- China

- /

- Medical Equipment

- /

- SHSE:688581

3 Stocks Estimated To Be Up To 47.4% Below Intrinsic Value

Reviewed by Simply Wall St

In a week marked by mixed performances in major U.S. stock indexes and a notable divergence between growth and value stocks, investors are keenly observing the market's shifting dynamics. Amidst record highs for indices like the S&P 500 and Nasdaq Composite, identifying undervalued stocks becomes crucial as sector performance varies widely. In this context, finding stocks that are estimated to be significantly below their intrinsic value can offer potential opportunities for investors looking to navigate these complex market conditions effectively.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SKS Technologies Group (ASX:SKS) | A$1.945 | A$3.85 | 49.5% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP289.00 | CLP576.34 | 49.9% |

| Befesa (XTRA:BFSA) | €22.32 | €44.53 | 49.9% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$27.10 | HK$54.03 | 49.8% |

| Visional (TSE:4194) | ¥8535.00 | ¥17012.42 | 49.8% |

| Ingenia Communities Group (ASX:INA) | A$4.62 | A$9.15 | 49.5% |

| First Advantage (NasdaqGS:FA) | US$19.81 | US$39.49 | 49.8% |

| DoubleVerify Holdings (NYSE:DV) | US$20.77 | US$41.28 | 49.7% |

| Nyab (OM:NYAB) | SEK5.20 | SEK10.29 | 49.5% |

| Carter Bankshares (NasdaqGS:CARE) | US$19.30 | US$38.28 | 49.6% |

Let's take a closer look at a couple of our picks from the screened companies.

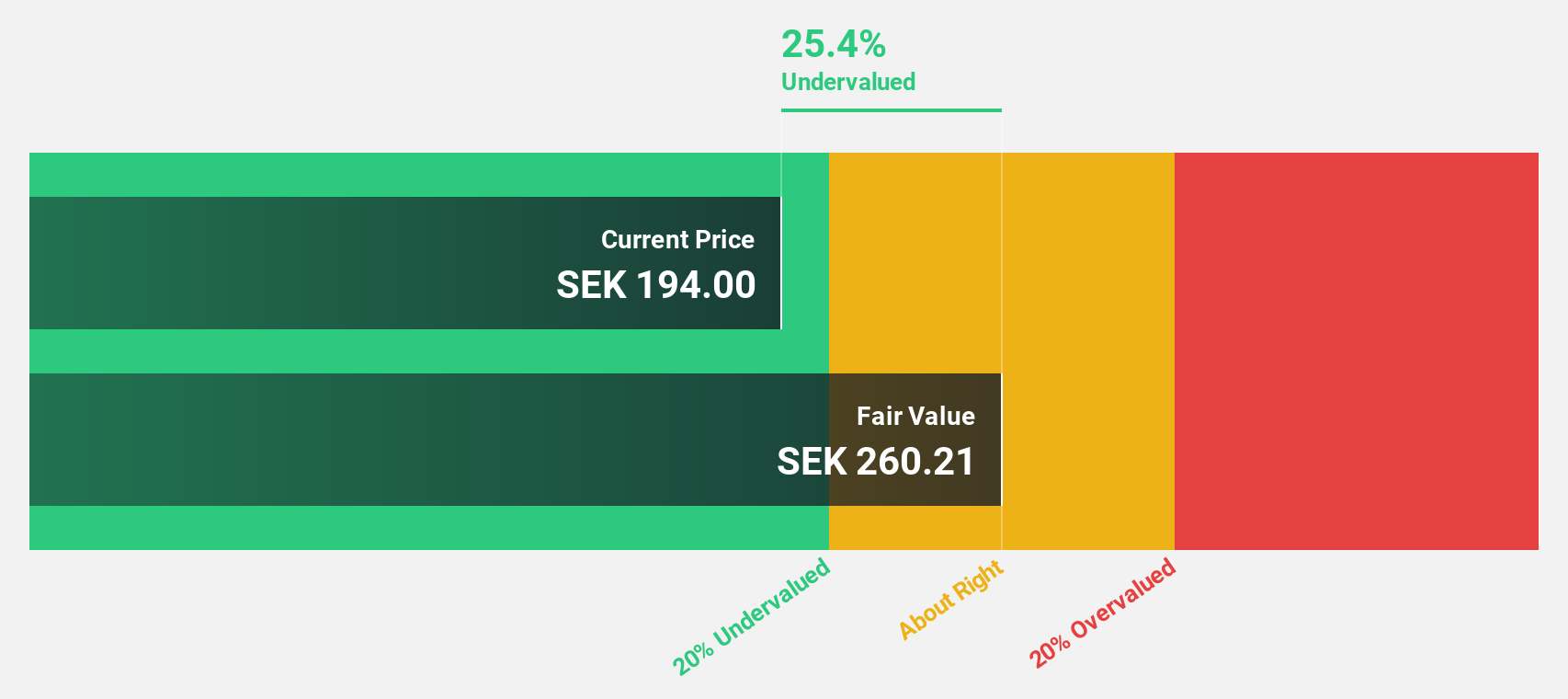

CellaVision (OM:CEVI)

Overview: CellaVision AB (publ) develops and sells instruments, software, and reagents for blood and body fluids analysis in Sweden and internationally, with a market cap of approximately SEK5.39 billion.

Operations: The company's revenue primarily comes from Automated Microscopy Systems and Reagents in the field of Hematology, amounting to SEK737.16 million.

Estimated Discount To Fair Value: 28.7%

CellaVision is trading at SEK 226, significantly below its estimated fair value of SEK 316.81, indicating it may be undervalued based on cash flows. The company reported strong financial performance with third-quarter sales of SEK 178.66 million and net income of SEK 31.11 million, showing growth from the previous year. Forecasts suggest revenue will grow at 12.9% annually, outpacing the Swedish market, with earnings expected to rise significantly over the next three years.

- The growth report we've compiled suggests that CellaVision's future prospects could be on the up.

- Take a closer look at CellaVision's balance sheet health here in our report.

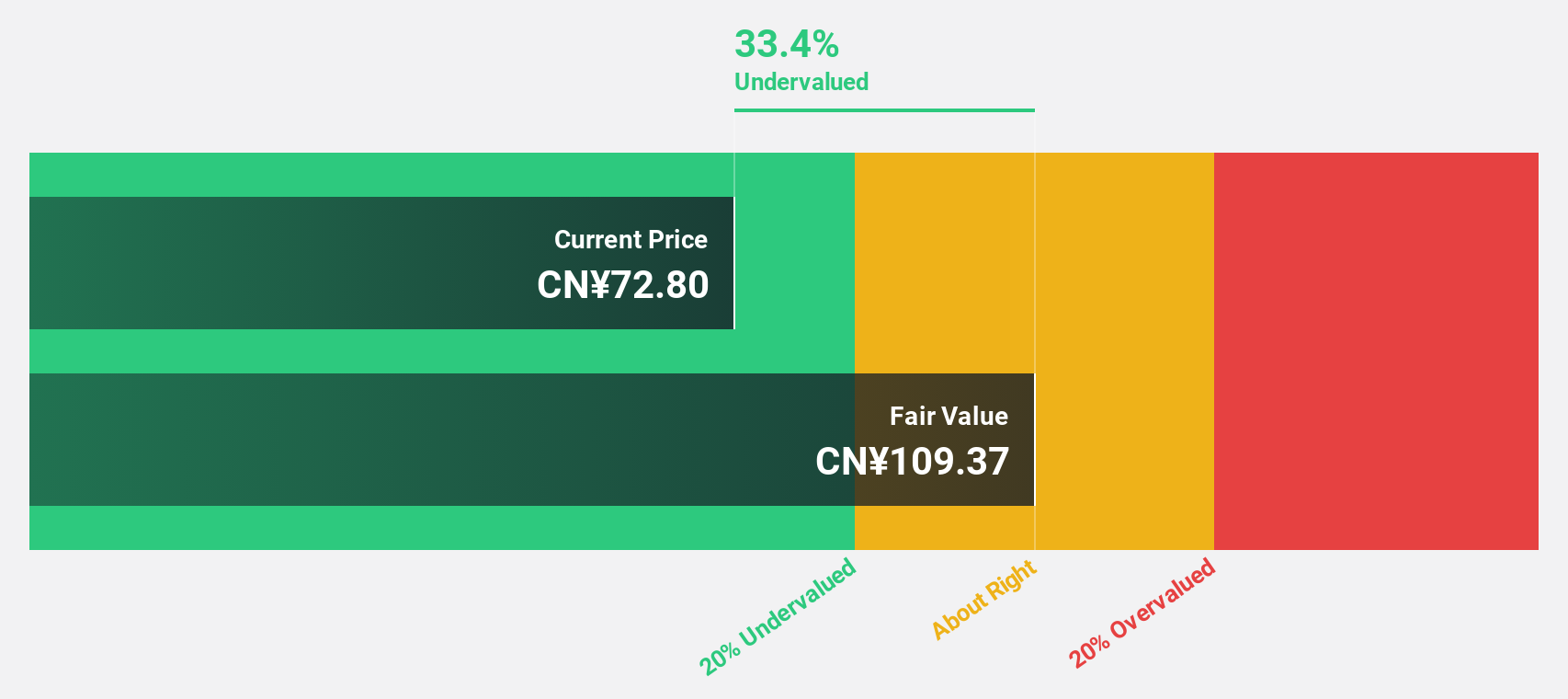

HangzhouS MedTech (SHSE:688581)

Overview: Hangzhou AGS MedTech Co., Ltd. focuses on the research, development, production, sale, and service of endoscopic surgery equipment and accessories in China with a market cap of CN¥5.25 billion.

Operations: The company's revenue primarily stems from its involvement in the endoscopic surgery equipment and accessories sector within China.

Estimated Discount To Fair Value: 47.4%

Hangzhou AGS MedTech Co., Ltd. is trading at CNY 65.19, well below its estimated fair value of CNY 124.02, making it undervalued based on cash flows. Recent earnings results show sales of CNY 427.26 million and net income of CNY 197.45 million for the first nine months, both up from last year. Revenue is forecast to grow significantly faster than the Chinese market, although profit growth will be slightly slower than the market average.

- Our expertly prepared growth report on HangzhouS MedTech implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on HangzhouS MedTech's balance sheet by reading our health report here.

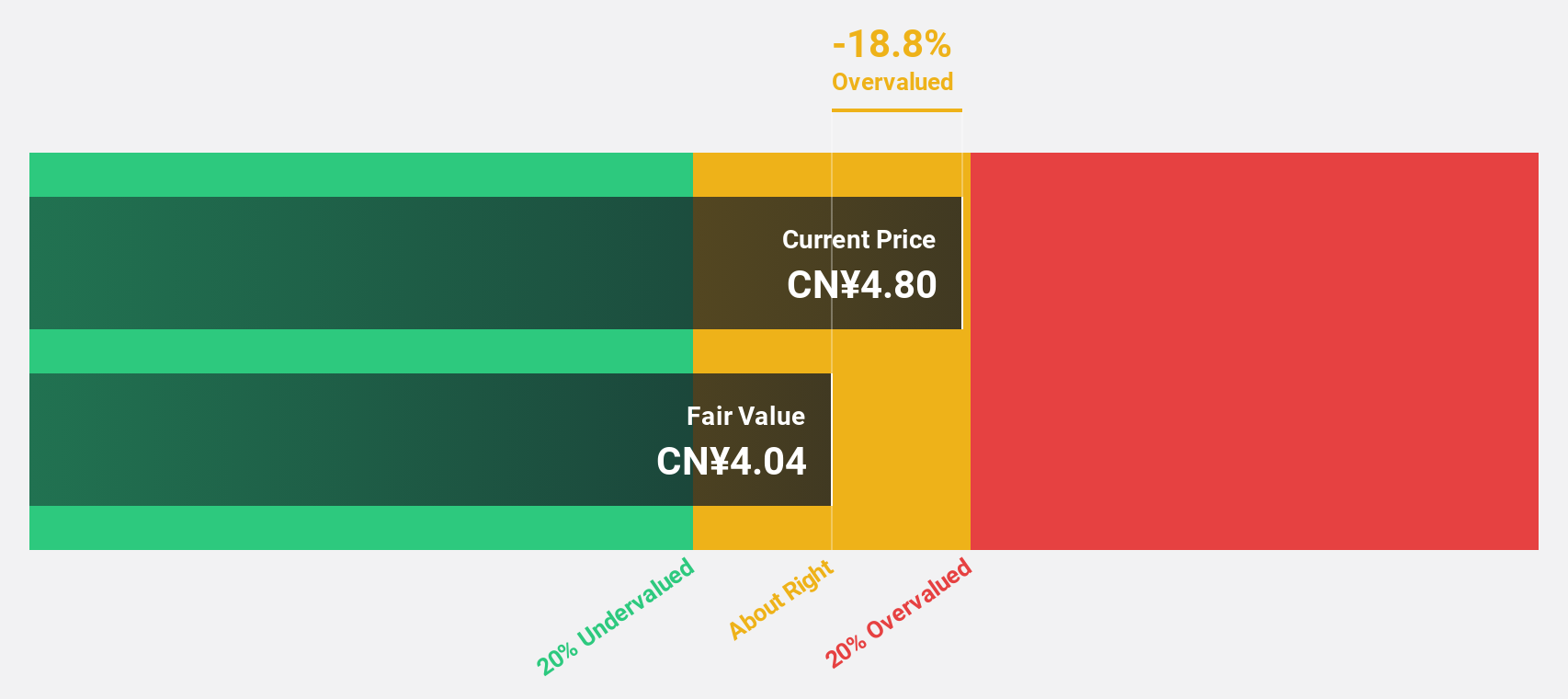

Guangdong Baolihua New Energy Stock (SZSE:000690)

Overview: Guangdong Baolihua New Energy Stock Co., Ltd. operates in the energy sector and has a market cap of CN¥10.29 billion.

Operations: Unfortunately, without specific revenue segment data provided in the Business operations text, I'm unable to summarize the company's revenue segments accurately. If you have additional information or details on their revenue breakdown, please share them for a more precise summary.

Estimated Discount To Fair Value: 43.2%

Guangdong Baolihua New Energy Stock is trading at CN¥4.73, significantly below its estimated fair value of CN¥8.32, highlighting its potential undervaluation based on cash flows. Despite a decrease in sales to CNY 6.11 billion for the first nine months of 2024, earnings grew by 31% over the past year and are expected to continue growing annually by 24.45%. However, its dividend yield of 6.34% is not well covered by free cash flows.

- Our growth report here indicates Guangdong Baolihua New Energy Stock may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Guangdong Baolihua New Energy Stock.

Key Takeaways

- Get an in-depth perspective on all 901 Undervalued Stocks Based On Cash Flows by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HangzhouS MedTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688581

HangzhouS MedTech

Engages in the research, development, production, sale, and service of endoscopic surgery equipment and accessories in China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives