- Philippines

- /

- Food and Staples Retail

- /

- PSE:KEEPR

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate a mix of economic indicators, including a strong year-end performance for U.S. indices and fluctuating manufacturing data from regions like China and Japan, investors are keenly assessing their portfolios for stability and growth potential. In this environment, dividend stocks can offer an appealing balance by providing regular income streams while potentially benefiting from broader market gains.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.13% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.57% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.29% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.68% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.02% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.01% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 2014 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

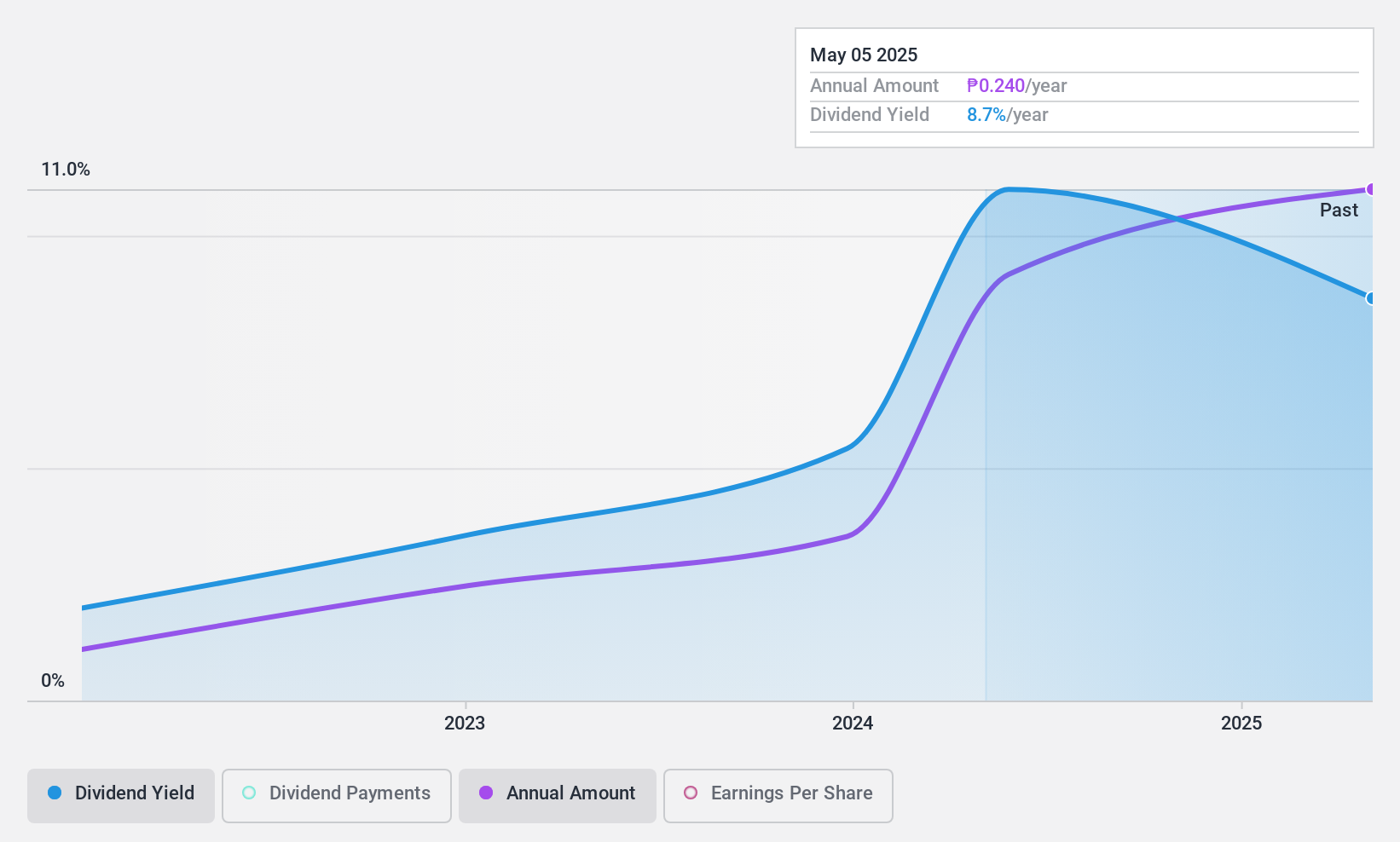

Keepers Holdings (PSE:KEEPR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Keepers Holdings, Inc. is an investment holding company involved in the distribution of liquor, wine, and specialty beverages in the Philippines with a market cap of ₱33.66 billion.

Operations: The Keepers Holdings, Inc. generates its revenue from the sale of spirits, wines, and specialty beverages amounting to ₱17.80 billion.

Dividend Yield: 8.6%

Keepers Holdings offers an attractive dividend yield of 8.62%, ranking in the top 25% of Philippine dividend payers. The payout is sustainable, with a payout ratio of 78.3% and a cash payout ratio of 71.3%. Although dividends have been stable and growing, Keepers has only paid them for three years. Recent earnings growth supports this stability, with net income rising to PHP 2.17 billion for the nine months ending September 2024.

- Navigate through the intricacies of Keepers Holdings with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Keepers Holdings is priced lower than what may be justified by its financials.

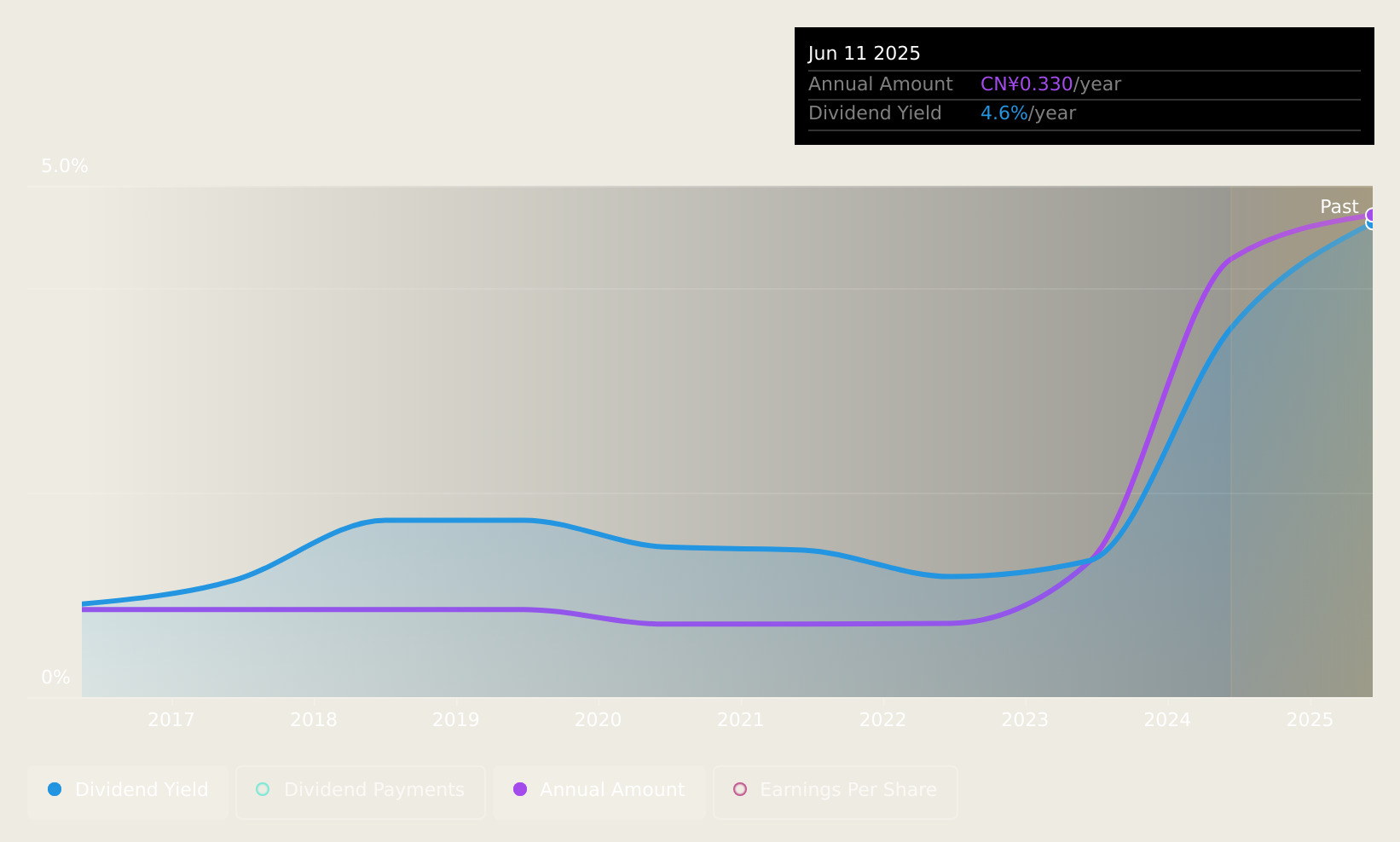

Changhong Meiling (SZSE:000521)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Changhong Meiling Co., Ltd. operates in the electrical machinery and equipment manufacturing industry both in China and internationally, with a market cap of CN¥8.10 billion.

Operations: Changhong Meiling Co., Ltd. generates revenue through its operations in the electrical machinery and equipment manufacturing sector, serving both domestic and international markets.

Dividend Yield: 3.6%

Changhong Meiling's dividend yield of 3.55% is among the top 25% in China, supported by a low payout ratio of 40% and a cash payout ratio of 14.7%, ensuring sustainability. Over the past decade, dividends have been stable and reliable with consistent growth. Recent earnings show net income increased to CNY 530.44 million for the nine months ending September 2024, reflecting strong financial health that supports ongoing dividend payments.

- Take a closer look at Changhong Meiling's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Changhong Meiling is trading behind its estimated value.

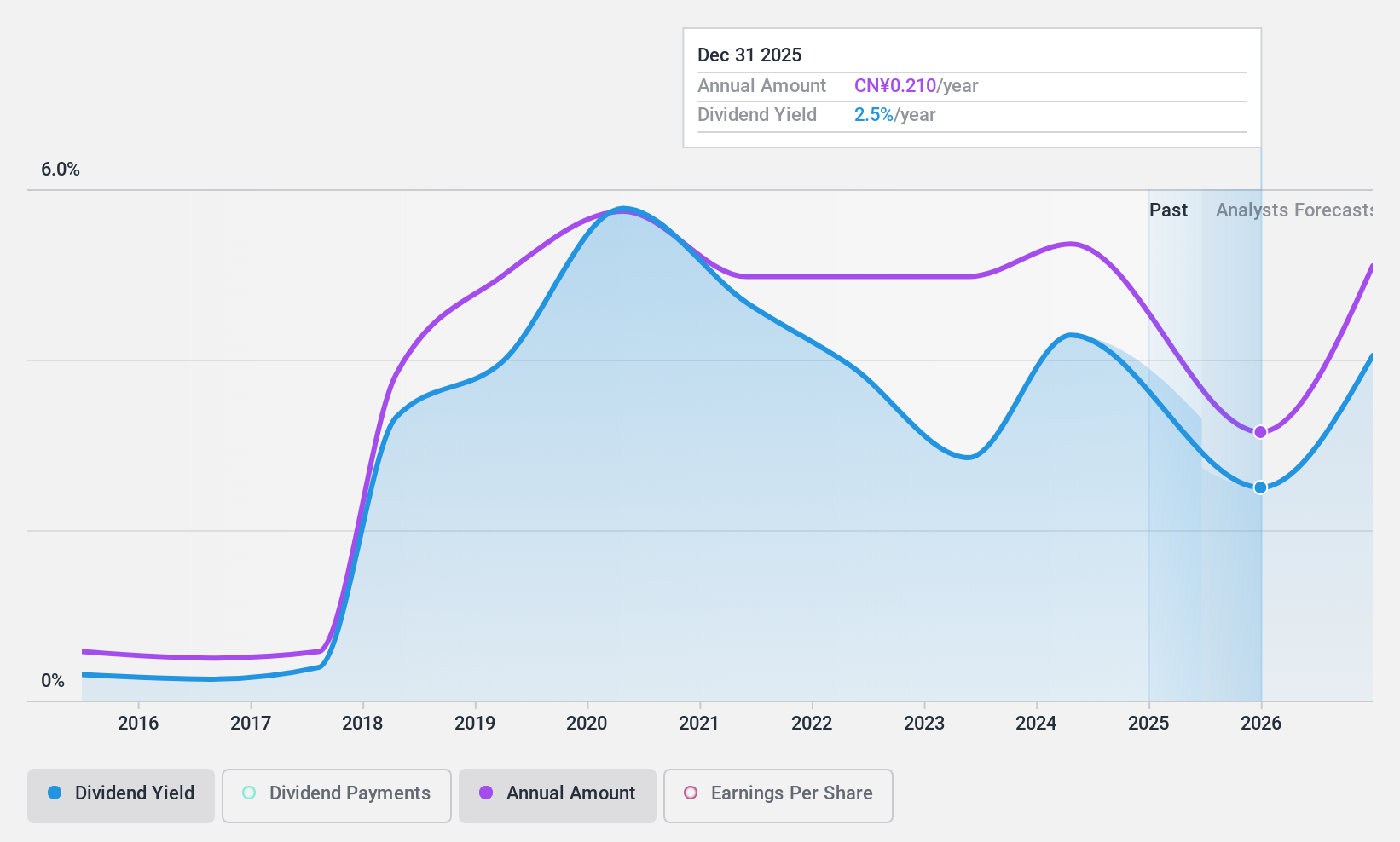

Teyi Pharmaceutical GroupLtd (SZSE:002728)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teyi Pharmaceutical Group Co., Ltd operates in the research, development, production, and sale of Chinese patent medicines and pharmaceutical products in China, with a market cap of approximately CN¥4.63 billion.

Operations: Teyi Pharmaceutical Group Co., Ltd generates revenue from its activities in research and development, production, and sale of Chinese patent medicines, pharmaceutical preparations, and raw materials within the People's Republic of China.

Dividend Yield: 3.8%

Teyi Pharmaceutical Group Ltd's dividend yield of 3.84% ranks in the top 25% of Chinese dividend payers, although it is not well covered by earnings or free cash flows due to a high payout ratio. Despite stable and reliable dividends over the past decade, recent financial performance shows a significant decline in net income to CNY 6.01 million for the nine months ending September 2024, raising concerns about future dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Teyi Pharmaceutical GroupLtd.

- Upon reviewing our latest valuation report, Teyi Pharmaceutical GroupLtd's share price might be too optimistic.

Key Takeaways

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 2011 more companies for you to explore.Click here to unveil our expertly curated list of 2014 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keepers Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About PSE:KEEPR

Keepers Holdings

An investment holding company, engages in the liquor, wine, and specialty beverage distribution business in the Philippines.

Outstanding track record with flawless balance sheet and pays a dividend.