Rakon And 2 Other Penny Stocks To Watch For Portfolio Growth

Reviewed by Simply Wall St

Global markets have shown mixed results, with major U.S. indexes like the S&P 500 and Nasdaq Composite reaching record highs, while smaller-cap stocks faced declines. In such a diverse market landscape, identifying stocks with strong fundamentals is crucial for investors seeking potential growth opportunities. Penny stocks, often representing smaller or newer companies, continue to offer intriguing possibilities for those willing to explore this investment space. Despite their vintage label, these stocks can present valuable opportunities when backed by solid financials and growth potential.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$143.12M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.435 | MYR1.18B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.16 | £806.27M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.05 | HK$44.27B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.56 | A$67.4M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.53 | £67.32M | ★★★★☆☆ |

| Tristel (AIM:TSTL) | £3.65 | £183.61M | ★★★★★★ |

Click here to see the full list of 5,698 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Rakon (NZSE:RAK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Rakon Limited designs, manufactures, and sells frequency control and timing solutions for various applications globally, with a market cap of NZ$136.63 million.

Operations: The company's revenue is primarily derived from its New Zealand operations at NZ$58.83 million, followed by its France/India segment at NZ$27.70 million and France Hirel at NZ$25.93 million.

Market Cap: NZ$136.63M

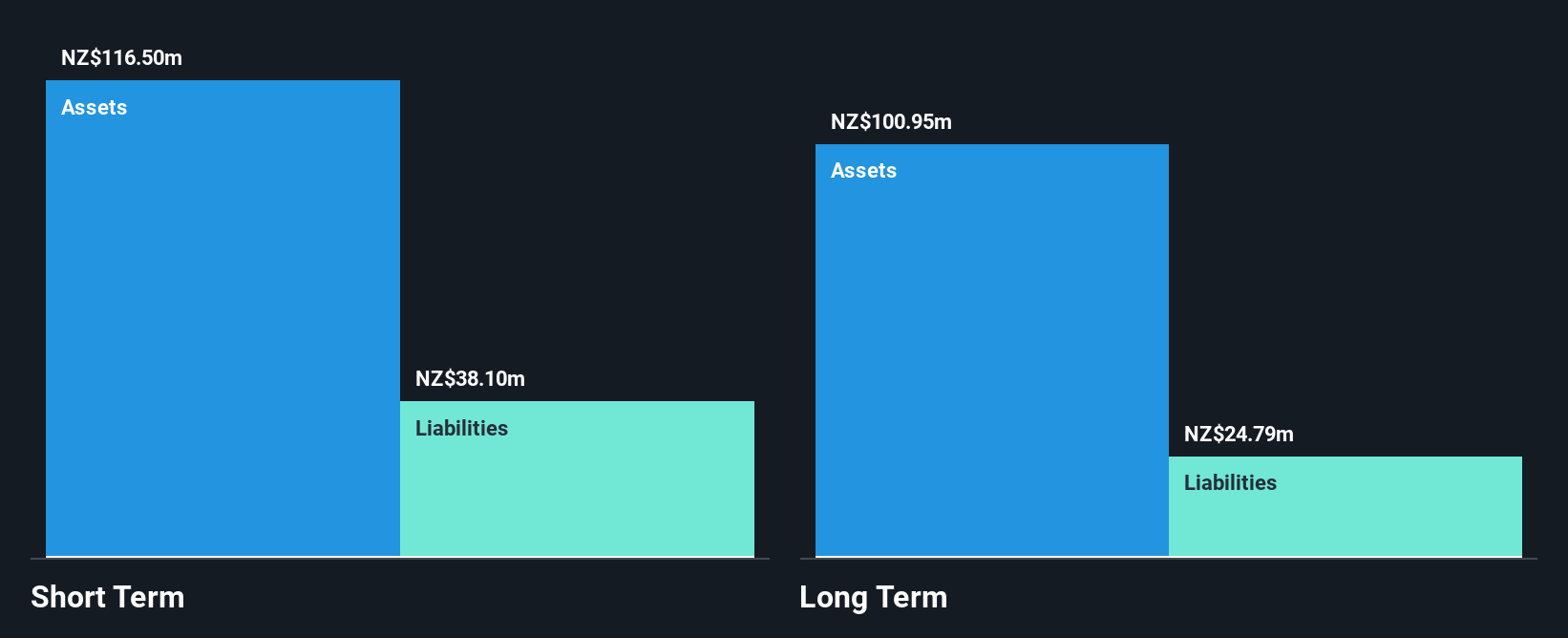

Rakon Limited's recent earnings report shows a decline in sales to NZ$41.66 million, resulting in a net loss of NZ$10.37 million for the half year ended September 30, 2024. Despite this, Rakon maintains strong short-term financial health with assets exceeding liabilities and has reduced its debt-to-equity ratio significantly over five years. The company is trading slightly below its estimated fair value and has not diluted shareholders recently. Strategic contracts with the German Aerospace Center and other satellite projects highlight Rakon's potential in space technology, although high share price volatility remains a concern for investors interested in penny stocks.

- Navigate through the intricacies of Rakon with our comprehensive balance sheet health report here.

- Gain insights into Rakon's outlook and expected performance with our report on the company's earnings estimates.

SinoMedia Holding (SEHK:623)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SinoMedia Holding Limited is an investment holding company that offers TV advertisement, creative content production, and digital marketing services to advertisers and advertising agents in Hong Kong, Singapore, and the People's Republic of China, with a market cap of HK$457.02 million.

Operations: The company generated CN¥719.86 million in revenue from its advertising segment.

Market Cap: HK$457.02M

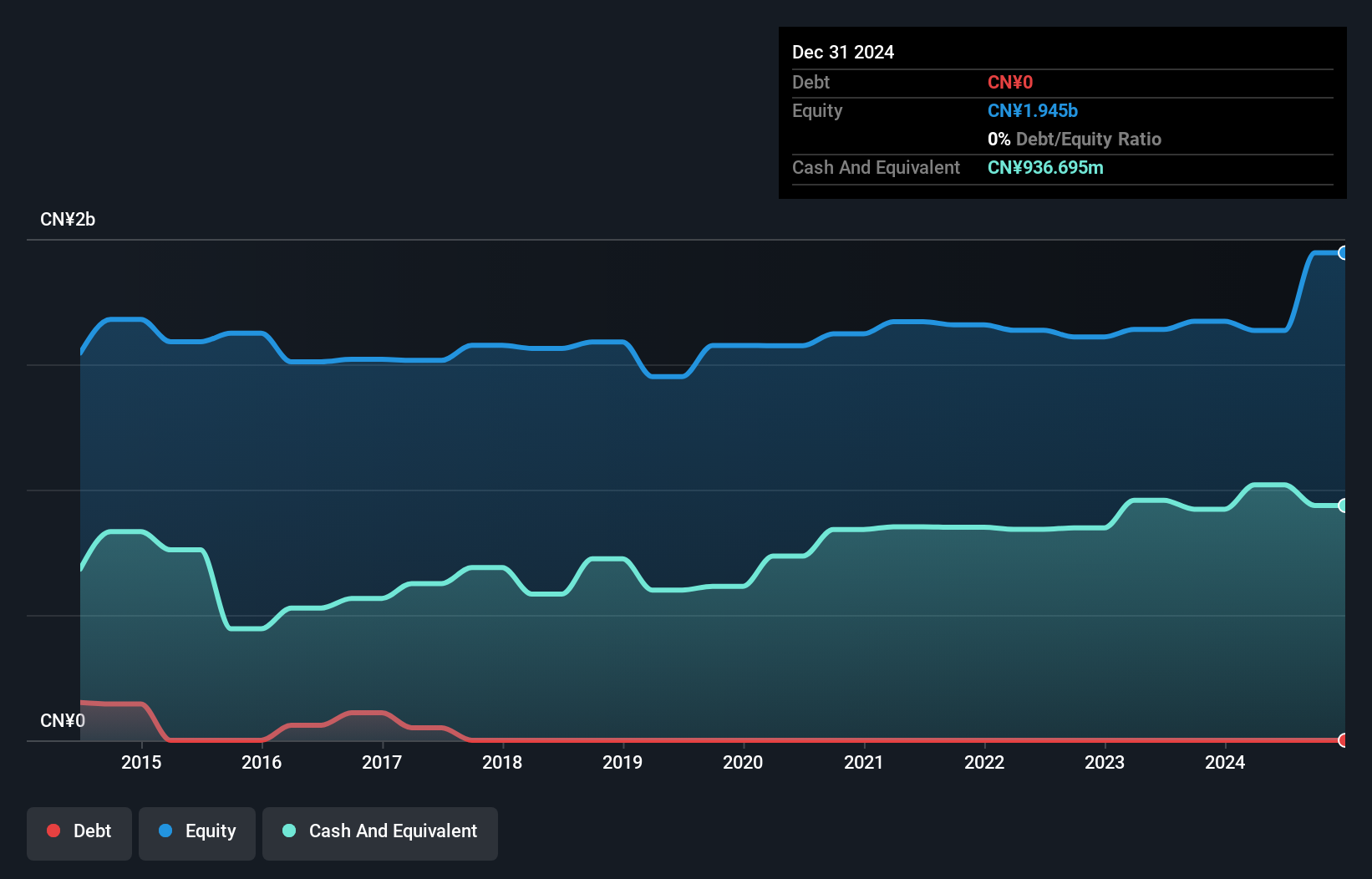

SinoMedia Holding Limited, with a market cap of HK$457.02 million, presents an interesting case for penny stock investors. The company boasts CN¥719.86 million in revenue from its advertising segment and has maintained high-quality earnings despite recent negative earnings growth of 20.8%. Its financial health is robust, with short-term assets significantly exceeding both short and long-term liabilities, and it remains debt-free—eliminating concerns over interest coverage or debt burden. Although trading at a substantial discount to estimated fair value, the firm's net profit margins have decreased compared to last year, alongside an unstable dividend track record.

- Click to explore a detailed breakdown of our findings in SinoMedia Holding's financial health report.

- Examine SinoMedia Holding's past performance report to understand how it has performed in prior years.

Topscore Fashion (SHSE:603608)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Topscore Fashion Co., Ltd. operates in the fashion shoes and apparel sector and mobile Internet marketing business in China, with a market cap of approximately CN¥1.39 billion.

Operations: The company's revenue is derived entirely from its operations in China, amounting to CN¥1.13 billion.

Market Cap: CN¥1.39B

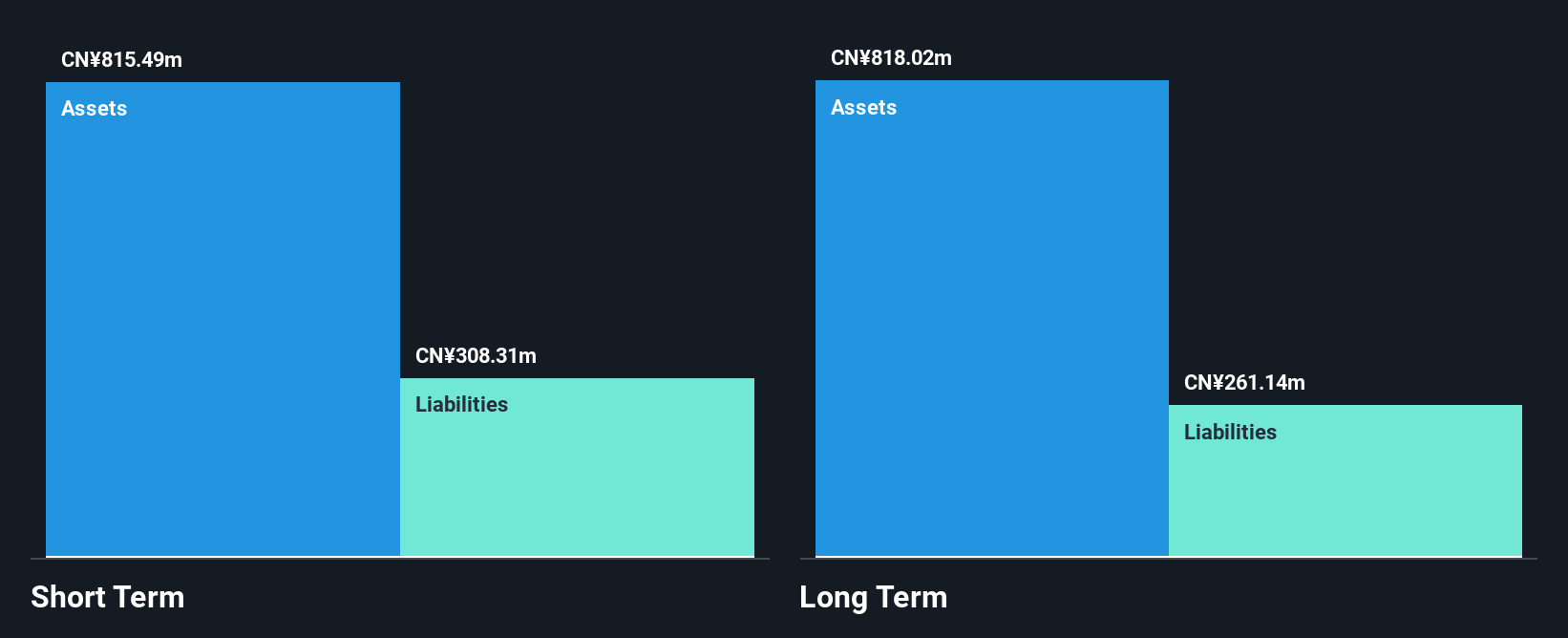

Topscore Fashion Co., Ltd. presents a mixed opportunity for penny stock investors, with a market cap of CN¥1.39 billion and revenues of CN¥800.67 million for the first nine months of 2024, down from CN¥944.57 million the previous year. Despite its unprofitability and increasing net losses, the company maintains strong liquidity with short-term assets exceeding both short- and long-term liabilities. The debt level is manageable as cash exceeds total debt, but rising debt-to-equity ratios over five years warrant caution. Trading at 49.2% below estimated fair value offers potential upside if operational improvements occur amidst stable weekly volatility.

- Click here to discover the nuances of Topscore Fashion with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Topscore Fashion's track record.

Taking Advantage

- Click this link to deep-dive into the 5,698 companies within our Penny Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:RAK

Rakon

Designs, manufactures, and sells frequency control and timing solutions for various applications in Asia, North America, Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives