As global markets navigate a landscape of mixed economic signals and geopolitical uncertainties, small-cap stocks have shown resilience, with the S&P MidCap 400 posting its first weekly gain since January amid light trading volumes. Against this backdrop of cautious optimism, identifying promising stocks involves looking for companies that can thrive in uncertain environments—those with strong fundamentals, innovative strategies, and the potential to capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Indofood Agri Resources | 30.05% | 2.36% | 41.87% | ★★★★★★ |

| Baazeem Trading | 6.93% | -1.88% | -2.38% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 2.07% | 16.18% | 21.11% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Billion Industrial Holdings | 7.13% | 18.54% | -14.41% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 14.22% | -1.39% | -14.93% | ★★★★★☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

| Saudi Chemical Holding | 73.23% | 15.66% | 44.81% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Philippine National Bank (PSE:PNB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Philippine National Bank offers a wide range of banking and financial products and services, with a market capitalization of ₱67.67 billion.

Operations: The bank's primary revenue streams are retail banking, contributing ₱34.18 billion, and corporate banking at ₱11.34 billion. Treasury operations also play a significant role with revenues of ₱9.94 billion.

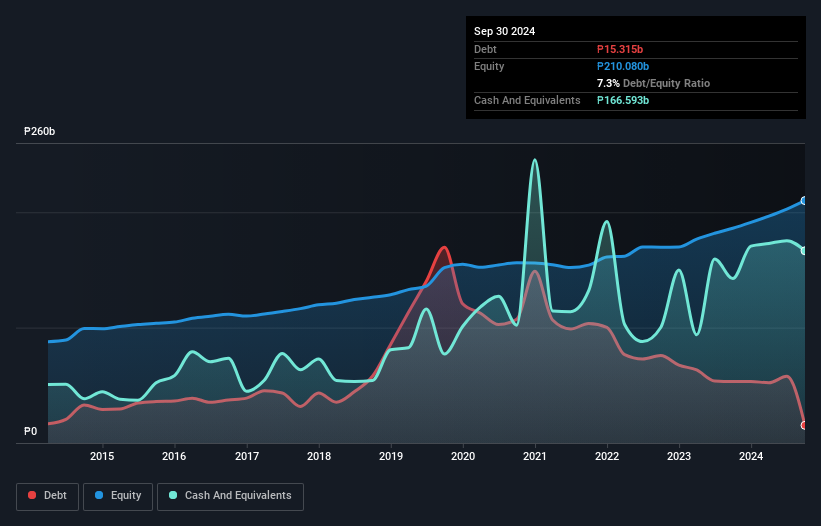

Philippine National Bank, with total assets of ₱1,257.6 billion and equity of ₱216.6 billion, is making waves as it trades at 53% below its estimated fair value. The bank's earnings grew by 17% last year, surpassing the industry average, though it's forecasted to decline by an average of 5% annually over the next three years. Despite a net interest margin of 4.5%, PNB faces challenges with a high level of bad loans at 6.9%. Recent board decisions include a cash dividend declaration amounting to PHP 2.76 per share from unrestricted retained earnings for fiscal year-end December 2024.

Atlantic China Welding Consumables (SHSE:600558)

Simply Wall St Value Rating: ★★★★★★

Overview: Atlantic China Welding Consumables, Inc. focuses on the research, development, production, and sale of welding rods, wires, and fluxes both in China and internationally with a market cap of CN¥4.62 billion.

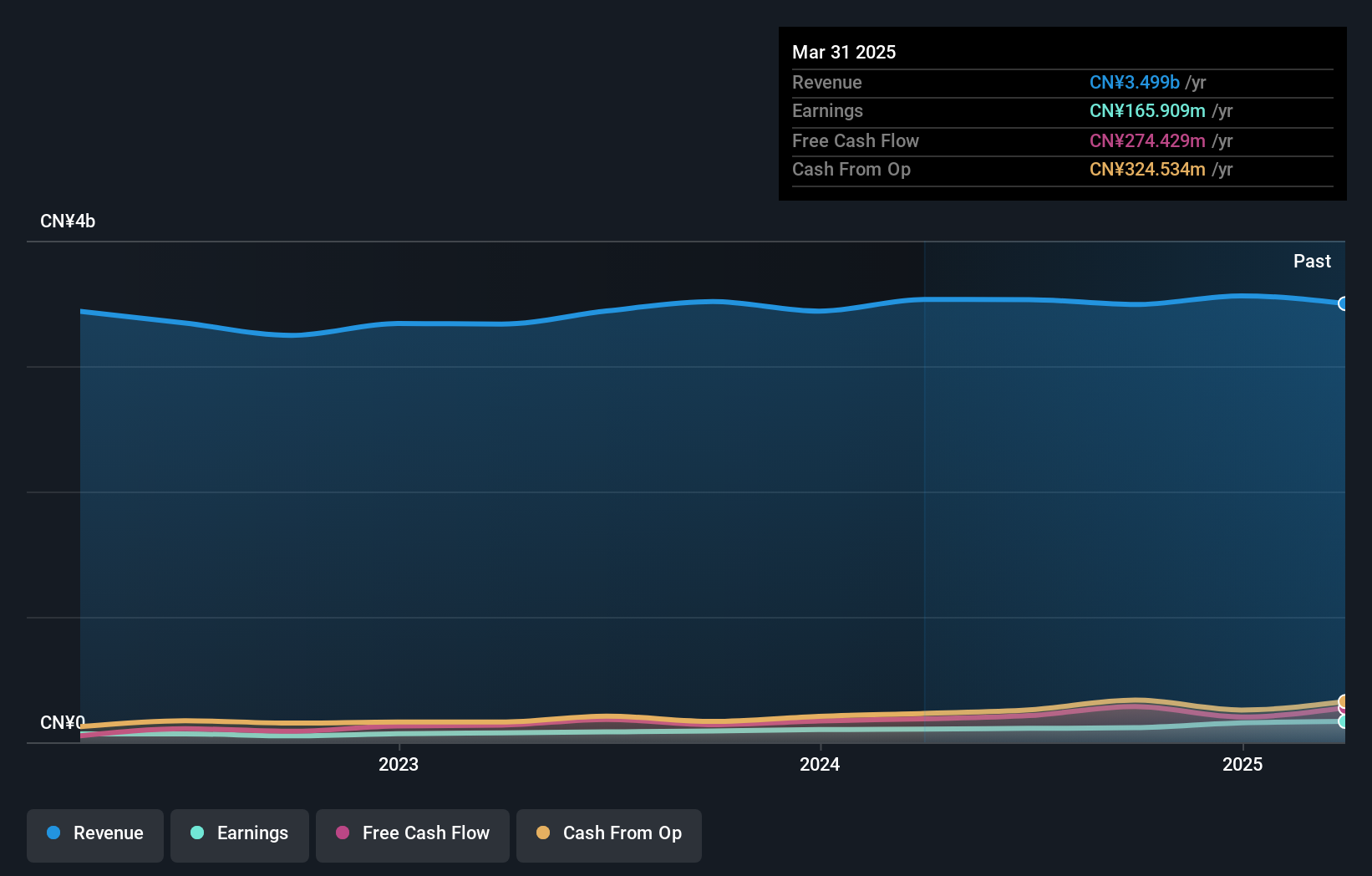

Operations: The company generates revenue primarily from the sale of raw materials, amounting to CN¥3.49 billion.

Atlantic China Welding Consumables, a smaller player in its field, is trading at 63% below estimated fair value, suggesting potential undervaluation. The company has shown robust earnings growth of 27.9% over the past year, outpacing the machinery industry's modest 0.1%. A significant one-off gain of CN¥29.6M has influenced recent financial results as of September 2024. With more cash than total debt and a reduced debt-to-equity ratio from 14.1% to 3.8% over five years, its financial health appears stable. Despite these positives, investors should consider how non-recurring gains might impact future earnings sustainability.

Shanghai Chlor-Alkali Chemical (SHSE:600618)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai Chlor-Alkali Chemical Co., Ltd. is engaged in the manufacturing and sale of chemical products both domestically and internationally, with a market capitalization of CN¥9.59 billion.

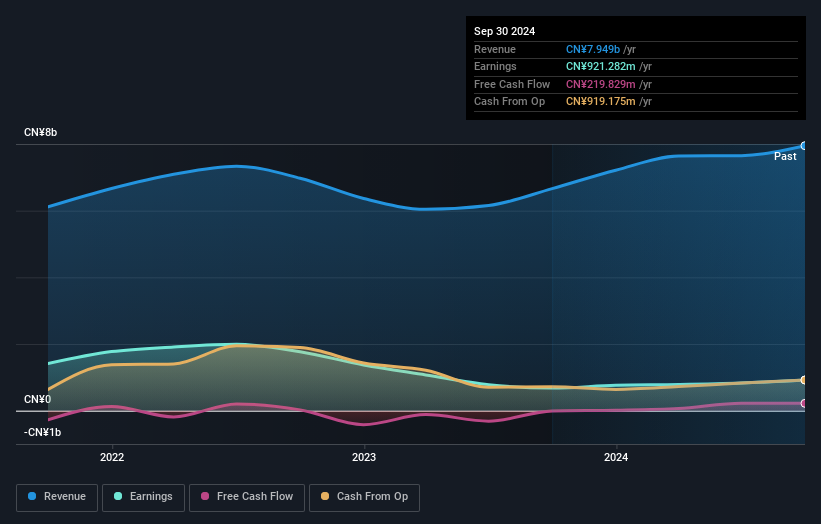

Operations: The company generates revenue primarily through the sale of chemical products. Its financial performance is influenced by cost structures related to production and distribution. The net profit margin reflects the company's profitability trends over time.

Shanghai Chlor-Alkali Chemical stands out with a price-to-earnings ratio of 13.8x, significantly lower than the CN market average of 38.1x, indicating potential value. The company's earnings surged by 36%, surpassing the chemicals industry average of -5.5%, showcasing robust growth momentum. Despite a slight increase in its debt-to-equity ratio from 7.3 to 7.7 over five years, it maintains more cash than total debt, demonstrating financial stability and ability to cover interest payments effortlessly. With high-quality earnings and positive free cash flow, this small company seems poised for continued performance in its sector.

- Get an in-depth perspective on Shanghai Chlor-Alkali Chemical's performance by reading our health report here.

Understand Shanghai Chlor-Alkali Chemical's track record by examining our Past report.

Where To Now?

- Discover the full array of 3247 Global Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600618

Shanghai Chlor-Alkali Chemical

Manufactures and sells chemical products in China and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives