- New Zealand

- /

- Healthcare Services

- /

- NZSE:OCA

Oceania Healthcare's (NZSE:OCA) earnings have declined over three years, contributing to shareholders 59% loss

This week we saw the Oceania Healthcare Limited (NZSE:OCA) share price climb by 12%. But that is small recompense for the exasperating returns over three years. Regrettably, the share price slid 62% in that period. So it is really good to see an improvement. After all, could be that the fall was overdone.

While the stock has risen 12% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Oceania Healthcare

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

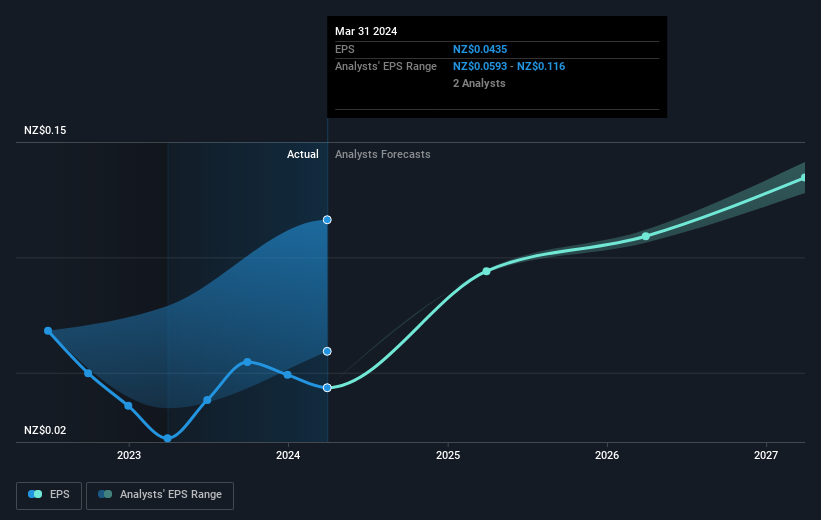

Oceania Healthcare saw its EPS decline at a compound rate of 36% per year, over the last three years. In comparison the 28% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that Oceania Healthcare has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Oceania Healthcare's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Oceania Healthcare's TSR of was a loss of 59% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Investors in Oceania Healthcare had a tough year, with a total loss of 22%, against a market gain of about 1.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Oceania Healthcare has 2 warning signs (and 1 which can't be ignored) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on New Zealander exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:OCA

Oceania Healthcare

Owns and operates various care centers and retirement villages in New Zealand.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives