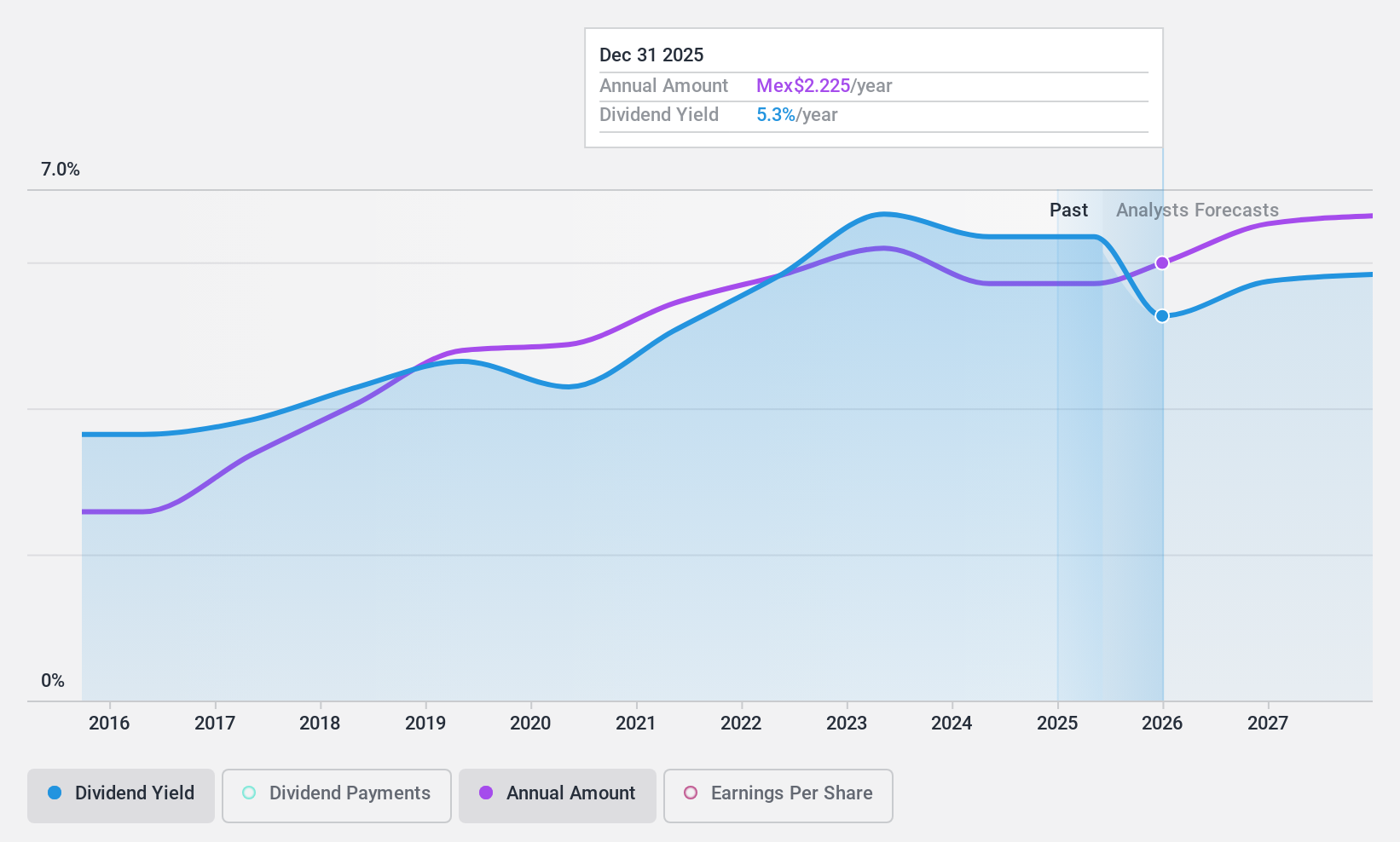

Bolsa Mexicana de Valores. de (BMV:BOLSA A)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bolsa Mexicana de Valores, S.A.B. de C.V. operates as the primary stock exchange in Mexico with a market cap of MX$18.56 billion.

Operations: Bolsa Mexicana de Valores, S.A.B. de C.V. generates revenue through its operations as Mexico's leading stock exchange.

Dividend Yield: 6.4%

Bolsa Mexicana de Valores has shown consistent earnings growth, with net income rising to MXN 1.17 billion for the first nine months of 2024. Its dividend yield stands at 6.4%, slightly below top-tier payers in Mexico but reliable and stable over the past decade. The dividends are well-covered by both earnings (payout ratio: 80.4%) and cash flows (cash payout ratio: 66.3%), indicating sustainability despite not being among the highest yields in its market segment.

- Delve into the full analysis dividend report here for a deeper understanding of Bolsa Mexicana de Valores. de.

- Insights from our recent valuation report point to the potential overvaluation of Bolsa Mexicana de Valores. de shares in the market.

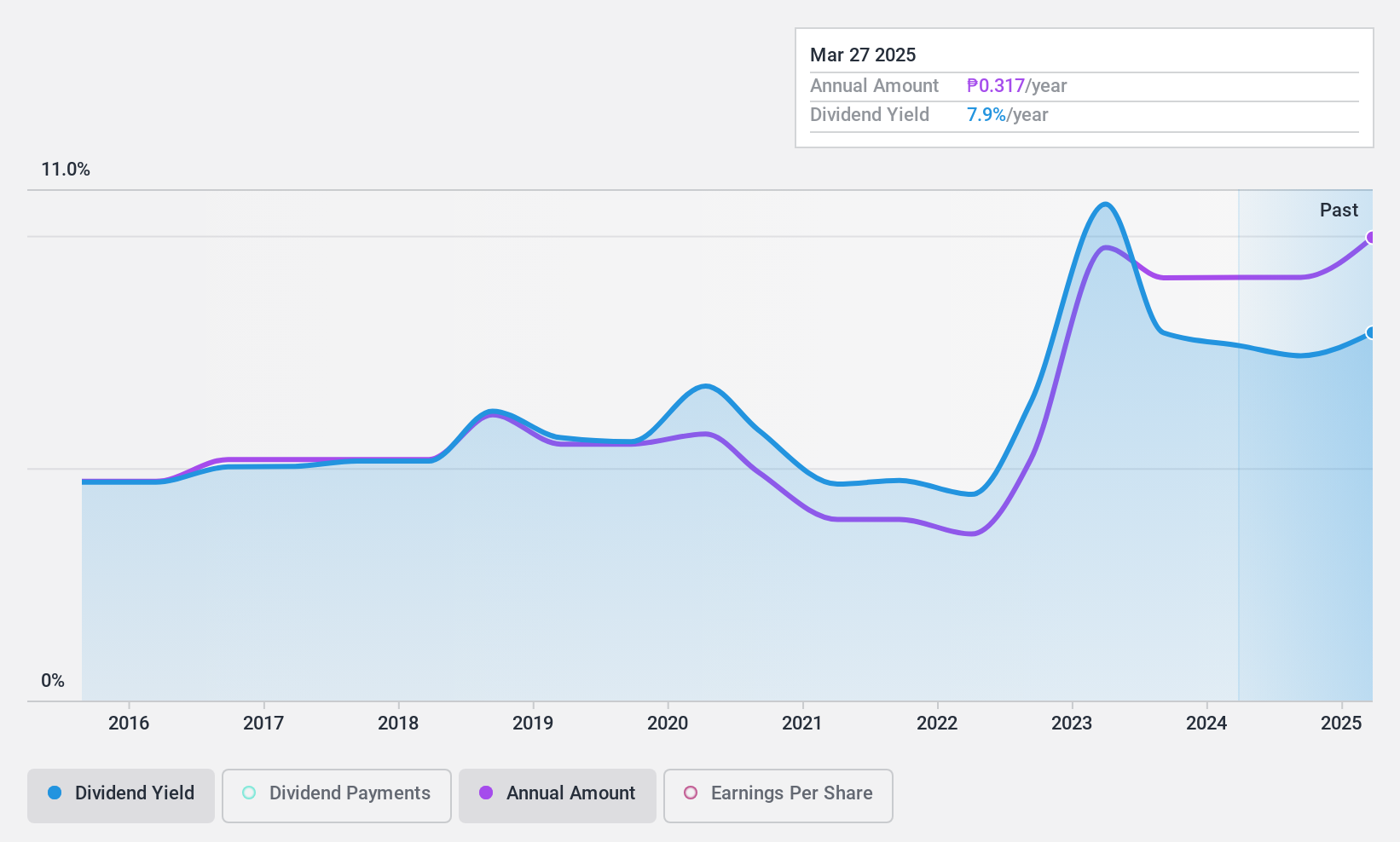

Shang Properties (PSE:SHNG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shang Properties, Inc., along with its subsidiaries, operates in the property investment and development sector mainly in the Philippines, with a market capitalization of approximately ₱18.95 billion.

Operations: Shang Properties, Inc. generates revenue through its core activities in property investment and development within the Philippine market.

Dividend Yield: 7.3%

Shang Properties, Inc. reported strong earnings growth with net income reaching PHP 4.24 billion for the first nine months of 2024. Despite a high dividend yield of 7.28%, which ranks in the top 25% in the Philippines, its dividends are not well-covered by free cash flows due to a substantial cash payout ratio of 1990.2%. While earnings sufficiently cover payouts with a low payout ratio of 22.9%, dividends have been volatile and unreliable over the past decade.

- Dive into the specifics of Shang Properties here with our thorough dividend report.

- Our expertly prepared valuation report Shang Properties implies its share price may be too high.

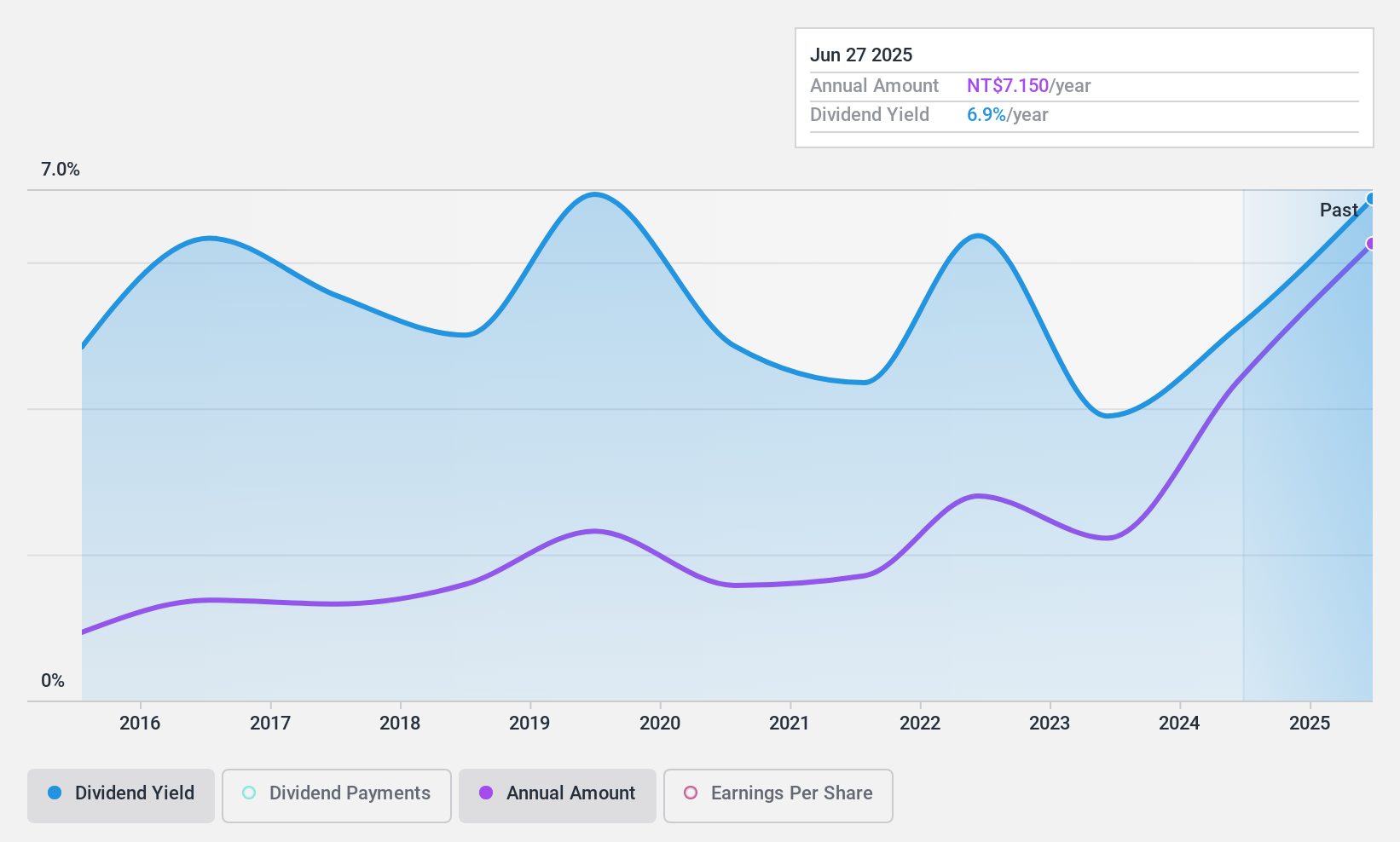

Shinkong Insurance (TWSE:2850)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shinkong Insurance Co., Ltd. offers property insurance services to individuals and corporations in Taiwan, with a market capitalization of NT$33.33 billion.

Operations: Shinkong Insurance Co., Ltd.'s revenue is derived entirely from its property insurance segment, amounting to NT$20.59 billion.

Dividend Yield: 4.7%

Shinkong Insurance's dividend yield of 4.73% places it among the top 25% in Taiwan, though its dividends have been volatile and unreliable over the past decade. Despite this, payouts are well-covered by a payout ratio of 48.5% and a cash payout ratio of 59.2%. Recent earnings show mixed results with Q3 net income declining to TWD 814.76 million from TWD 995.64 million year-over-year, while nine-month earnings improved to TWD 2,502.25 million from TWD 2,166.71 million previously.

- Navigate through the intricacies of Shinkong Insurance with our comprehensive dividend report here.

- The analysis detailed in our Shinkong Insurance valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Embark on your investment journey to our 1971 Top Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:SHNG

Shang Properties

Engages in property investment and development business primarily in the Philippines.

Solid track record with adequate balance sheet and pays a dividend.