- Philippines

- /

- Food and Staples Retail

- /

- PSE:PGOLD

3 Top Dividend Stocks Offering Up To 5.9% Yield

Reviewed by Simply Wall St

Amidst global market fluctuations, including the recent partial reversal of "Trump Trade" gains in U.S. stocks and mixed economic signals from Europe and Asia, investors are increasingly turning their attention to stable income sources like dividend stocks. In such uncertain times, a good dividend stock is often characterized by a reliable yield and the potential for steady payouts, offering a degree of financial predictability that can be particularly appealing.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

Click here to see the full list of 1966 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

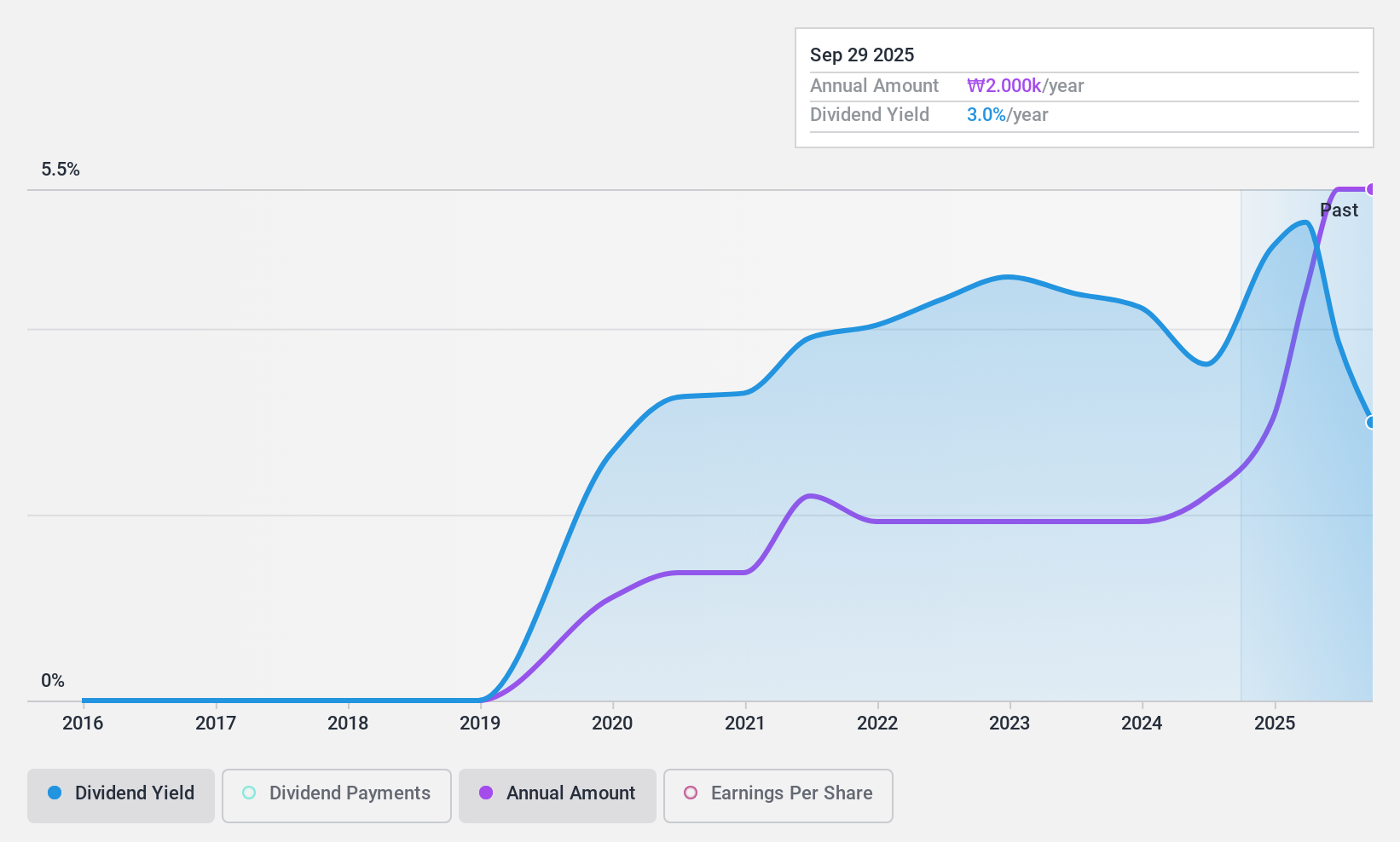

SNT Holdings (KOSE:A036530)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SNT Holdings CO., LTD operates in the auto parts and industrial facilities sectors, with a market cap of ₩324.62 billion.

Operations: SNT Holdings CO., LTD generates revenue from vehicle parts amounting to ₩1.27 billion and industrial equipment totaling ₩286.84 million.

Dividend Yield: 4.9%

SNT Holdings offers a compelling dividend yield of 4.9%, placing it in the top 25% of dividend payers in the Korean market. Despite its short and volatile five-year dividend history, the company's dividends are well-covered by earnings with a low payout ratio of 10.1% and cash flows at 15.3%. Recent earnings growth, highlighted by a net income increase to KRW 31,208.88 million for Q3, supports potential sustainability in future payouts.

- Get an in-depth perspective on SNT Holdings' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that SNT Holdings is priced lower than what may be justified by its financials.

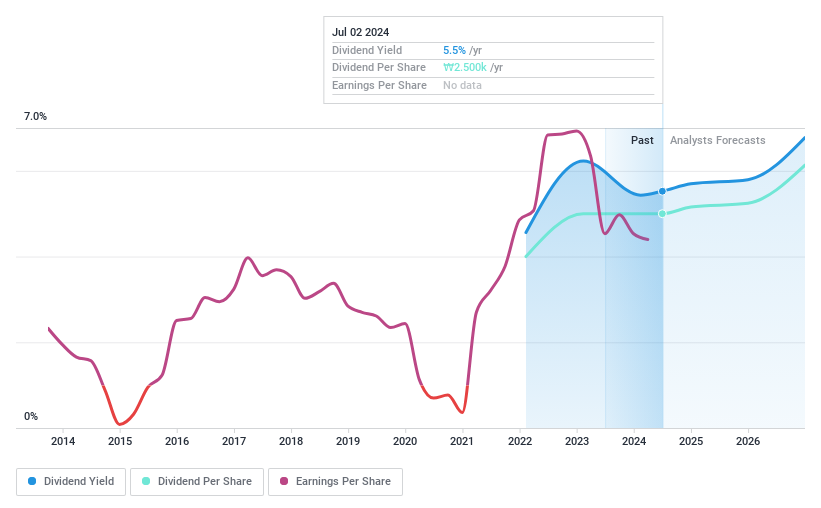

GS Holdings (KOSE:A078930)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GS Holdings Corp., along with its subsidiaries, operates in the energy, power generation, retail, service, construction, and infrastructure sectors with a market cap of ₩3.97 trillion.

Operations: GS Holdings Corp. generates revenue through various segments, including Trade (₩3.67 trillion), Distribution (₩11.08 trillion), and Gas and Electric Business (₩7.58 trillion).

Dividend Yield: 6%

GS Holdings' dividend yield of 5.96% ranks it among the top 25% in the Korean market. Despite a brief three-year dividend history, payments have been stable and well-supported by earnings with an 18.2% payout ratio and cash flows at 14.8%. Trading at a significant discount to its estimated fair value, GS Holdings presents potential value, though its short dividend track record may concern some investors seeking long-term reliability.

- Click here to discover the nuances of GS Holdings with our detailed analytical dividend report.

- The valuation report we've compiled suggests that GS Holdings' current price could be quite moderate.

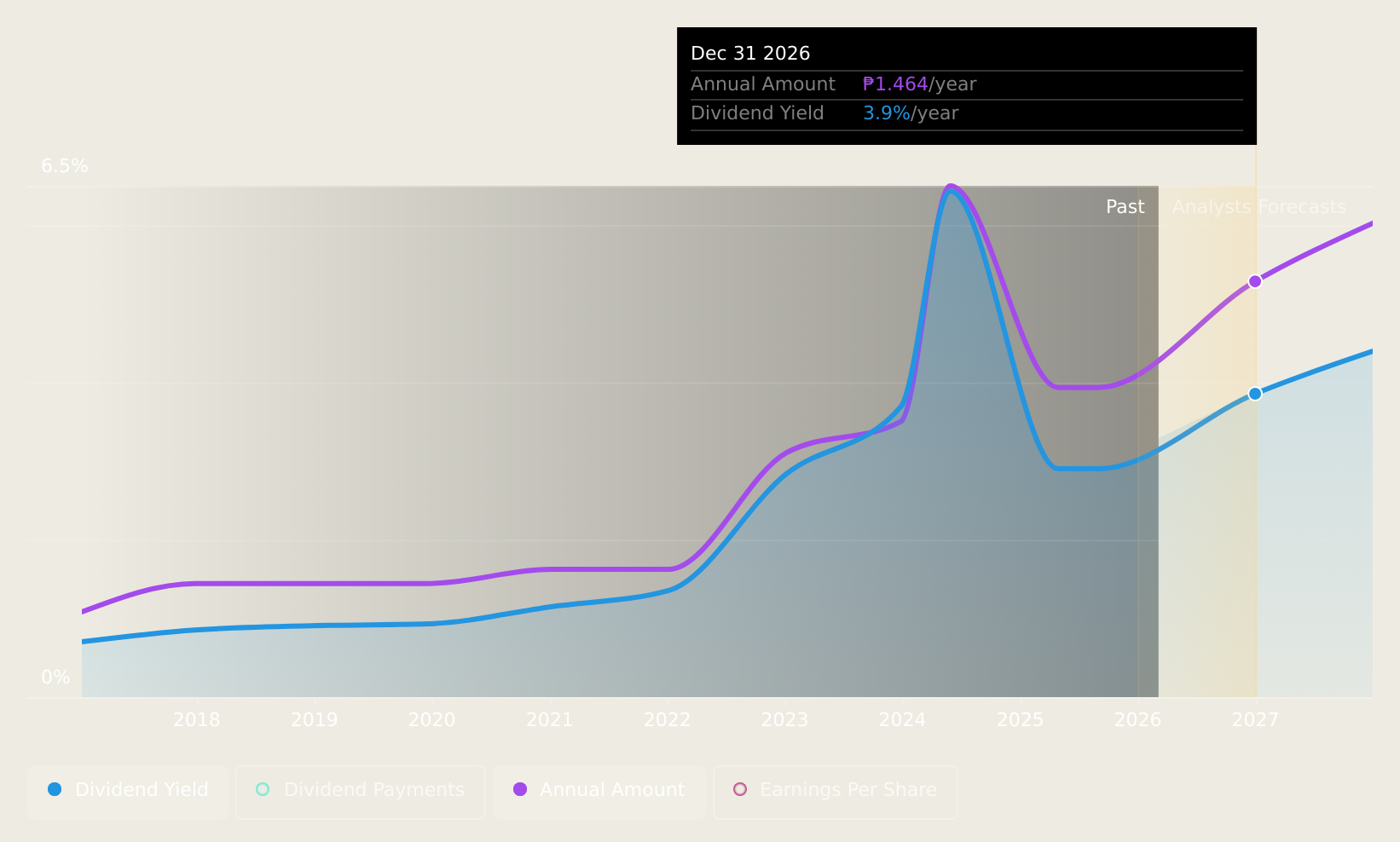

Puregold Price Club (PSE:PGOLD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Puregold Price Club, Inc. operates in the retail and wholesale trading of dry goods, food, and other merchandise in the Philippines with a market cap of ₱87.11 billion.

Operations: Puregold Price Club, Inc.'s revenue from its retailing business amounts to ₱211.71 billion.

Dividend Yield: 5.9%

Puregold Price Club's dividend yield of 5.92% falls below the top 25% in the Philippine market, and its dividend history has been volatile over the past decade. However, dividends are well-supported by earnings with a payout ratio of 60.3% and cash flows at 43.3%. Recent earnings show increased sales but a slight dip in quarterly net income year-over-year. The company is trading significantly below its estimated fair value, offering potential investment appeal despite an unstable dividend track record.

- Click here and access our complete dividend analysis report to understand the dynamics of Puregold Price Club.

- In light of our recent valuation report, it seems possible that Puregold Price Club is trading behind its estimated value.

Key Takeaways

- Discover the full array of 1966 Top Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:PGOLD

Puregold Price Club

Engages in the retail and wholesale trading of dry goods, food, and other merchandise in the Philippines.

Undervalued with excellent balance sheet and pays a dividend.