High Growth Tech And 2 Other Promising Stocks with Potential Growth

Reviewed by Simply Wall St

In the wake of recent political shifts and economic policy changes, global markets have shown a mixed performance with U.S. stocks rallying on growth and tax hopes, while European markets face uncertainties due to potential trade policy impacts. As investors navigate these dynamic conditions, identifying promising stocks involves looking for companies that demonstrate strong growth potential and resilience in adapting to regulatory changes and market fluctuations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.61% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

Click here to see the full list of 1281 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Sword Group (ENXTPA:SWP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sword Group S.E. is a company that provides IT and software solutions on a global scale, with a market capitalization of €335.15 million.

Operations: Sword Group generates revenue through its IT and software services across regions, with notable contributions from Belux (€104.26 million), Switzerland (€105.75 million), and the United Kingdom (€88.88 million).

Sword Group, navigating through a competitive landscape, reported a revenue increase to €156.89 million in the first half of 2024, up from €146.12 million the previous year, although net income slightly decreased to €10.16 million from €12.87 million. This reflects a robust growth trajectory with revenues growing at 13.8% per year, outpacing the French market's 5.6%. Despite this positive trend, earnings are projected to rise at 18.5% annually—higher than France's average of 12.3% but not surpassing the significant growth benchmark of over 20%. The company’s commitment to innovation is evident in its R&D spending trends which bolster its competitive edge in technology development and customer acquisition.

- Click here to discover the nuances of Sword Group with our detailed analytical health report.

Gain insights into Sword Group's past trends and performance with our Past report.

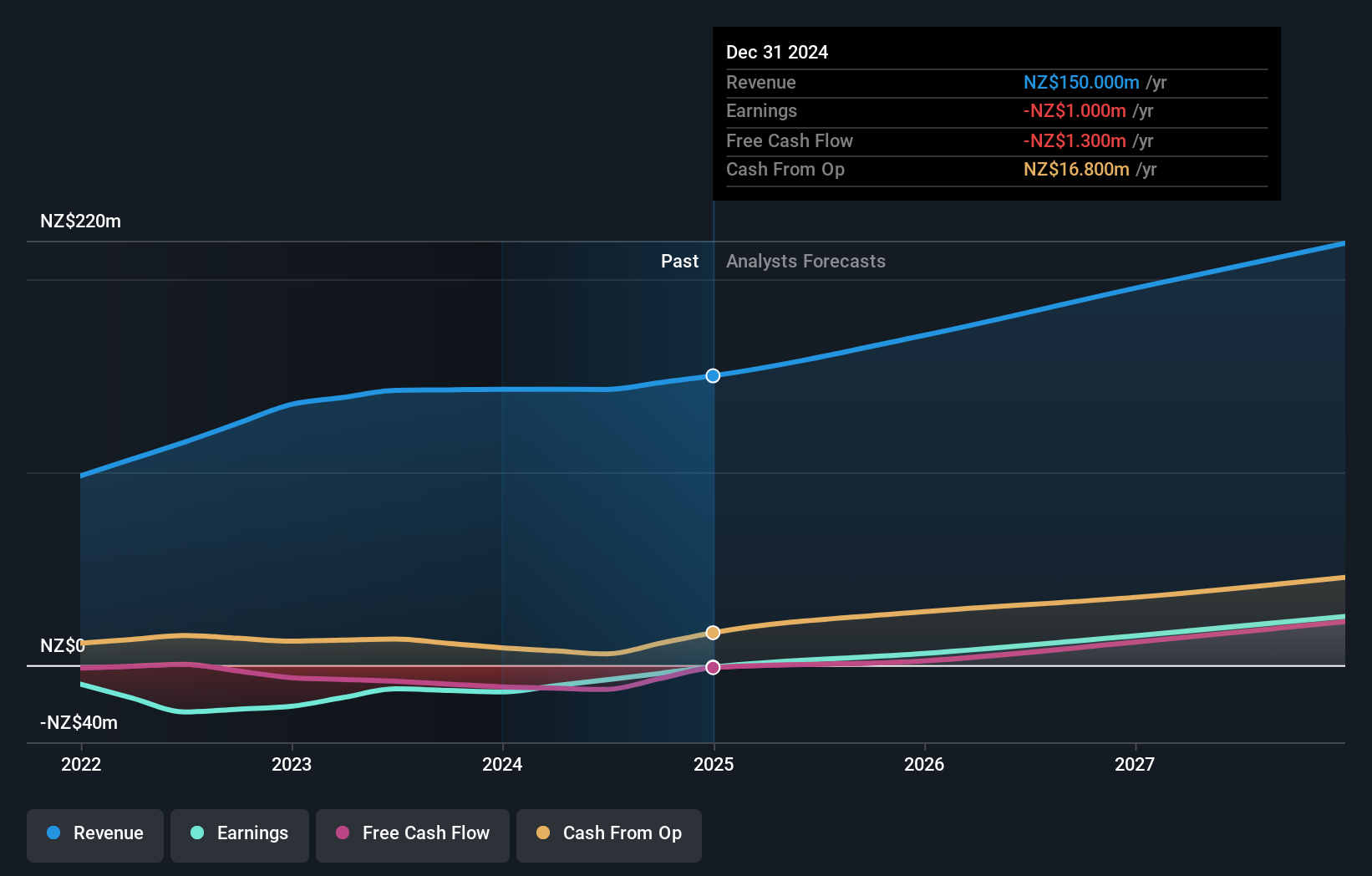

Vista Group International (NZSE:VGL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vista Group International Limited offers software and data analytics solutions to the global film industry, with a market capitalization of NZ$675.00 million.

Operations: Vista Group International generates revenue primarily through its software and data analytics solutions tailored for the global film industry. The company focuses on providing innovative technology to enhance the operational efficiency of its clients, contributing to its market presence.

Vista Group International, amid a challenging landscape, demonstrates a promising trajectory with expected revenue growth of 12.5% annually, outpacing New Zealand's market average of 4.4%. This growth is underpinned by significant projected earnings increases, forecasted at nearly 59.9% per year over the next three years as the company moves towards profitability. R&D investments remain pivotal, aligning with industry shifts towards innovative software solutions and enhancing competitive positioning in technology development—a critical factor for future success in high-growth tech sectors.

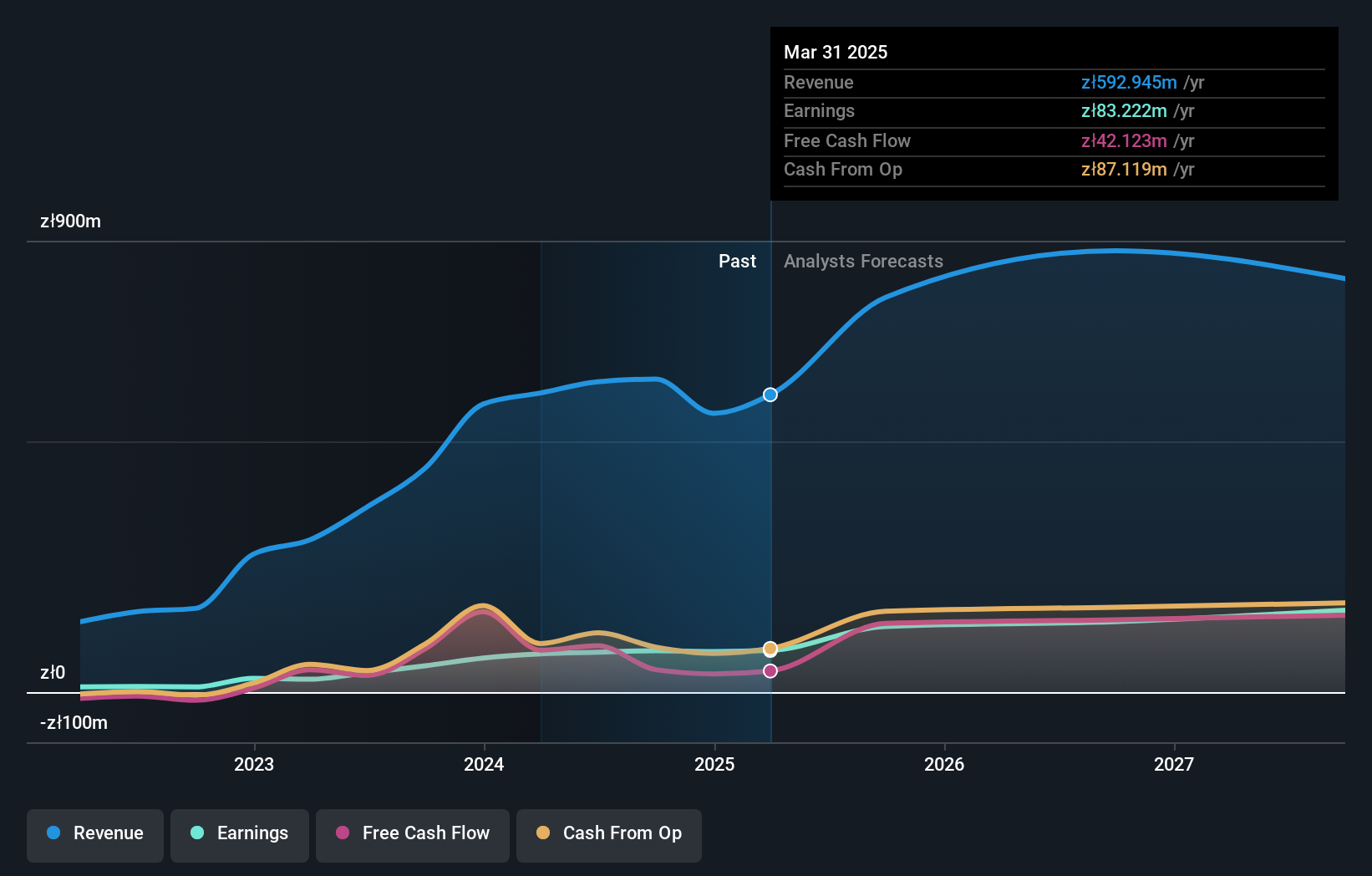

Synektik Spólka Akcyjna (WSE:SNT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Synektik Spólka Akcyjna offers products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications in Poland with a market capitalization of PLN 1.54 billion.

Operations: Synektik Spólka Akcyjna generates revenue primarily from its Diagnostic and IT Equipment segment, which accounts for PLN 41.25 billion, and the Production of Radio Pharmaceuticals segment, contributing PLN 3.83 billion. The company is involved in providing specialized solutions for the medical sector in Poland.

Synektik Spólka Akcyjna, recently added to the S&P Global BMI Index, showcases robust earnings growth of 20% annually, outstripping Poland's average of 14.6%. This performance is bolstered by a significant 104.4% surge in past year earnings, surpassing its industry's modest 2.2% increase. Despite revenue projections growing at a slower pace of 3.8%, compared to the market's 4.2%, the company’s commitment to R&D is evident with expenses aligning closely with these strategic growth areas, ensuring sustained innovation and market relevance in evolving tech landscapes.

Next Steps

- Click here to access our complete index of 1281 High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Sword Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SWP

Undervalued with solid track record.