- Thailand

- /

- Entertainment

- /

- SET:AS

NZX And 2 Other Penny Stocks With Promising Fundamentals

Reviewed by Simply Wall St

Global markets have experienced another week of gains, with major indices such as the Dow Jones Industrial Average and S&P 500 Index reaching record highs, while geopolitical factors and domestic policies continue to influence investor sentiment. For those exploring investment opportunities in smaller or newer companies, penny stocks—despite their somewhat outdated moniker—remain a significant area of interest. These stocks can provide unexpected value when supported by strong financial fundamentals, offering potential for growth that larger firms might not match. In this article, we examine three penny stocks with promising financial strength that may present long-term opportunities for investors seeking hidden value.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.44B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.725 | £177.65M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

| ME Group International (LSE:MEGP) | £2.20 | £828.88M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.96 | HK$43.61B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.415 | £439.1M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.54 | £67.51M | ★★★★☆☆ |

Click here to see the full list of 5,701 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

NZX (NZSE:NZX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NZX Limited operates a stock exchange in New Zealand and has a market cap of NZ$487.26 million.

Operations: The company's revenue is primarily derived from Funds Services (NZ$40.27 million), followed by Secondary Markets (NZ$24.75 million), Information Services (NZ$19.57 million), Capital Markets Origination (NZ$15.74 million), Wealth Tech. (NZ$8.01 million), Regulation (NZ$3.89 million), and Corporate Services (NZ$0.10 million).

Market Cap: NZ$487.26M

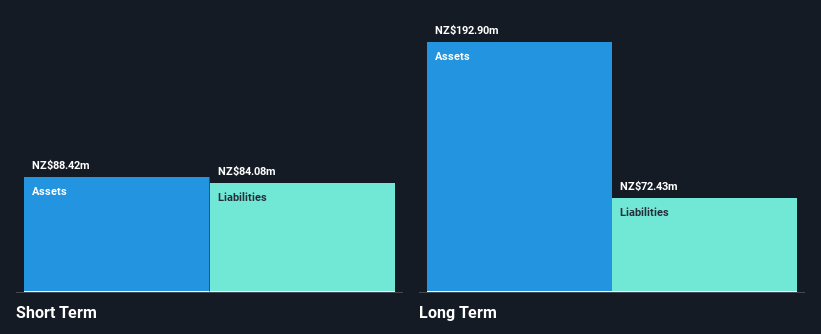

NZX Limited has shown impressive earnings growth of 58.9% over the past year, outpacing the industry average and reflecting stronger-than-expected capital raisings. Despite this growth, its dividend yield of 4.09% is not well covered by earnings or free cash flows, indicating potential sustainability concerns. The company’s financial health appears stable with short-term assets exceeding both short-term and long-term liabilities, and a satisfactory net debt to equity ratio of 39.2%. However, the board's inexperience could be a factor to monitor as it may influence strategic decisions moving forward.

- Unlock comprehensive insights into our analysis of NZX stock in this financial health report.

- Explore NZX's analyst forecasts in our growth report.

Jutal Offshore Oil Services (SEHK:3303)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jutal Offshore Oil Services Limited is an investment holding company involved in the fabrication of facilities and provision of integrated services for the oil and gas, new energy, and refining and chemical industries, with a market cap of HK$1.45 billion.

Operations: The company's revenue is primarily derived from the oil and gas segment, which accounts for CN¥2.98 billion, with additional contributions from the new energy and refinery and chemical segment totaling CN¥64.13 million.

Market Cap: HK$1.45B

Jutal Offshore Oil Services Limited has demonstrated significant earnings growth, with a remarkable increase of 26,624.6% over the past year, far surpassing the industry average. The company maintains a robust financial position, with short-term assets of CN¥2.2 billion exceeding both short-term and long-term liabilities. Its debt is well-covered by operating cash flow, and it holds more cash than total debt, reflecting strong liquidity management. However, shareholder dilution occurred in the past year as shares outstanding grew by 7.6%. While its return on equity is considered low at 16.5%, profit margins have improved to 11.9%.

- Navigate through the intricacies of Jutal Offshore Oil Services with our comprehensive balance sheet health report here.

- Gain insights into Jutal Offshore Oil Services' historical outcomes by reviewing our past performance report.

Asphere Innovations (SET:AS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Asphere Innovations Public Company Limited, along with its subsidiaries, offers online game services in Thailand, Singapore, Malaysia, Vietnam, and internationally with a market cap of THB1.99 billion.

Operations: The company generates revenue from its Publishing Online Game segment, which accounts for THB1.27 billion, and its Distribution Segment, contributing THB3.01 million.

Market Cap: THB2B

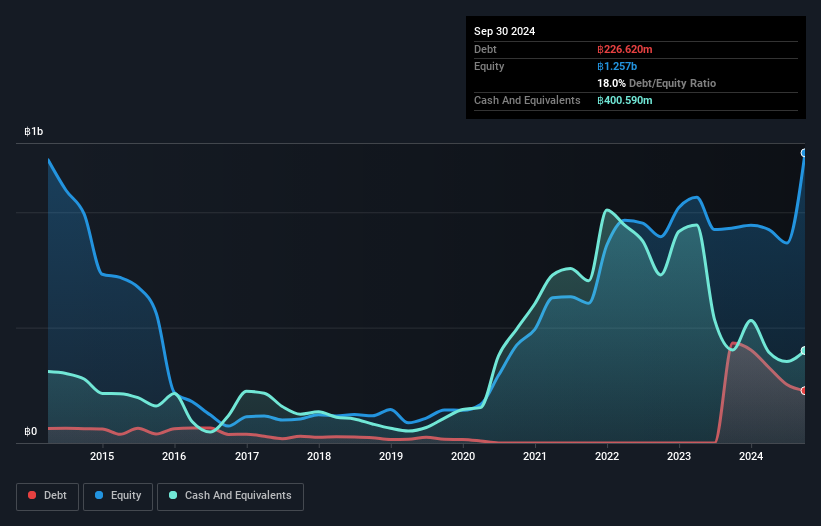

Asphere Innovations has shown strong earnings growth of 37.6% over the past year, outpacing the entertainment industry average. Despite a relatively new management team with an average tenure of 1.6 years, the company maintains financial stability with short-term assets (THB562.6M) exceeding both short and long-term liabilities. Its debt is well-managed, covered by operating cash flow and cash reserves surpassing total debt. However, its return on equity remains low at 16.8%, and its dividend coverage is weak due to insufficient free cash flows. The price-to-earnings ratio of 8.8x suggests it may be undervalued compared to the market average.

- Dive into the specifics of Asphere Innovations here with our thorough balance sheet health report.

- Assess Asphere Innovations' previous results with our detailed historical performance reports.

Taking Advantage

- Discover the full array of 5,701 Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:AS

Asphere Innovations

Provides online game services in Thailand, Singapore, Malaysia, Vietnam, and internationally.

Solid track record with excellent balance sheet.