- New Zealand

- /

- Healthcare Services

- /

- NZSE:RYM

Ryman Healthcare (NZSE:RYM) shareholders have lost 69% over 3 years, earnings decline likely the culprit

Ryman Healthcare Limited (NZSE:RYM) shareholders should be happy to see the share price up 20% in the last quarter. But that is small recompense for the exasperating returns over three years. Regrettably, the share price slid 72% in that period. So it is really good to see an improvement. Perhaps the company has turned over a new leaf.

With the stock having lost 4.0% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Ryman Healthcare

We don't think that Ryman Healthcare's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over three years, Ryman Healthcare grew revenue at 13% per year. That's a pretty good rate of top-line growth. So it seems unlikely the 20% share price drop (each year) is entirely about the revenue. It could be that the losses were much larger than expected. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

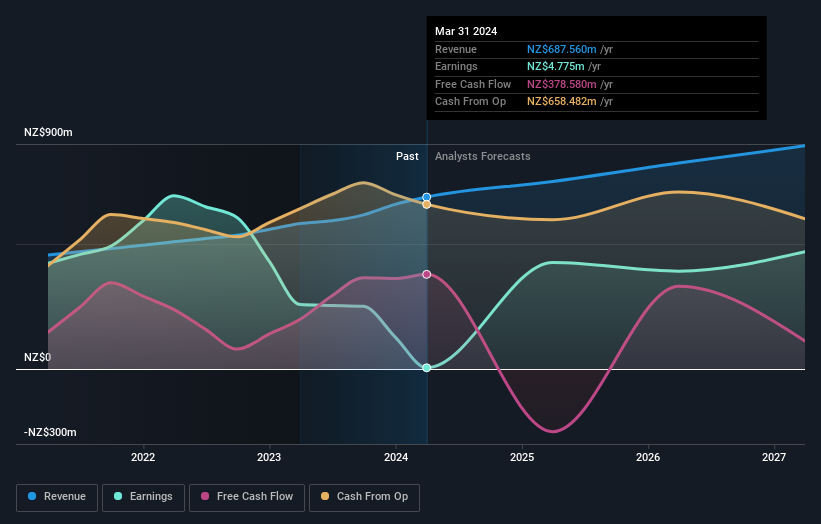

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Ryman Healthcare will earn in the future (free profit forecasts).

What About The Total Shareholder Return (TSR)?

We've already covered Ryman Healthcare's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Ryman Healthcare's TSR of was a loss of 69% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Investors in Ryman Healthcare had a tough year, with a total loss of 32%, against a market gain of about 10%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 10% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Ryman Healthcare better, we need to consider many other factors. For example, we've discovered 4 warning signs for Ryman Healthcare that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on New Zealander exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:RYM

Ryman Healthcare

Develops, owns, and operates integrated retirement villages, rest homes, and hospitals for the elderly people in New Zealand and Australia.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives