- United Arab Emirates

- /

- Banks

- /

- ADX:BOS

Undiscovered Gems To Explore This February 2025

Reviewed by Simply Wall St

As global markets edge towards record highs, small-cap stocks have recently lagged behind their larger counterparts, with the Russell 2000 Index trailing the S&P 500 by a notable margin. In this environment of heightened inflation and cautious monetary policy, identifying undiscovered gems requires a focus on companies with strong fundamentals and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Bank Of Sharjah P.J.S.C (ADX:BOS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bank Of Sharjah P.J.S.C., along with its subsidiaries, offers commercial and investment banking products and services in the United Arab Emirates, with a market capitalization of AED2.94 billion.

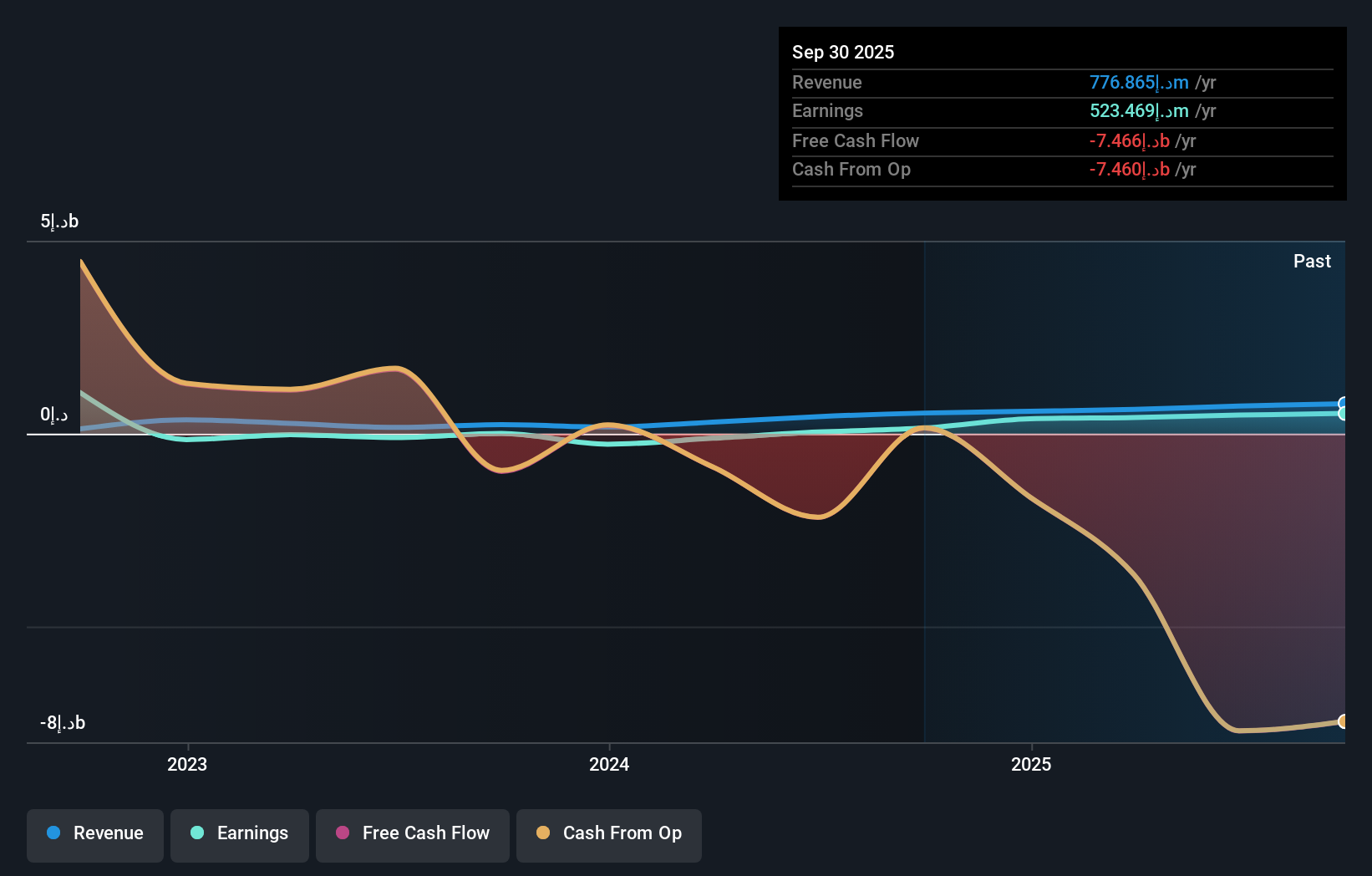

Operations: Bank Of Sharjah generates revenue primarily through its commercial and investment banking services. The company's financial performance is influenced by various factors, including interest income and fee-based services. It is important to note the trends in net profit margin, which can provide insights into profitability over time.

Bank of Sharjah, with AED40.7 billion in assets and AED3.8 billion in equity, has shown signs of turning a corner by becoming profitable recently. The bank's total deposits reach AED29.5 billion against loans of AED23.4 billion, indicating a solid deposit base that primarily funds its operations, reducing reliance on external borrowing. Despite having high-quality earnings and a competitive price-to-earnings ratio at 7.6x compared to the AE market's 13.3x, challenges persist with a high bad loans ratio at 8.3% and low allowance for bad loans at 83%, highlighting areas needing attention for sustained growth.

- Navigate through the intricacies of Bank Of Sharjah P.J.S.C with our comprehensive health report here.

Learn about Bank Of Sharjah P.J.S.C's historical performance.

Philippine National Bank (PSE:PNB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Philippine National Bank offers a range of banking and financial products and services, with a market capitalization of ₱46.00 billion.

Operations: PNB generates revenue primarily from retail banking, corporate banking, and treasury activities, with retail banking contributing ₱30.15 billion and corporate banking adding ₱15.23 billion. The bank's net profit margin is a key financial metric to consider when evaluating its profitability.

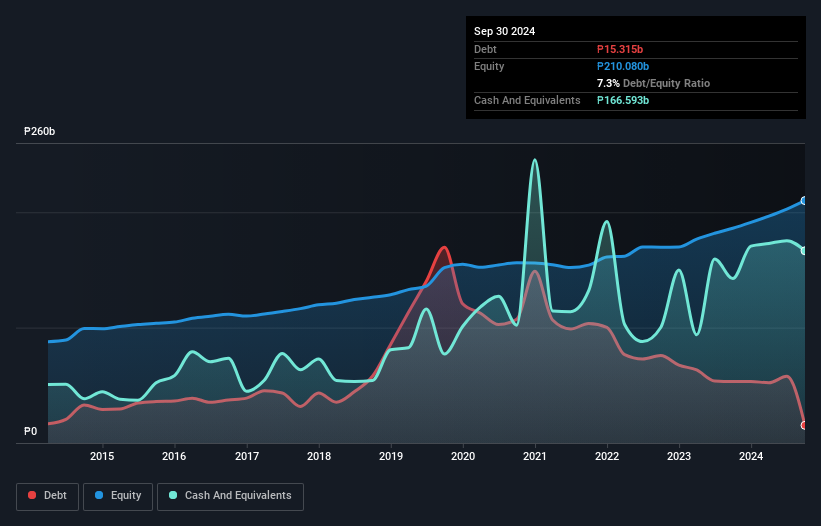

Philippine National Bank, with total assets of ₱1,197.7B and equity of ₱210.1B, showcases a robust financial foundation. It boasts total deposits of ₱942.2B and loans amounting to ₱594.2B while maintaining a net interest margin of 4.2%. However, the bank faces challenges with high bad loans at 7.9% and a low allowance for these at 86%. Despite these hurdles, earnings surged by 41% last year, outpacing the industry average growth rate of 17%. Trading significantly below its fair value estimate by over 70%, PNB remains an intriguing prospect in the banking sector landscape.

- Dive into the specifics of Philippine National Bank here with our thorough health report.

Evaluate Philippine National Bank's historical performance by accessing our past performance report.

Sakura DevelopmentLtd (TWSE:2539)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sakura Development Co., Ltd specializes in the sale and lease of residential properties, primarily in the Zhongzhangtou area of Taiwan, with a market capitalization of NT$53.59 billion.

Operations: Sakura Development generates revenue through the sale and lease of residential properties in Taiwan's Zhongzhangtou area. The company's market capitalization stands at NT$53.59 billion.

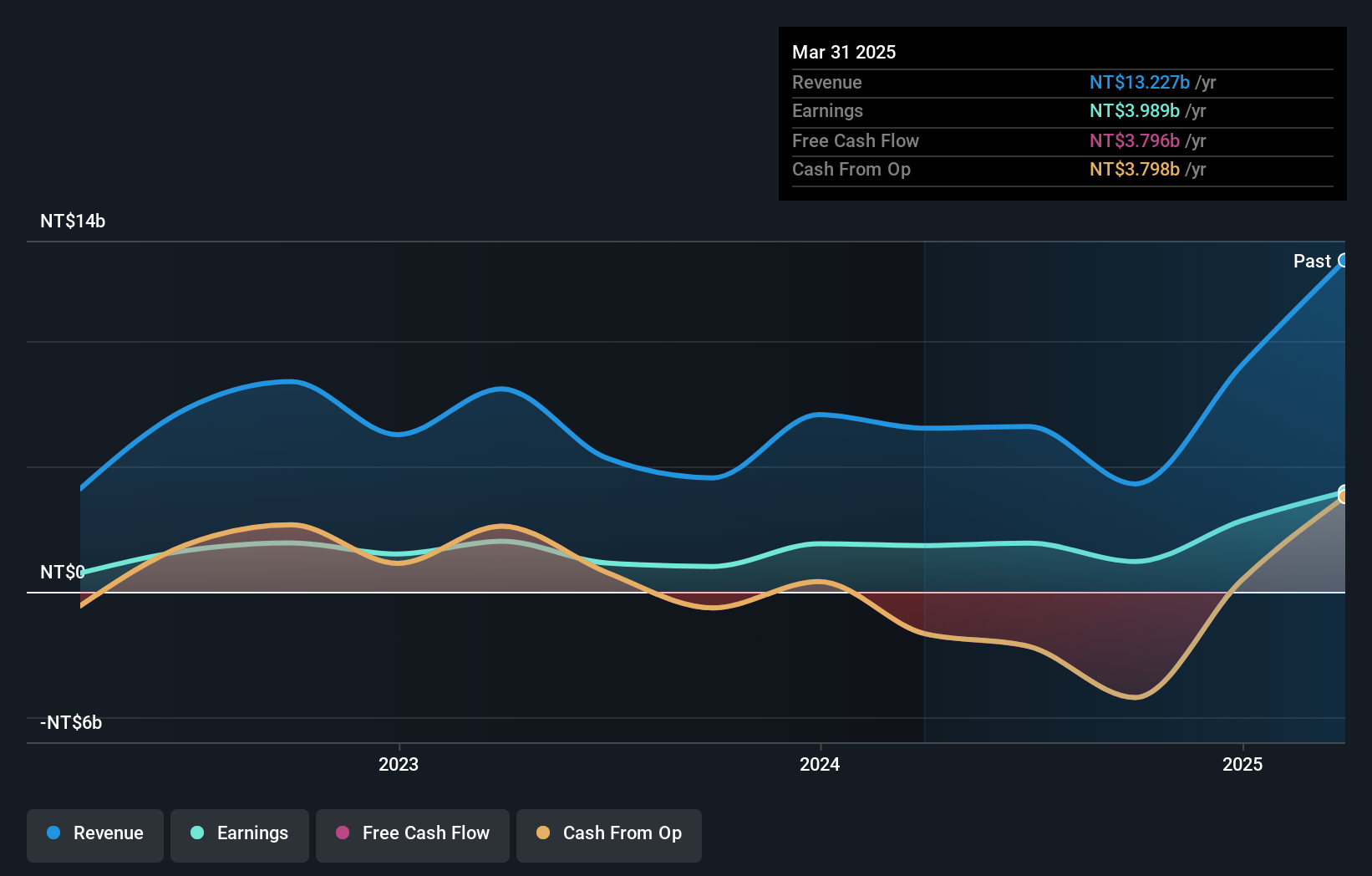

Sakura Development Ltd. showcases a solid growth trajectory with earnings increasing 9.8% annually over the last five years, although recent expansion efforts might have stretched its financials. The company recently acquired land in Taichung City and Changhua County for TWD 957 million and TWD 511 million respectively, indicating strategic expansion moves. However, the net debt to equity ratio remains high at 106.5%, suggesting potential leverage concerns despite interest payments being well-covered by profits. While not free cash flow positive, Sakura's profitability provides some cushion against financial pressures as it navigates these ambitious growth plans in real estate development.

Key Takeaways

- Discover the full array of 4745 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank Of Sharjah P.J.S.C might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:BOS

Bank Of Sharjah P.J.S.C

Provides commercial and investment banking products and services in the United Arab Emirates.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives