- New Zealand

- /

- Specialty Stores

- /

- NZSE:KMD

KMD Brands Limited's (NZSE:KMD) Subdued P/E Might Signal An Opportunity

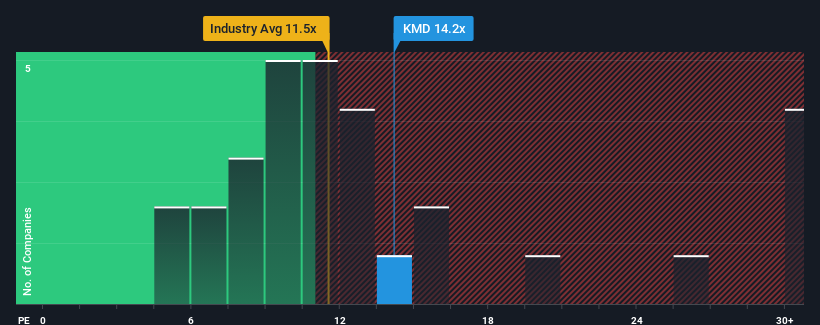

There wouldn't be many who think KMD Brands Limited's (NZSE:KMD) price-to-earnings (or "P/E") ratio of 14.2x is worth a mention when the median P/E in New Zealand is similar at about 16x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been more advantageous for KMD Brands as its earnings haven't fallen as much as the rest of the market. It might be that many expect the comparatively superior earnings performance to vanish, which has kept the P/E from rising. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's earnings continue outplaying the market.

Check out our latest analysis for KMD Brands

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, KMD Brands would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 2.6%. Even so, admirably EPS has lifted 199% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next three years should generate growth of 29% each year as estimated by the eight analysts watching the company. With the market only predicted to deliver 21% per year, the company is positioned for a stronger earnings result.

In light of this, it's curious that KMD Brands' P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From KMD Brands' P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of KMD Brands' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Before you settle on your opinion, we've discovered 1 warning sign for KMD Brands that you should be aware of.

If you're unsure about the strength of KMD Brands' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if KMD Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:KMD

KMD Brands

Designs, markets, wholesales, and retails apparel, footwear, and equipment for surfing and the outdoors under the Kathmandu, Rip Curl, and Oboz brands in New Zealand, Australia, North America, Europe, Southeast Asia, and Brazil.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives