- Thailand

- /

- Healthcare Services

- /

- SET:THG

3 Insider-Favored Growth Companies With High Ownership

Reviewed by Simply Wall St

In a week marked by diverging performances among major U.S. stock indexes, growth stocks have continued to rally, with the S&P 500 and Nasdaq Composite reaching record highs. As investors navigate this complex landscape, insider ownership can be a significant indicator of confidence in a company's growth potential, suggesting alignment between management and shareholders' interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 24% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's review some notable picks from our screened stocks.

Thonburi Healthcare Group (SET:THG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Thonburi Healthcare Group Public Company Limited, along with its subsidiaries, operates private hospitals in Thailand and has a market cap of approximately THB15.51 billion.

Operations: The company's revenue segments include Hospital Operations at THB8.19 billion, Hospital Management at THB764.61 million, Healthcare Solution Provider at THB427.75 million, and Development and Sales of Hospital Operation Software at THB36 million.

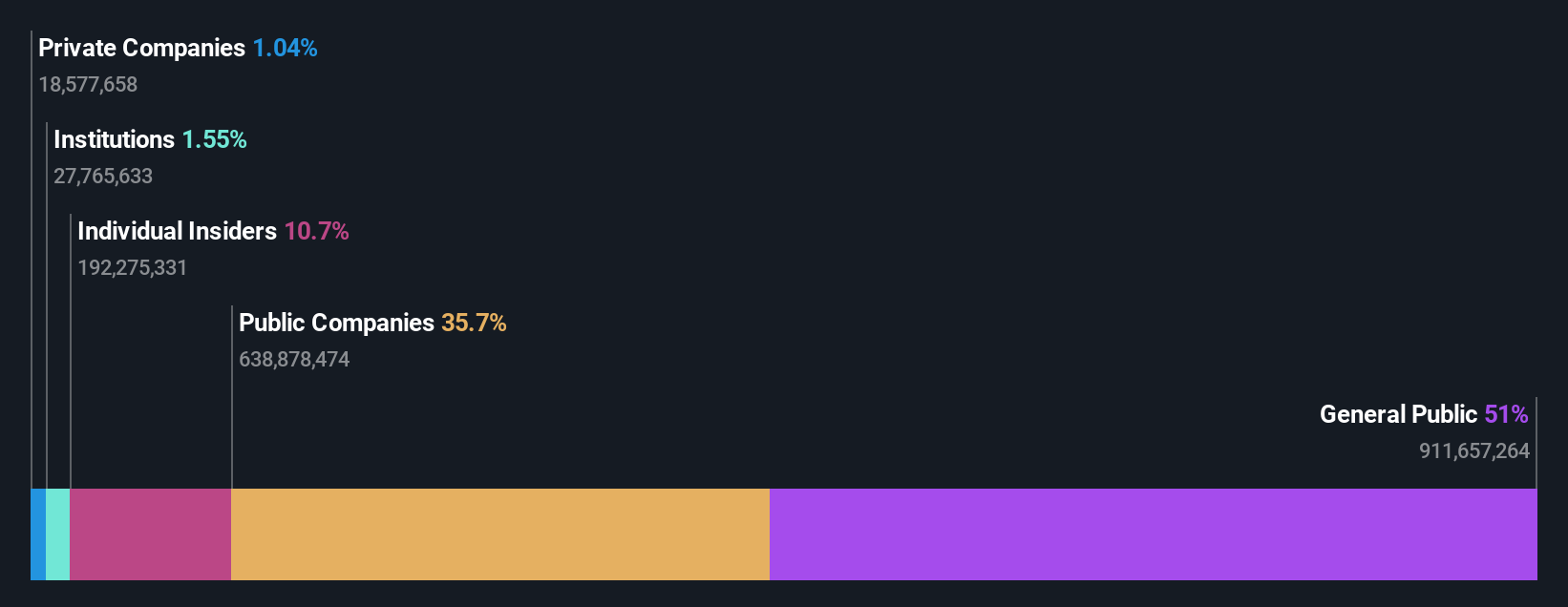

Insider Ownership: 38.3%

Revenue Growth Forecast: 13.2% p.a.

Thonburi Healthcare Group's revenue is expected to grow at 13.2% annually, surpassing the Thai market average of 6.5%, though still below a high growth threshold of 20%. Despite its volatile share price and recent financial losses, the company trades at good value relative to peers. Insider ownership remains substantial with no significant insider trading in recent months. The firm is forecasted to become profitable within three years, indicating potential for above-average market growth.

- Click to explore a detailed breakdown of our findings in Thonburi Healthcare Group's earnings growth report.

- Upon reviewing our latest valuation report, Thonburi Healthcare Group's share price might be too pessimistic.

Do-Fluoride New Materials (SZSE:002407)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Do-Fluoride New Materials Co., Ltd. develops, produces, and sells inorganic fluorides, electronic chemicals, lithium-ion batteries, and related materials both in China and internationally with a market cap of CN¥15.51 billion.

Operations: The company's revenue segments include inorganic fluorides, electronic chemicals, and lithium-ion batteries along with related materials, serving both domestic and international markets.

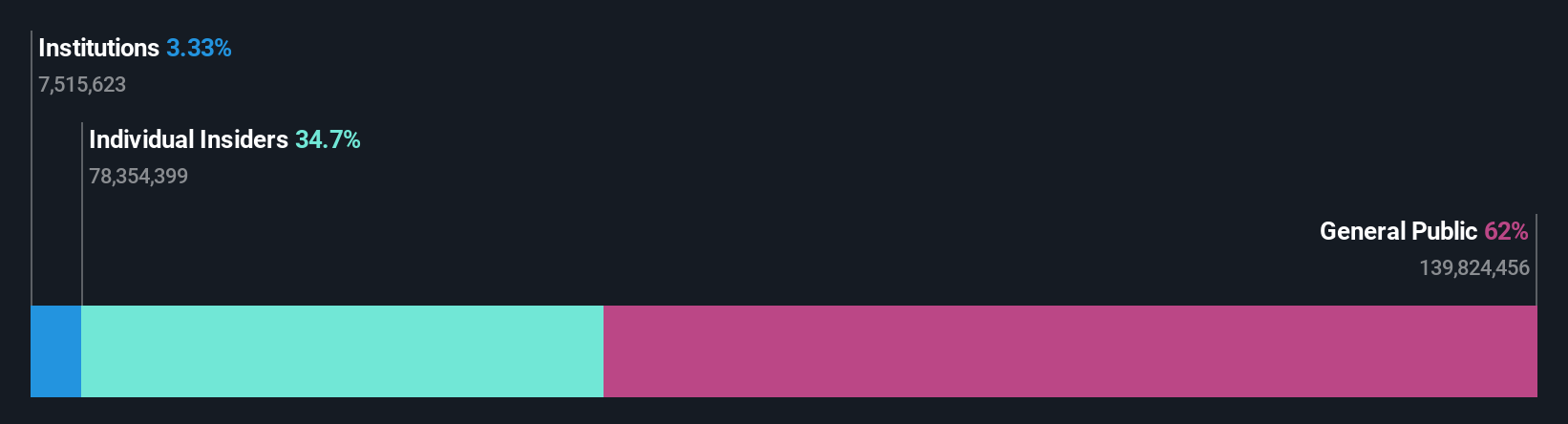

Insider Ownership: 13.9%

Revenue Growth Forecast: 17.2% p.a.

Do-Fluoride New Materials is forecasted to achieve significant earnings growth of 73.67% annually, outpacing the Chinese market's average. However, recent results show declining financial performance with sales and net income dropping sharply over the past year. Despite this, insider ownership remains substantial with no major insider trading activities recently reported. Revenue growth expectations are strong at 17.2% per year but fall below high growth thresholds, while return on equity projections remain low at 5.2%.

- Get an in-depth perspective on Do-Fluoride New Materials' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Do-Fluoride New Materials is priced higher than what may be justified by its financials.

Wuxi Longsheng TechnologyLtd (SZSE:300680)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Wuxi Longsheng Technology Co., Ltd is a Chinese company that manufactures auto parts, with a market cap of CN¥5.96 billion.

Operations: The company generates revenue from its operations in the auto parts manufacturing sector.

Insider Ownership: 35.1%

Revenue Growth Forecast: 26.2% p.a.

Wuxi Longsheng Technology is poised for robust growth with forecasted annual revenue and earnings increases of 26.2% and 29.7%, respectively, surpassing the broader Chinese market's growth rates. Recent financials show a strong performance, with nine-month sales rising to CNY 1.64 billion from CNY 1.19 billion last year, and net income improving significantly to CNY 153.6 million. Despite low return on equity projections, the stock's price-to-earnings ratio suggests it is undervalued compared to the market average.

- Take a closer look at Wuxi Longsheng TechnologyLtd's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, Wuxi Longsheng TechnologyLtd's share price might be too optimistic.

Summing It All Up

- Click this link to deep-dive into the 1508 companies within our Fast Growing Companies With High Insider Ownership screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Thonburi Healthcare Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:THG

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives