- New Zealand

- /

- Medical Equipment

- /

- NZSE:FPH

Upgraded Earnings Guidance And Dividend Lift Could Be A Game Changer For Fisher & Paykel Healthcare (NZSE:FPH)

Reviewed by Sasha Jovanovic

- Fisher & Paykel Healthcare has already reported half-year 2025 results showing sales of NZ$1,088.5 million and net income of NZ$213.0 million, alongside higher basic earnings per share and an increased interim dividend.

- The company also raised its full-year revenue and net profit guidance, signaling management confidence that recent operational momentum can continue.

- Next, we’ll explore how the upgraded full-year earnings guidance may influence Fisher & Paykel Healthcare’s existing investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Fisher & Paykel Healthcare Investment Narrative Recap

To own Fisher & Paykel Healthcare, you need to believe in sustained global demand for its respiratory and hospital devices, supported by ongoing product innovation. The upgraded full year 2025 revenue and profit guidance reinforces the current positive earnings catalyst in the short term, while the biggest ongoing risk remains intensifying competition in respiratory and OSA masks, which could pressure market share and pricing if rivals gain more traction.

The raised full year guidance to NZ$2.17 billion to NZ$2.27 billion in revenue and NZ$410 million to NZ$460 million in net profit after tax directly links the latest results to the earnings growth catalyst, as it ties stronger first half trading to higher expectations for the full year and may influence how investors weigh that upside against competitive and margin risks.

Yet while near term earnings guidance has improved, investors should still be aware of how intensifying competition in respiratory care could...

Read the full narrative on Fisher & Paykel Healthcare (it's free!)

Fisher & Paykel Healthcare's narrative projects NZ$2.8 billion revenue and NZ$593.5 million earnings by 2028. This requires 11.3% yearly revenue growth and about a NZ$216.3 million earnings increase from NZ$377.2 million today.

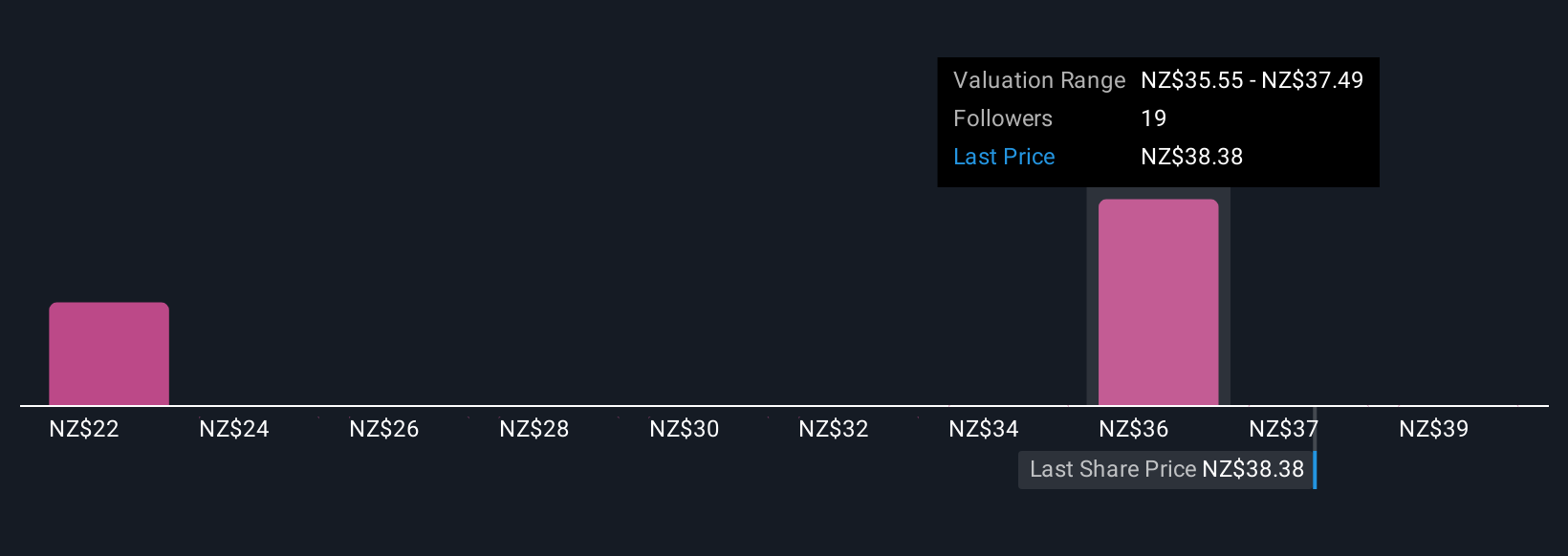

Uncover how Fisher & Paykel Healthcare's forecasts yield a NZ$37.26 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community currently see fair value for Fisher & Paykel Healthcare between NZ$21.98 and NZ$41.37, highlighting a wide spread of individual expectations. When you set those views against the upgraded full year earnings guidance, it underlines how differently people weigh the company’s growth potential and competitive threats, and why it can pay to compare several perspectives.

Explore 6 other fair value estimates on Fisher & Paykel Healthcare - why the stock might be worth 43% less than the current price!

Build Your Own Fisher & Paykel Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fisher & Paykel Healthcare research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Fisher & Paykel Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fisher & Paykel Healthcare's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NZSE:FPH

Fisher & Paykel Healthcare

Designs, manufactures, markets, and sells medical device products and systems in North America, Europe, the Asia Pacific, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026