- New Zealand

- /

- Logistics

- /

- NZSE:FRW

Why We Think Freightways Limited's (NZSE:FRE) CEO Compensation Is Not Excessive At All

Despite strong share price growth of 40% for Freightways Limited (NZSE:FRE) over the last few years, earnings growth has been disappointing, which suggests something is amiss. The upcoming AGM on 26 October 2022 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. In our analysis below, we show why shareholders may consider holding off a raise for the CEO's compensation until company performance improves.

Check out the opportunities and risks within the XX Logistics industry.

Comparing Freightways Limited's CEO Compensation With The Industry

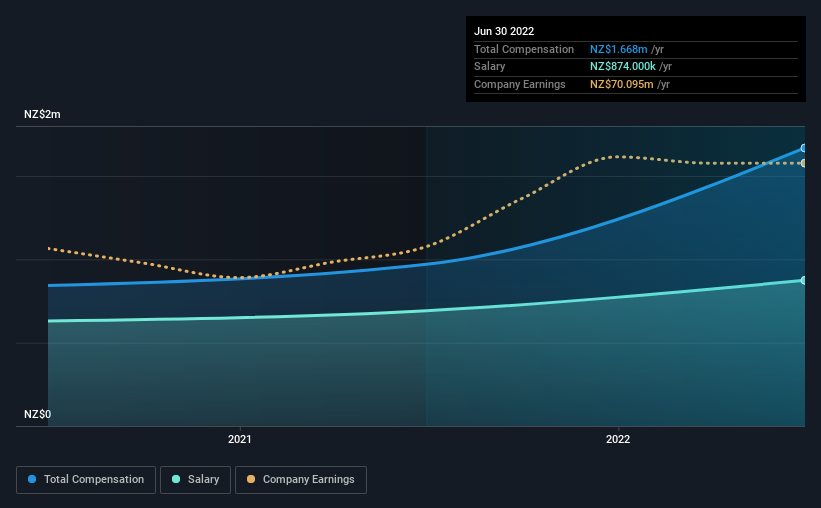

At the time of writing, our data shows that Freightways Limited has a market capitalization of NZ$1.8b, and reported total annual CEO compensation of NZ$1.7m for the year to June 2022. Notably, that's an increase of 72% over the year before. We note that the salary of NZ$874.0k makes up a sizeable portion of the total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations ranging from NZ$708m to NZ$2.8b, the reported median CEO total compensation was NZ$1.3m. From this we gather that Mark Troughear is paid around the median for CEOs in the industry. What's more, Mark Troughear holds NZ$4.3m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | NZ$874k | NZ$692k | 52% |

| Other | NZ$794k | NZ$278k | 48% |

| Total Compensation | NZ$1.7m | NZ$970k | 100% |

Speaking on an industry level, nearly 73% of total compensation represents salary, while the remainder of 27% is other remuneration. Freightways pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Freightways Limited's Growth Numbers

Over the last three years, Freightways Limited has shrunk its earnings per share by 1.1% per year. In the last year, its revenue is up 9.1%.

The lack of EPS growth is certainly uninspiring. The fairly low revenue growth fails to impress given that the EPS is down. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Freightways Limited Been A Good Investment?

We think that the total shareholder return of 40%, over three years, would leave most Freightways Limited shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 4 warning signs for Freightways that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:FRW

Freightways Group

Provides express package and business mail, and information management services in New Zealand, Australia, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives