- New Zealand

- /

- Food

- /

- NZSE:FCG

Should You Be Adding Fonterra Co-operative Group (NZSE:FCG) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Fonterra Co-operative Group (NZSE:FCG). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Fonterra Co-operative Group with the means to add long-term value to shareholders.

View our latest analysis for Fonterra Co-operative Group

How Quickly Is Fonterra Co-operative Group Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Over the last three years, Fonterra Co-operative Group has grown EPS by 14% per year. That growth rate is fairly good, assuming the company can keep it up.

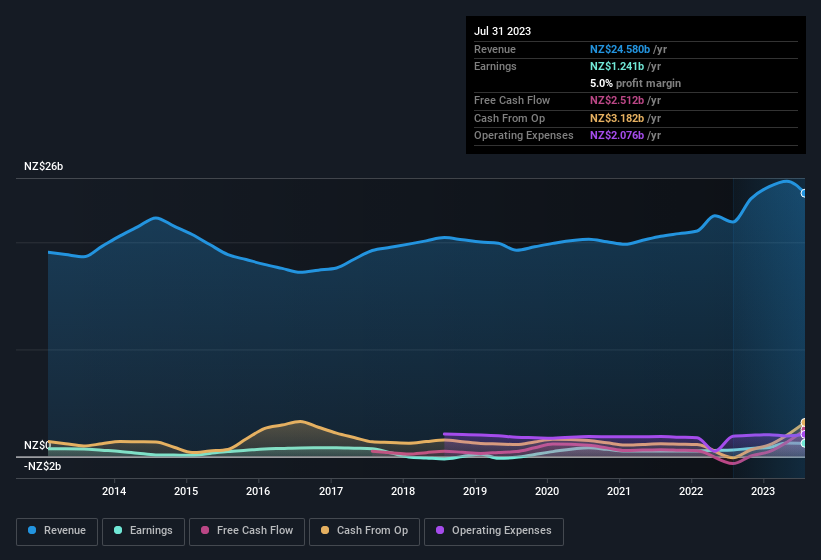

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Fonterra Co-operative Group is growing revenues, and EBIT margins improved by 3.6 percentage points to 8.1%, over the last year. Both of which are great metrics to check off for potential growth.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Fonterra Co-operative Group's balance sheet strength, before getting too excited.

Are Fonterra Co-operative Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see Fonterra Co-operative Group insiders walking the walk, by spending NZ$354k on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. Zooming in, we can see that the biggest insider purchase was by Director Andrew Macfarlane for NZ$240k worth of shares, at about NZ$2.53 per share.

Should You Add Fonterra Co-operative Group To Your Watchlist?

One positive for Fonterra Co-operative Group is that it is growing EPS. That's nice to see. While some companies are struggling to grow EPS, Fonterra Co-operative Group seems free from that morose affliction. The real kicker is that insiders have been accumulating, suggesting that those who understand the company best see some potential. You should always think about risks though. Case in point, we've spotted 1 warning sign for Fonterra Co-operative Group you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Fonterra Co-operative Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:FCG

Fonterra Co-operative Group

Fonterra Co-operative Group Limited, together with its subsidiaries, collects, manufactures, and sells milk and milk-derived products.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives