- New Zealand

- /

- Airlines

- /

- NZSE:AIR

3 Asian Companies That May Be Priced Below Their Estimated Worth In September 2025

Reviewed by Simply Wall St

As global markets navigate a period of uncertainty with mixed performances across major indices, Asia's financial landscape presents intriguing opportunities for investors. In this context, identifying undervalued stocks becomes crucial, as these may offer potential value in a market characterized by cautious optimism and strategic monetary policies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥84.60 | CN¥165.09 | 48.8% |

| West Holdings (TSE:1407) | ¥1689.00 | ¥3295.90 | 48.8% |

| TOWA (TSE:6315) | ¥1697.00 | ¥3351.25 | 49.4% |

| Suzhou Alton Electrical & Mechanical Industry (SZSE:301187) | CN¥30.39 | CN¥59.25 | 48.7% |

| Star Micronics (TSE:7718) | ¥1682.00 | ¥3330.99 | 49.5% |

| Robosense Technology (SEHK:2498) | HK$37.76 | HK$73.72 | 48.8% |

| Japan Data Science ConsortiumLtd (TSE:4418) | ¥1005.00 | ¥1977.84 | 49.2% |

| Hangzhou Zhongtai Cryogenic Technology (SZSE:300435) | CN¥17.74 | CN¥35.01 | 49.3% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.53 | CN¥78.38 | 49.6% |

| AIMECHATEC (TSE:6227) | ¥3900.00 | ¥7721.86 | 49.5% |

Let's dive into some prime choices out of the screener.

Air New Zealand (NZSE:AIR)

Overview: Air New Zealand Limited, along with its subsidiaries, offers air passenger and cargo transportation services across various regions including New Zealand, Australia, the Pacific Islands, Asia, the United Kingdom, Europe, and the Americas with a market cap of NZ$1.98 billion.

Operations: The company's revenue is primarily derived from the transportation of passengers and cargo, amounting to NZ$6.76 billion.

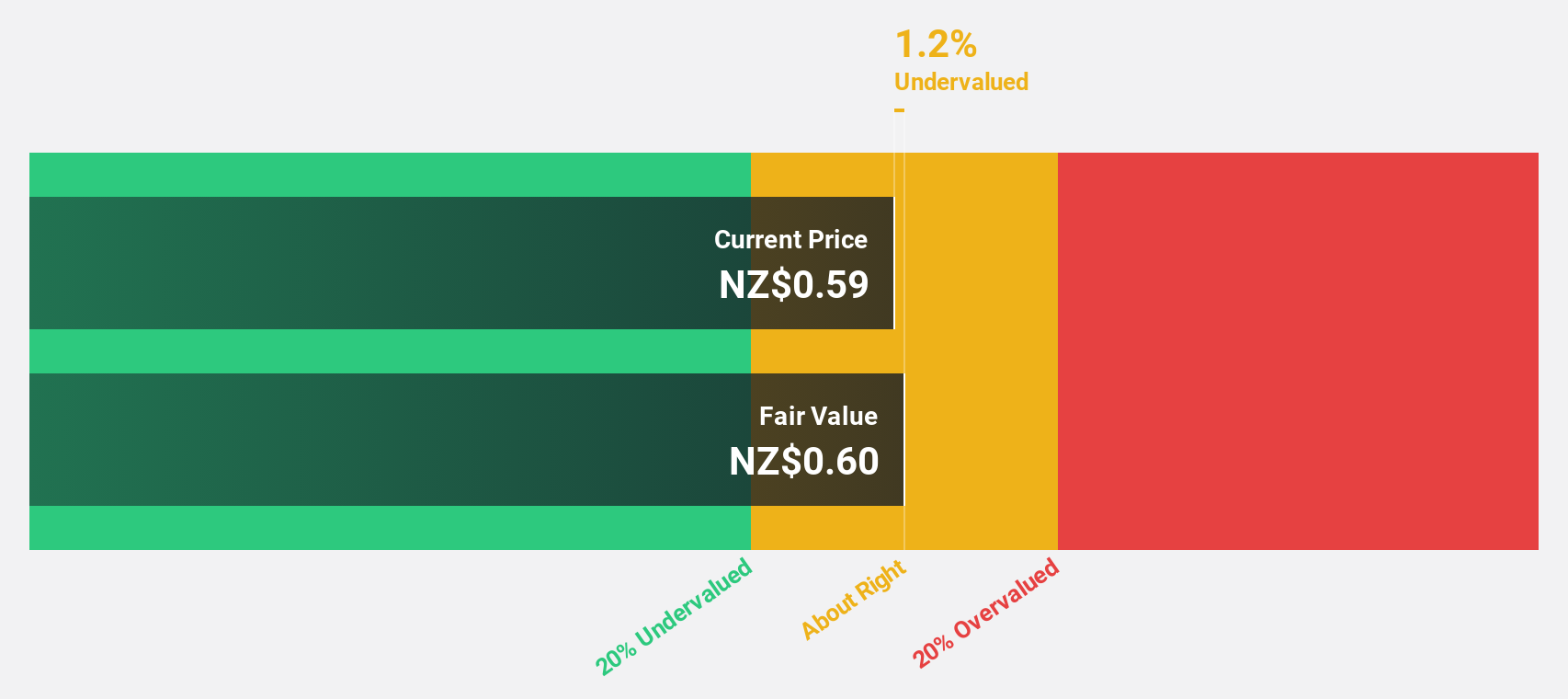

Estimated Discount To Fair Value: 11.8%

Air New Zealand's current trading price of NZ$0.61 is 11.8% below its estimated fair value of NZ$0.69, suggesting it may be undervalued based on discounted cash flow analysis. Despite a recent dividend decrease and modest revenue growth forecast at 4.4% annually, earnings are expected to grow significantly at 22.7% per year, outpacing the NZ market average of 21.9%. However, net income has declined slightly from last year to NZ$126 million for the full year ending June 2025.

- Our expertly prepared growth report on Air New Zealand implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Air New Zealand's balance sheet health report.

Zylox-Tonbridge Medical Technology (SEHK:2190)

Overview: Zylox-Tonbridge Medical Technology Co., Ltd. is a medical device company that offers neuro- and peripheral-vascular interventional devices in China and internationally, with a market cap of HK$8.01 billion.

Operations: The company generates revenue from the sales of neurovascular and peripheral-vascular interventional surgical devices, totaling CN¥898.46 million.

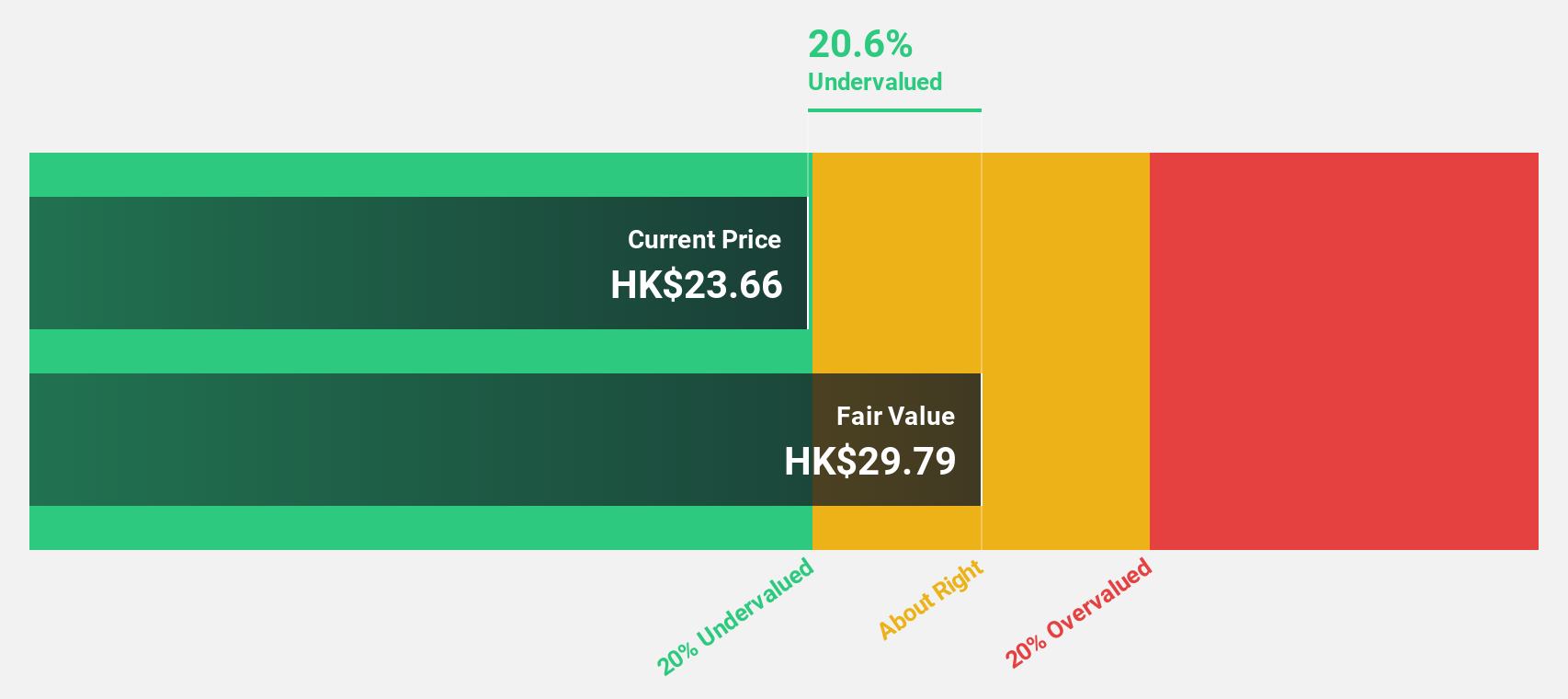

Estimated Discount To Fair Value: 15%

Zylox-Tonbridge Medical Technology's current trading price of HK$25.08 is 15% below its estimated fair value of HK$29.51, indicating potential undervaluation based on cash flows. Recent earnings for the half-year showed net income growth to CNY 121.2 million from CNY 68.87 million a year ago, with revenue up to CNY 481.97 million from CNY 365.99 million, reflecting robust performance and significant earnings growth forecasted at over 37% annually, surpassing the Hong Kong market average.

- The growth report we've compiled suggests that Zylox-Tonbridge Medical Technology's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Zylox-Tonbridge Medical Technology.

Singapore Technologies Engineering (SGX:S63)

Overview: Singapore Technologies Engineering Ltd is a global technology, defence, and engineering company with a market cap of SGD24.14 billion.

Operations: The company generates revenue from three main segments: Commercial Aerospace with SGD4.56 billion, Urban Solutions & Satcom at SGD2.02 billion, and Defence & Public Security contributing SGD5.25 billion.

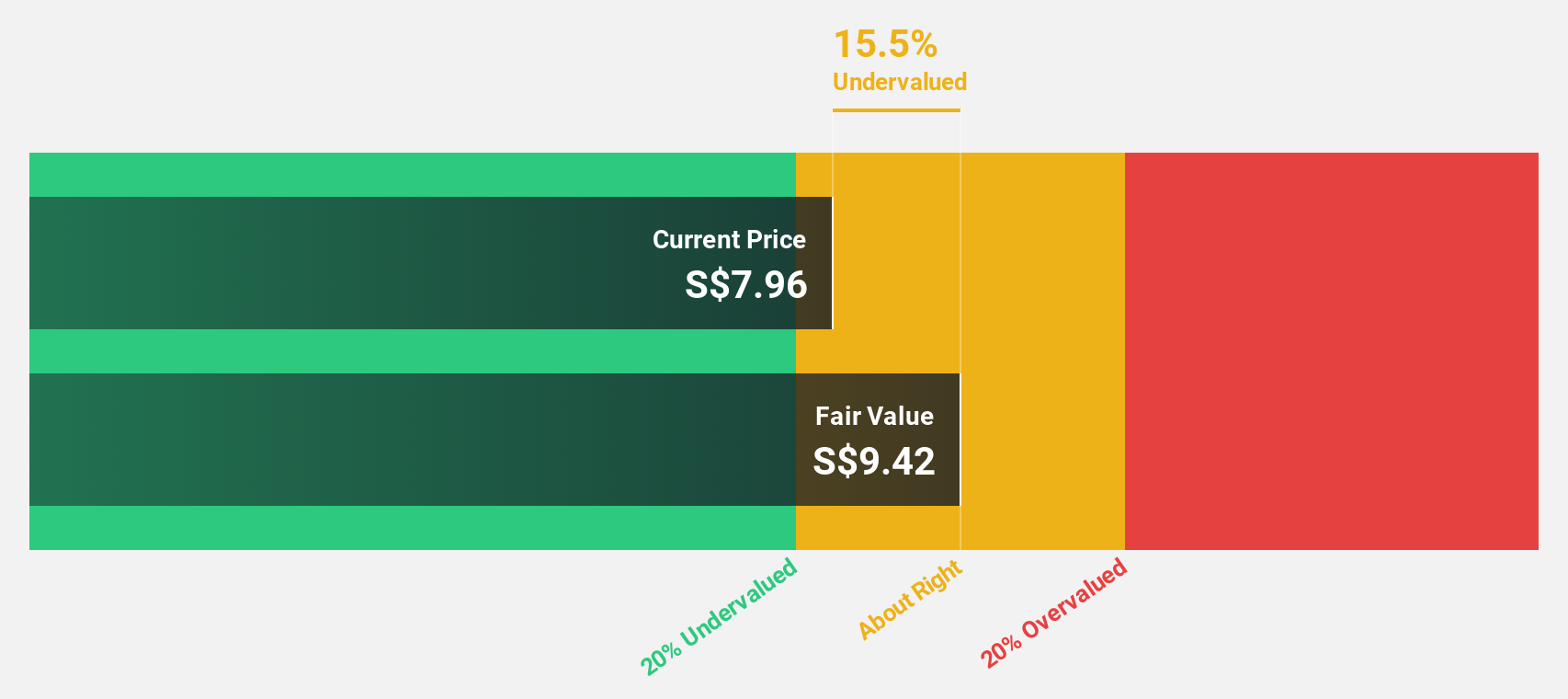

Estimated Discount To Fair Value: 19%

Singapore Technologies Engineering's current price of S$7.74 is 19% below its estimated fair value of S$9.56, indicating potential undervaluation based on cash flows. The company reported H1 2025 earnings with net income rising to S$402.83 million from S$336.53 million a year prior, alongside securing new contracts worth $4.7 billion in Q2 2025 across various segments, demonstrating robust operational performance despite a high debt level and unstable dividend track record.

- According our earnings growth report, there's an indication that Singapore Technologies Engineering might be ready to expand.

- Unlock comprehensive insights into our analysis of Singapore Technologies Engineering stock in this financial health report.

Turning Ideas Into Actions

- Take a closer look at our Undervalued Asian Stocks Based On Cash Flows list of 292 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:AIR

Air New Zealand

Provides air passenger and cargo transportation on scheduled airlines services in New Zealand, Australia, the Pacific Islands, Asia, the United Kingdom, Europe, and the Americas.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives