- New Zealand

- /

- Diversified Financial

- /

- NZSE:IFT

Does Infratil (NZSE:IFT) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Infratil (NZSE:IFT). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Infratil

How Fast Is Infratil Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that Infratil's EPS went from NZ$0.06 to NZ$0.39 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. Could this be a sign that the business has reached an inflection point?

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Not all of Infratil's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The good news is that Infratil is growing revenues, and EBIT margins improved by 21.9 percentage points to 38%, over the last year. Both of which are great metrics to check off for potential growth.

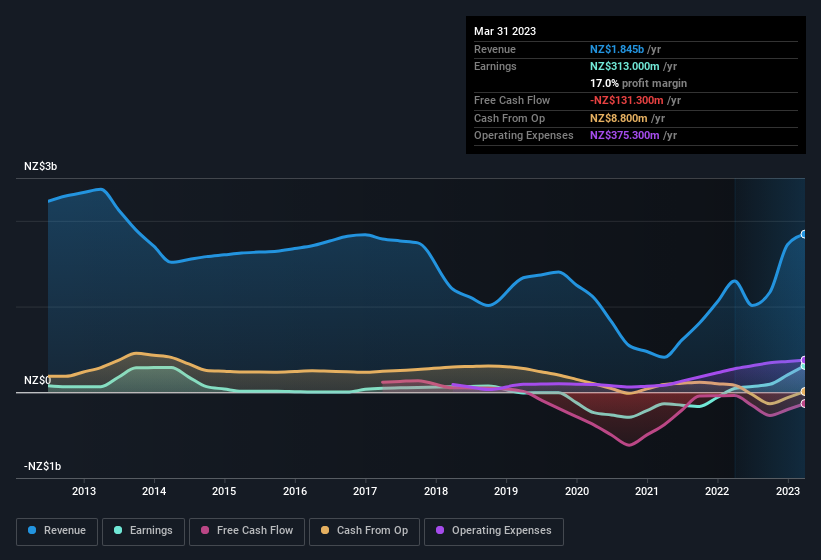

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Infratil?

Are Infratil Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's pleasing to note that insiders spent NZ$4.0m buying Infratil shares, over the last year, without reporting any share sales whatsoever. Buying like that is a fantastic look for the company and should rouse the market in anticipation for the future. It is also worth noting that it was Independent Director Andrew Clark who made the biggest single purchase, worth NZ$1.5m, paying NZ$9.86 per share.

Along with the insider buying, another encouraging sign for Infratil is that insiders, as a group, have a considerable shareholding. Notably, they have an enviable stake in the company, worth NZ$162m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Is Infratil Worth Keeping An Eye On?

Infratil's earnings per share have been soaring, with growth rates sky high. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Infratil deserves timely attention. However, before you get too excited we've discovered 3 warning signs for Infratil (2 are concerning!) that you should be aware of.

The good news is that Infratil is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:IFT

Infratil

An infrastructure investment firm specializing in digital Infrastructure, renewables, and social infrastructure.

Moderate growth potential and slightly overvalued.