Amidst global economic uncertainties and ongoing trade tensions, Asian markets have shown resilience, with investors keenly observing developments in major economies like China and Japan. For those interested in exploring opportunities within smaller or newer companies, penny stocks—despite the term's somewhat outdated nature—remain a relevant area for potential investment. By focusing on companies with strong financial foundations, investors can uncover hidden value and potential growth prospects in this segment of the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.72 | HK$42.71B | ★★★★★★ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.34 | SGD9.24B | ★★★★★☆ |

| T.A.C. Consumer (SET:TACC) | THB4.20 | THB2.52B | ★★★★★★ |

| Activation Group Holdings (SEHK:9919) | HK$0.87 | HK$647.93M | ★★★★★★ |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.475 | SGD452.86M | ★★★★★★ |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.05 | CN¥3.53B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.26 | HK$799.83M | ★★★★★★ |

| Newborn Town (SEHK:9911) | HK$4.73 | HK$6.67B | ★★★★★★ |

| Beng Kuang Marine (SGX:BEZ) | SGD0.205 | SGD40.84M | ★★★★★★ |

| China Lilang (SEHK:1234) | HK$4.00 | HK$4.79B | ★★★★★☆ |

Click here to see the full list of 1,171 stocks from our Asian Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Scales (NZSE:SCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Scales Corporation Limited manufactures and trades food ingredients across New Zealand, Asia, Europe, North America, and internationally with a market cap of NZ$595.82 million.

Operations: Scales generates revenue through its key segments: Logistics (NZ$98.80 million), Horticulture (NZ$248.88 million), and Global Proteins (NZ$266.79 million).

Market Cap: NZ$595.82M

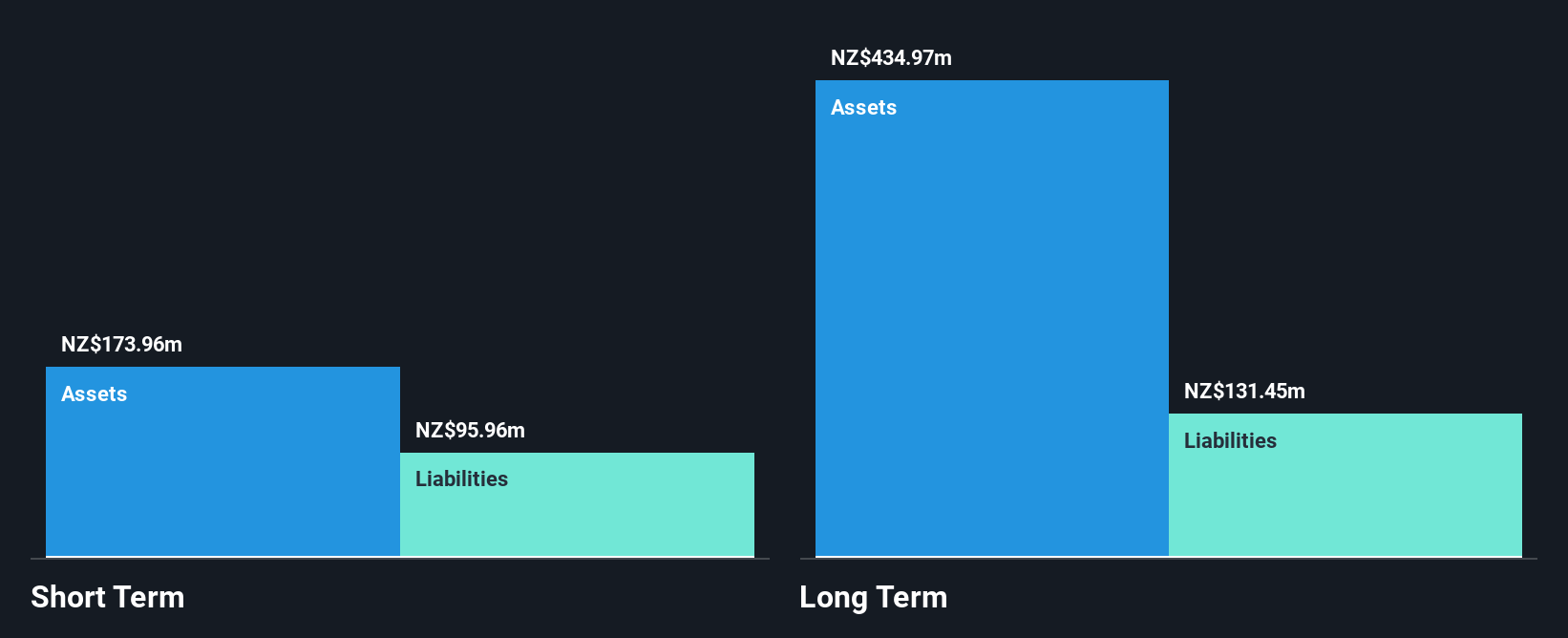

Scales Corporation Limited, with a market cap of NZ$595.82 million, has shown significant earnings growth of 486.9% over the past year, surpassing both its historical performance and industry averages. The company's recent earnings report highlighted a net income increase to NZ$30.73 million from NZ$5.24 million the previous year, reflecting improved profit margins and high-quality earnings. Scales' short-term assets exceed both short-term and long-term liabilities, indicating solid financial health. Despite having a relatively inexperienced board, its management team is seasoned with an average tenure of 10 years, contributing to stable operations amidst low return on equity levels.

- Get an in-depth perspective on Scales' performance by reading our balance sheet health report here.

- Explore Scales' analyst forecasts in our growth report.

Shanghai Bio-heart Biological Technology (SEHK:2185)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai Bio-heart Biological Technology Co., Ltd. (SEHK:2185) operates in the biotechnology sector, focusing on developing cardiovascular medical devices and has a market cap of approximately HK$0.53 billion.

Operations: Shanghai Bio-heart Biological Technology Co., Ltd. does not have any reported revenue segments at this time.

Market Cap: HK$533.08M

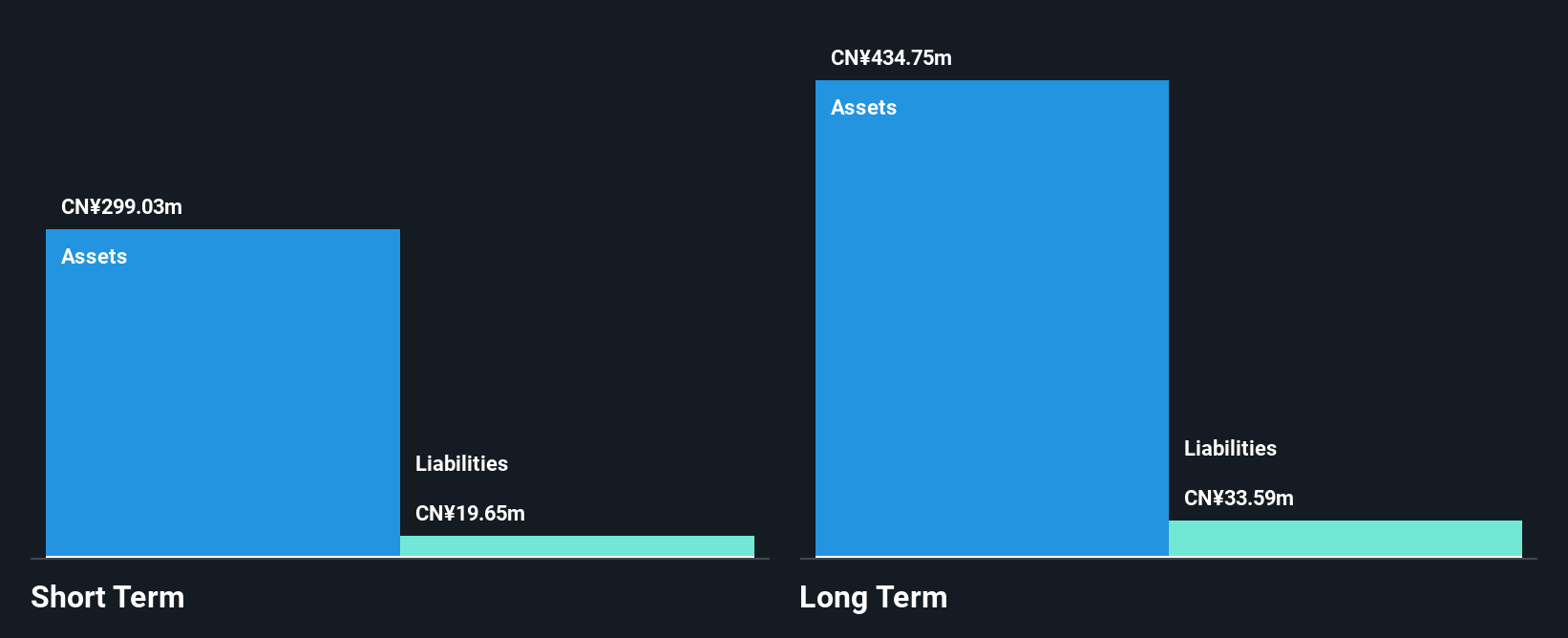

Shanghai Bio-heart Biological Technology, with a market cap of HK$0.53 billion, operates as a pre-revenue company focusing on cardiovascular medical devices. Despite being unprofitable, it has reduced losses by 16.1% annually over the past five years and remains debt-free with sufficient cash runway for more than two years. The recent approval of its Iberis® RDN system by China's NMPA marks a significant milestone in addressing resistant hypertension, showcasing potential future growth avenues. However, the stock's high volatility and an inexperienced board may pose risks to investors seeking stability in this penny stock investment opportunity.

- Click to explore a detailed breakdown of our findings in Shanghai Bio-heart Biological Technology's financial health report.

- Learn about Shanghai Bio-heart Biological Technology's historical performance here.

Xiamen Hexing Packaging Printing (SZSE:002228)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Xiamen Hexing Packaging Printing Co., Ltd. operates in the packaging and printing industry, with a market cap of CN¥3.53 billion.

Operations: The company generates revenue of CN¥11.63 billion from its packaging manufacturing industry segment.

Market Cap: CN¥3.53B

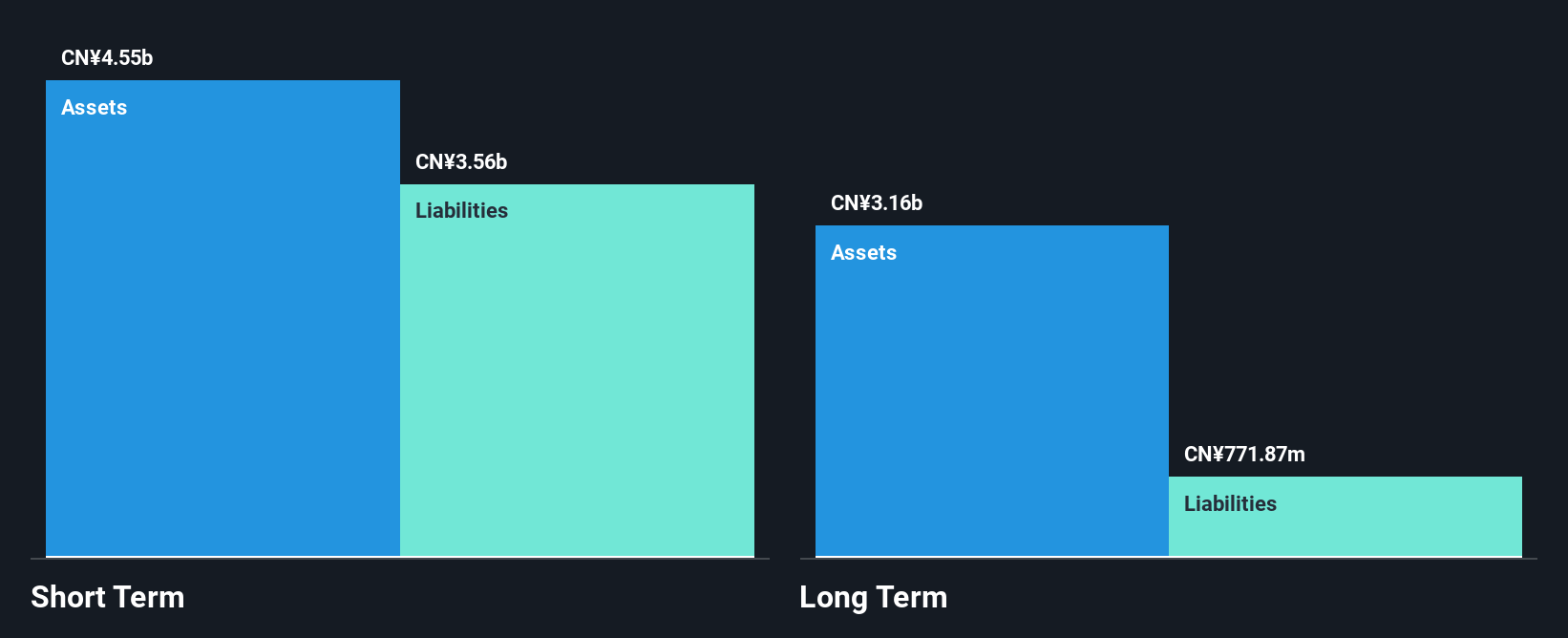

Xiamen Hexing Packaging Printing, with a market cap of CN¥3.53 billion, operates in the packaging and printing sector, generating CN¥11.63 billion in revenue. The company's financial health is supported by well-covered debt through operating cash flow and EBIT, while its short-term assets exceed both short- and long-term liabilities. Although earnings have declined by 22.1% annually over five years, recent growth of 20% surpasses industry averages. Despite trading significantly below estimated fair value and having a seasoned management team, its low return on equity and unsustainable dividend coverage remain concerns for investors in this penny stock space.

- Take a closer look at Xiamen Hexing Packaging Printing's potential here in our financial health report.

- Assess Xiamen Hexing Packaging Printing's future earnings estimates with our detailed growth reports.

Where To Now?

- Unlock our comprehensive list of 1,171 Asian Penny Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002228

Xiamen Hexing Packaging Printing

Xiamen Hexing Packaging Printing Co., Ltd.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives