- New Zealand

- /

- Food

- /

- NZSE:ATM

Investors Who Bought a2 Milk (NZSE:ATM) Shares Five Years Ago Are Now Up 617%

The a2 Milk Company Limited (NZSE:ATM) shareholders might be concerned after seeing the share price drop 20% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been spectacular. In fact, during that period, the share price climbed 617%. Impressive! So it might be that some shareholders are taking profits after good performance. But the real question is whether the business fundamentals can improve over the long term.

We love happy stories like this one. The company should be really proud of that performance!

See our latest analysis for a2 Milk

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

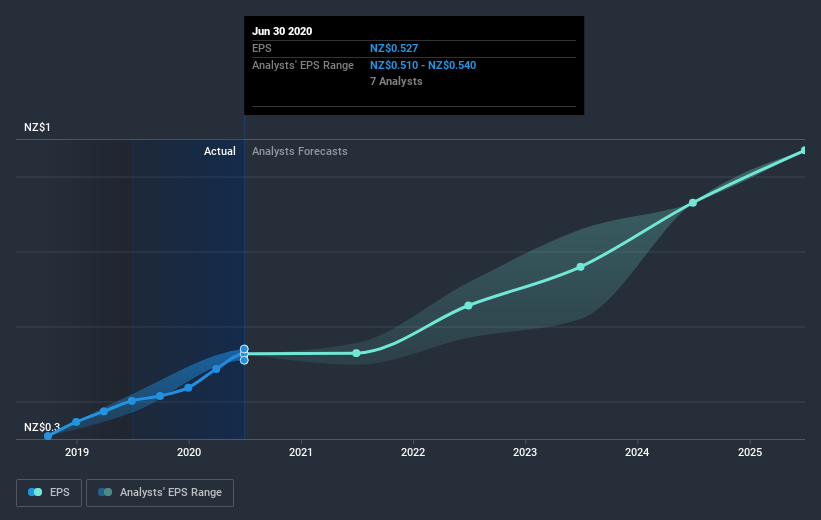

During the last half decade, a2 Milk became profitable. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. Indeed, the a2 Milk share price has gained 76% in three years. In the same period, EPS is up 61% per year. This EPS growth is higher than the 21% average annual increase in the share price over the same three years. So you might conclude the market is a little more cautious about the stock, these days.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While the broader market gained around 13% in the last year, a2 Milk shareholders lost 8.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 48% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for a2 Milk that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NZ exchanges.

If you decide to trade a2 Milk, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade a2 Milk, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NZSE:ATM

a2 Milk

Sells A2 protein type branded milk and related products in Australia, New Zealand, China, rest of Asia, and the United States.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives