- China

- /

- Consumer Durables

- /

- SZSE:000521

3 Reliable Dividend Stocks Offering Yields Up To 6.9%

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances across major indexes and geopolitical uncertainties, investors are increasingly focused on the Federal Reserve's upcoming policy decisions and the implications for interest rates. Amidst this backdrop, dividend stocks continue to attract attention for their potential to provide steady income streams, particularly as growth shares outperform value stocks. In such an environment, identifying reliable dividend stocks can be crucial for investors seeking stability and income in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.13% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.98% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.18% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.99% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.71% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.81% | ★★★★★★ |

Click here to see the full list of 1927 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

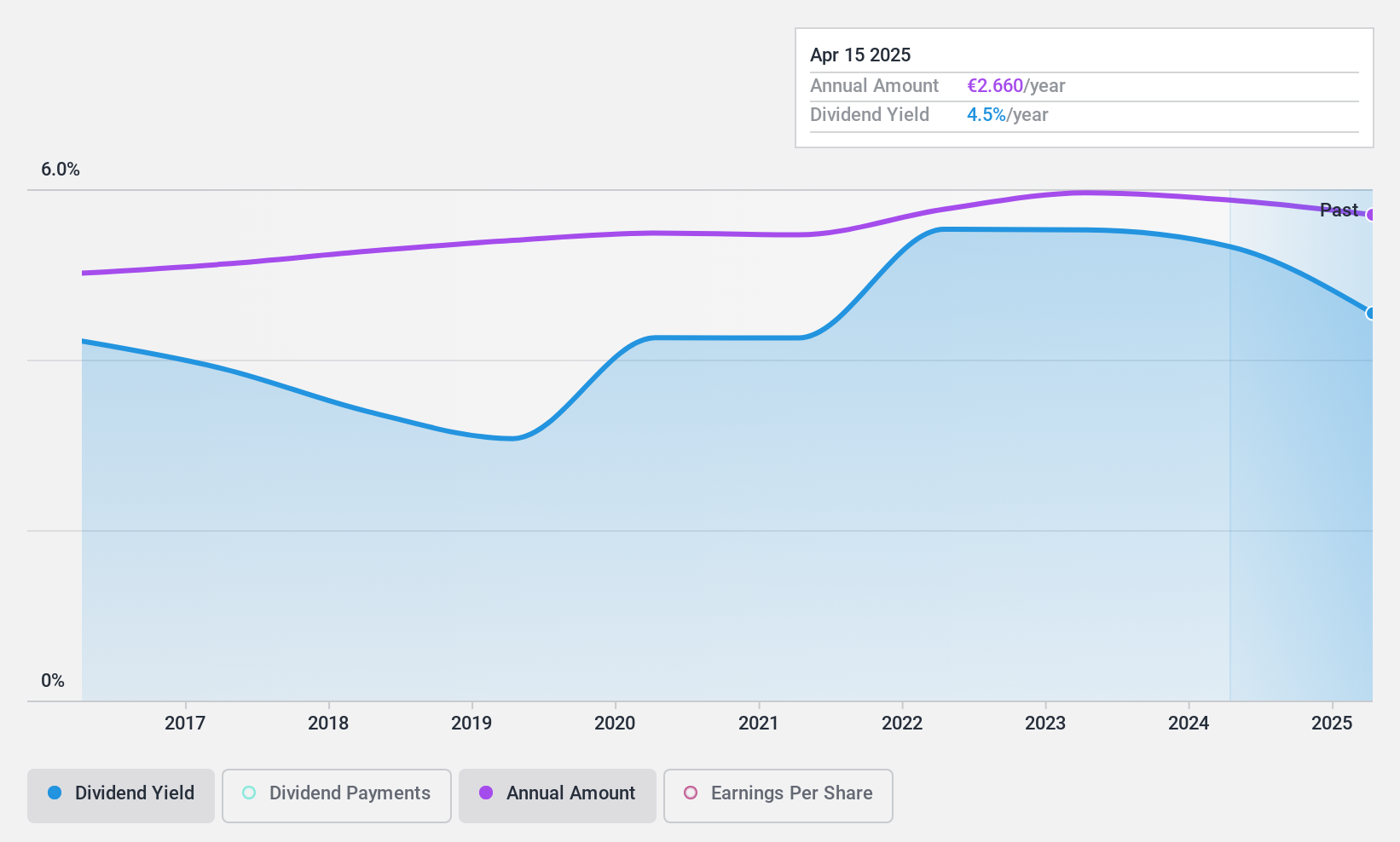

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative offers a range of banking products and services to diverse client segments in France, with a market cap of €1.07 billion.

Operations: Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative generates revenue through providing banking products and services to a variety of clients including individuals, professionals, farmers, businesses, private banking customers, and public and social housing community clients in France.

Dividend Yield: 5.1%

Caisse Régionale de Crédit Agricole Mutuel du Languedoc has consistently provided reliable and stable dividend payments over the past decade, with a current yield of 5.08%. Despite trading at 61.3% below estimated fair value, its dividend yield is lower than the top quartile in France. The company's earnings growth of 4.2% annually supports its low payout ratio of 29.8%, indicating well-covered dividends, though future sustainability data is lacking.

- Get an in-depth perspective on Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative's share price might be too pessimistic.

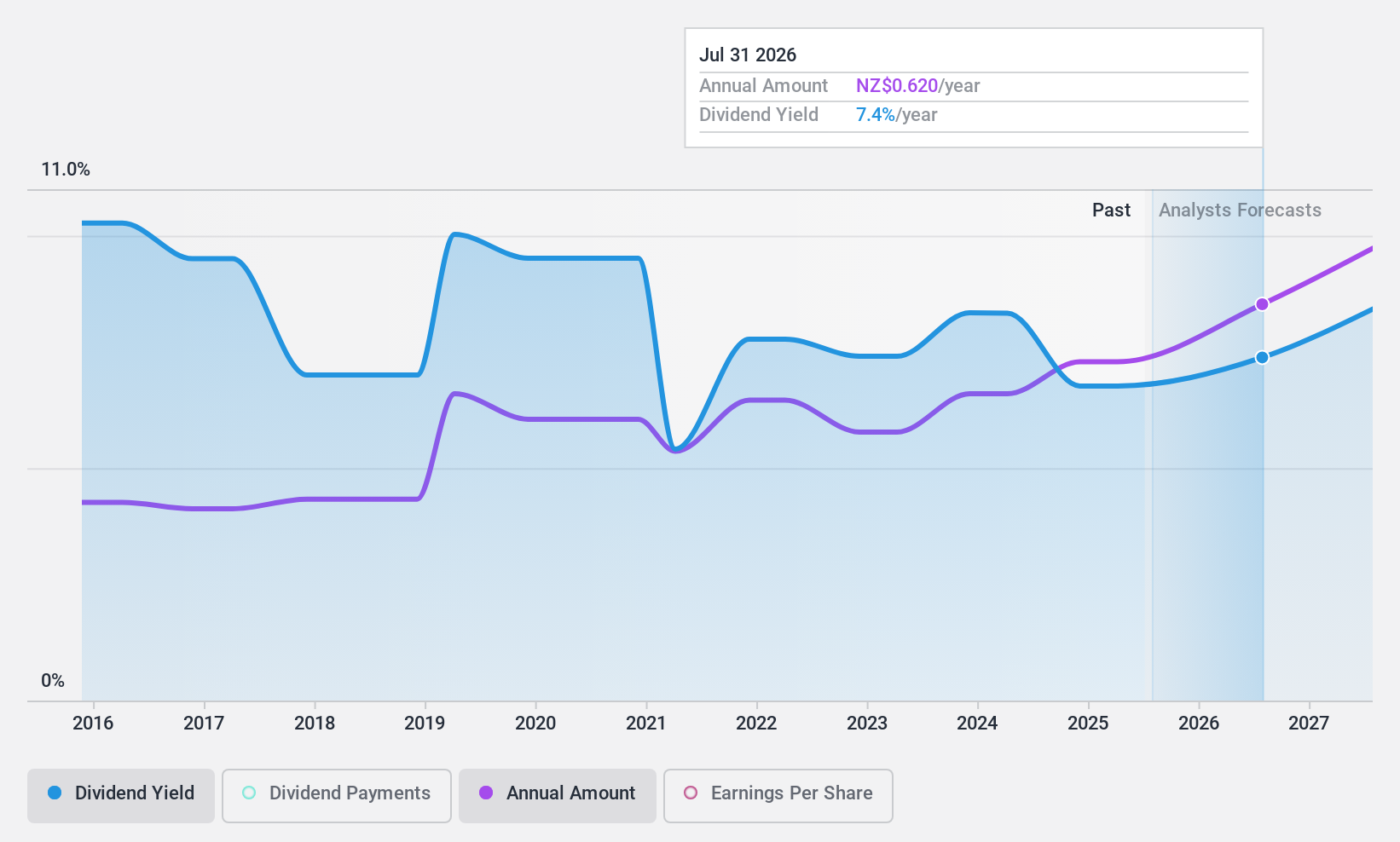

Hallenstein Glasson Holdings (NZSE:HLG)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Hallenstein Glasson Holdings Limited, along with its subsidiaries, is a retailer specializing in men's and women's clothing across New Zealand and Australia, with a market capitalization of NZ$455.72 million.

Operations: Hallenstein Glasson Holdings Limited generates revenue through its segments: Hallensteins at NZ$108.36 million, Glassons Australia at NZ$219.44 million, and Glassons New Zealand at NZ$120.30 million.

Dividend Yield: 6.9%

Hallenstein Glasson Holdings offers a high dividend yield of 6.94%, ranking in the top 25% of New Zealand's market. Its dividend reliability is backed by stable growth over the past decade, with payments well-covered by both earnings (payout ratio: 87.3%) and cash flows (cash payout ratio: 45.6%). Despite trading at a significant discount to its estimated fair value, recent earnings growth of 7.8% supports the sustainability of its dividends.

- Click to explore a detailed breakdown of our findings in Hallenstein Glasson Holdings' dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Hallenstein Glasson Holdings shares in the market.

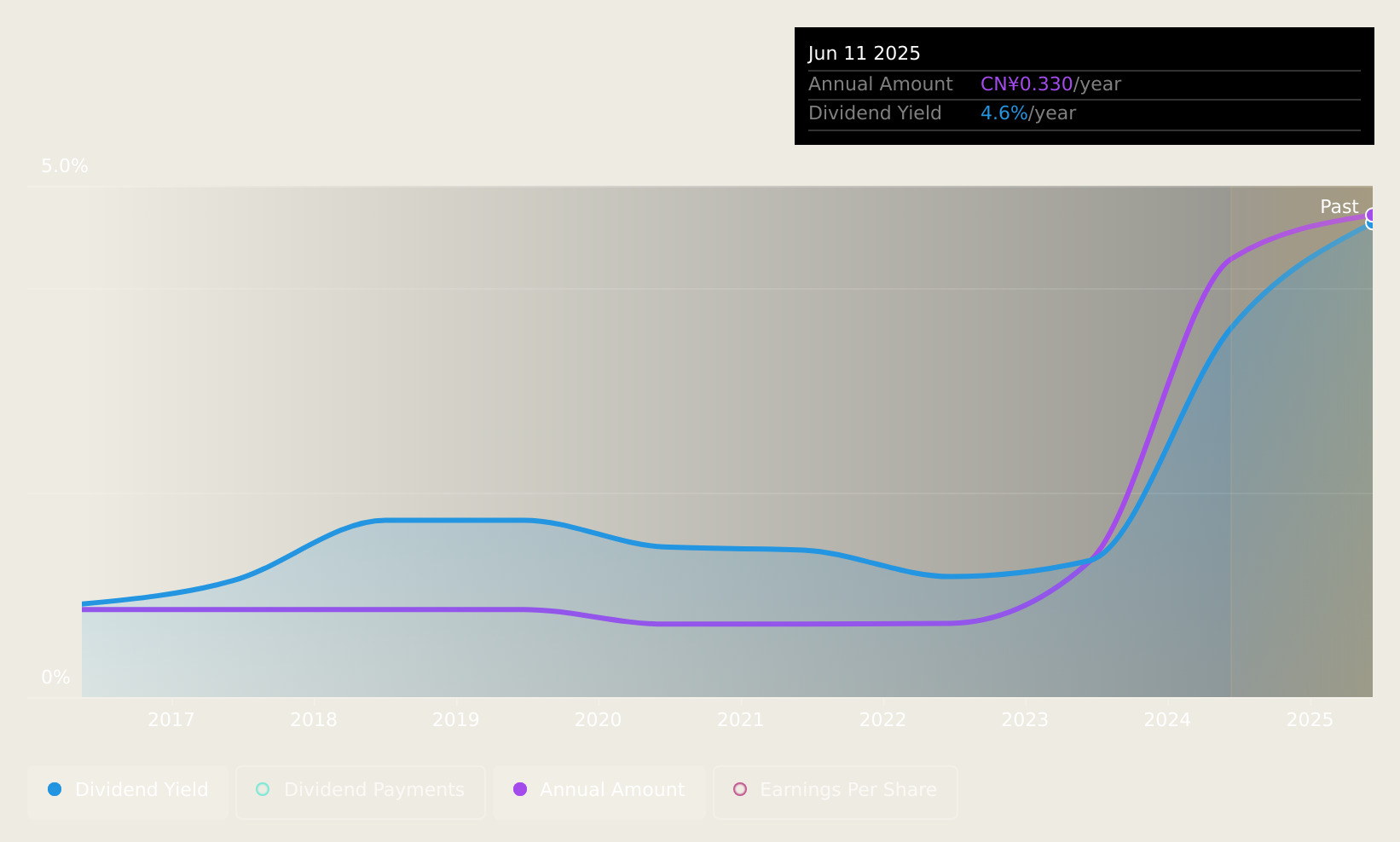

Changhong Meiling (SZSE:000521)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Changhong Meiling Co., Ltd. operates in the electrical machinery and equipment manufacturing industry both in China and internationally, with a market cap of CN¥8.54 billion.

Operations: Changhong Meiling Co., Ltd. generates its revenue from the manufacturing of electrical machinery and equipment, serving both domestic and international markets.

Dividend Yield: 3.3%

Changhong Meiling's dividend appeal is underscored by its stable and growing payouts over the past decade, with a yield of 3.34% placing it in the top 25% of China's market. The company's dividends are well-covered by earnings (payout ratio: 40%) and cash flows (cash payout ratio: 14.7%), ensuring sustainability. Recent earnings growth, with net income rising to CNY 530.44 million for nine months ending September 2024, further supports its dividend reliability amidst trading below fair value estimates.

- Click here to discover the nuances of Changhong Meiling with our detailed analytical dividend report.

- Our expertly prepared valuation report Changhong Meiling implies its share price may be lower than expected.

Taking Advantage

- Investigate our full lineup of 1927 Top Dividend Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000521

Changhong Meiling

Operates in electrical machinery and equipment manufacturing industry in China and internationally.

Flawless balance sheet 6 star dividend payer.