- New Zealand

- /

- Specialized REITs

- /

- NZSE:NZL

We Don’t Think New Zealand Rural Land's (NZSE:NZL) Earnings Should Make Shareholders Too Comfortable

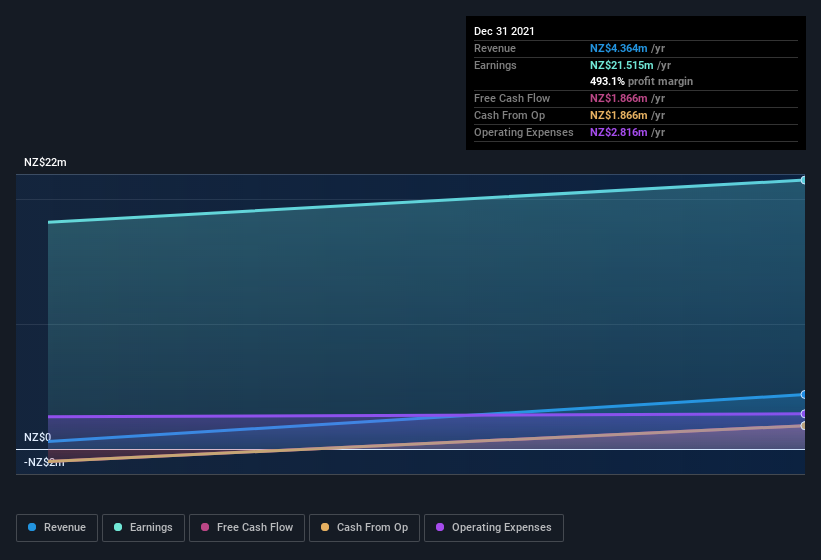

New Zealand Rural Land Company Limited (NZSE:NZL) posted some decent earnings, but shareholders didn't react strongly. Our analysis suggests they may be concerned about some underlying details.

See our latest analysis for New Zealand Rural Land

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. New Zealand Rural Land expanded the number of shares on issue by 60% over the last year. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of New Zealand Rural Land's EPS by clicking here.

A Look At The Impact Of New Zealand Rural Land's Dilution on Its Earnings Per Share (EPS).

As it happens, we don't know how much the company made or lost three years ago, because we don't have the data. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

If New Zealand Rural Land's EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

Alongside that dilution, it's also important to note that New Zealand Rural Land's profit was boosted by unusual items worth NZ$20m in the last twelve months. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. New Zealand Rural Land had a rather significant contribution from unusual items relative to its profit to December 2021. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On New Zealand Rural Land's Profit Performance

In its last report New Zealand Rural Land benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. And furthermore, it went and issued plenty of new shares, ensuring that each shareholder (who did not tip more money in) now owns a smaller proportion of the company. On reflection, the above-mentioned factors give us the strong impression that New Zealand Rural Land'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. When we did our research, we found 7 warning signs for New Zealand Rural Land (3 are significant!) that we believe deserve your full attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Valuation is complex, but we're here to simplify it.

Discover if New Zealand Rural Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:NZL

New Zealand Rural Land

Invests in rural farmland and forestry land in New Zealand.

Undervalued moderate.

Market Insights

Community Narratives