- Thailand

- /

- Electronic Equipment and Components

- /

- SET:DITTO

3 Stocks That May Be Trading Below Their Estimated Intrinsic Value

Reviewed by Simply Wall St

As global markets continue to reach new heights, with indices like the Dow Jones Industrial Average and S&P 500 Index hitting record intraday highs, investors are increasingly attentive to geopolitical developments and economic indicators that could influence future trends. Amidst this robust market environment, identifying stocks that may be trading below their estimated intrinsic value can offer potential opportunities for investors looking to capitalize on discrepancies between market price and underlying worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Round One (TSE:4680) | ¥1264.00 | ¥2521.53 | 49.9% |

| BMC Medical (SZSE:301367) | CN¥68.53 | CN¥136.94 | 50% |

| Equity Bancshares (NYSE:EQBK) | US$48.12 | US$96.15 | 50% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.70 | THB30.86 | 49.1% |

| Acerinox (BME:ACX) | €9.92 | €19.82 | 49.9% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.08 | CN¥22.06 | 49.8% |

| Nidaros Sparebank (OB:NISB) | NOK100.10 | NOK198.62 | 49.6% |

| Sands China (SEHK:1928) | HK$20.20 | HK$40.40 | 50% |

| iFLYTEKLTD (SZSE:002230) | CN¥51.82 | CN¥103.35 | 49.9% |

| Marcus & Millichap (NYSE:MMI) | US$40.88 | US$81.13 | 49.6% |

Underneath we present a selection of stocks filtered out by our screen.

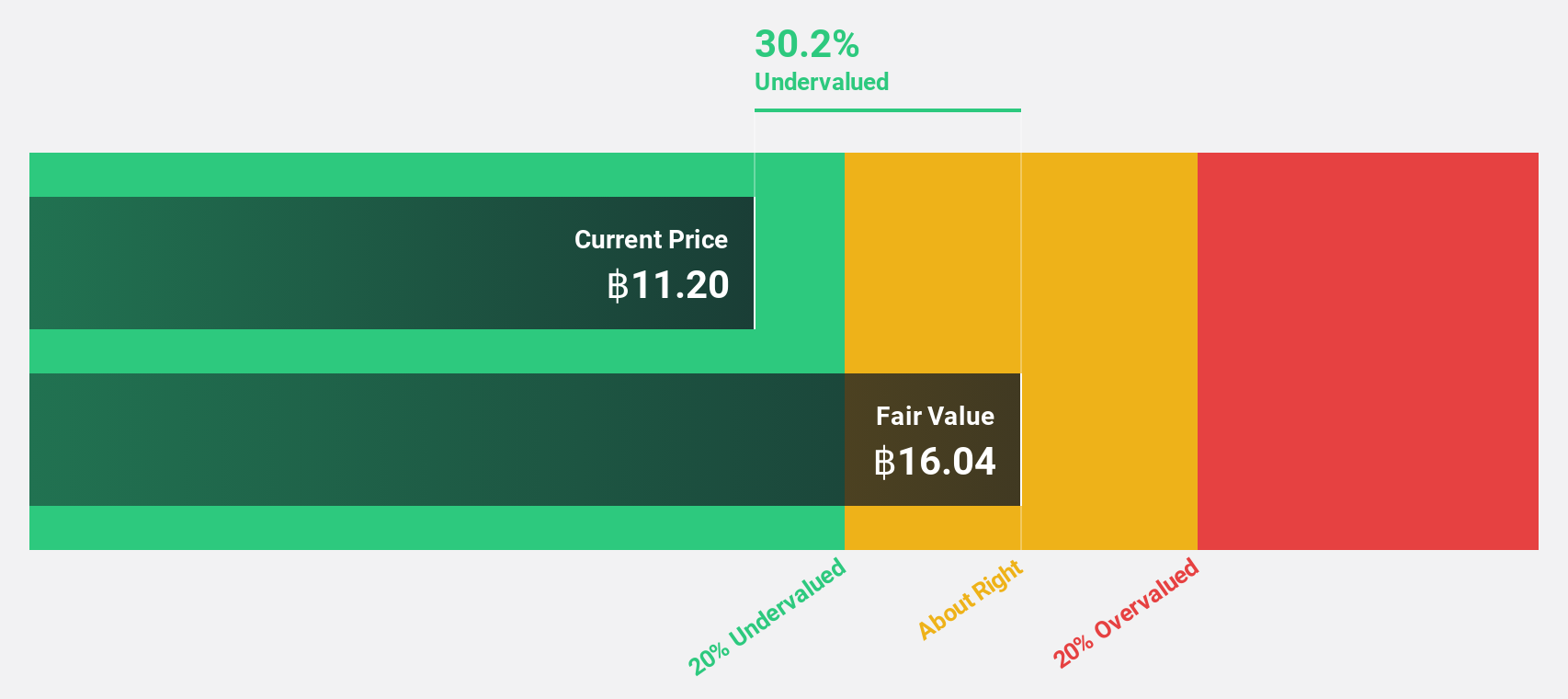

Ditto (Thailand) (SET:DITTO)

Overview: Ditto (Thailand) Public Company Limited provides data and document management solutions in Thailand and has a market cap of THB12.56 billion.

Operations: The company's revenue segments include Technology Engineering Services at THB1.07 billion, Data and Document Management Solution at THB692.38 million, and Photocopiers, Printer and Technology Products at THB475.38 million.

Estimated Discount To Fair Value: 11.1%

Ditto (Thailand) shows potential as an undervalued stock based on cash flows, trading at THB17.6, which is 11.1% below its estimated fair value of THB19.8. Recent earnings growth demonstrates strong performance, with net income rising to THB138.17 million in Q3 2024 from THB96.58 million a year ago. Despite past shareholder dilution and high share price volatility, Ditto's revenue and earnings are expected to grow significantly faster than the Thai market over the next three years.

- In light of our recent growth report, it seems possible that Ditto (Thailand)'s financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Ditto (Thailand) stock in this financial health report.

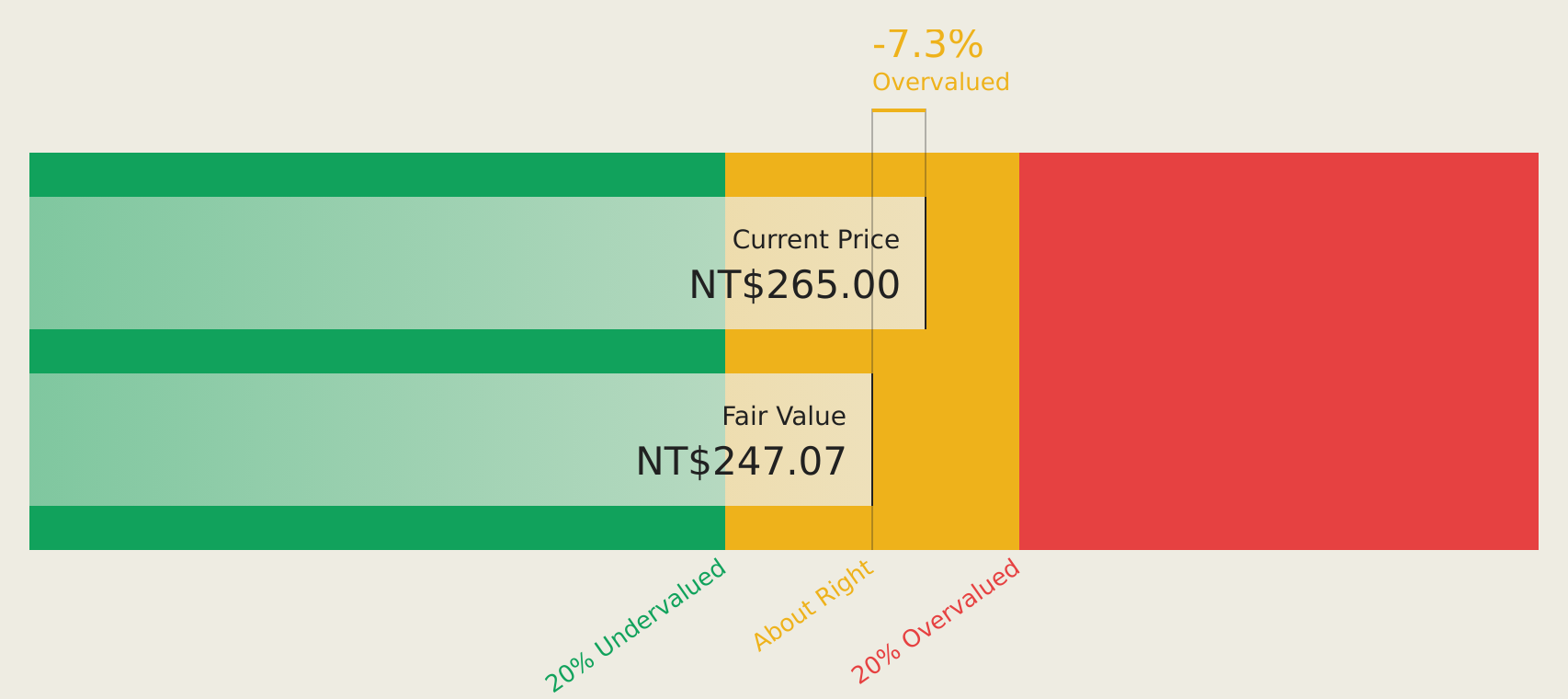

Ennoconn (TWSE:6414)

Overview: Ennoconn Corporation is engaged in the research, design, development, manufacturing, and sale of data storage and processing equipment, industrial motherboards, network communication products, and facility electromechanical systems both in Taiwan and internationally; it has a market cap of NT$41.42 billion.

Operations: The company's revenue segments include NT$54.61 billion from the Information Systems Department, NT$4.16 billion from the Network Communications Production and Sales Department, NT$26.93 billion from the Industrial Computer Software and Hardware Sales Department, and NT$60.85 billion from the Factory System and Electromechanical System Service Business Department.

Estimated Discount To Fair Value: 14.4%

Ennoconn appears undervalued based on cash flows, trading at NT$308.5, 14.4% below its fair value estimate of NT$360.24. Despite a decline in net income to TWD 690.67 million in Q3 2024 from TWD 762.63 million a year ago, the company shows potential with expected earnings growth of 22.31% annually over three years, outpacing the TW market's growth rate. However, past shareholder dilution and an unstable dividend track record are concerns to consider.

- The growth report we've compiled suggests that Ennoconn's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Ennoconn's balance sheet health report.

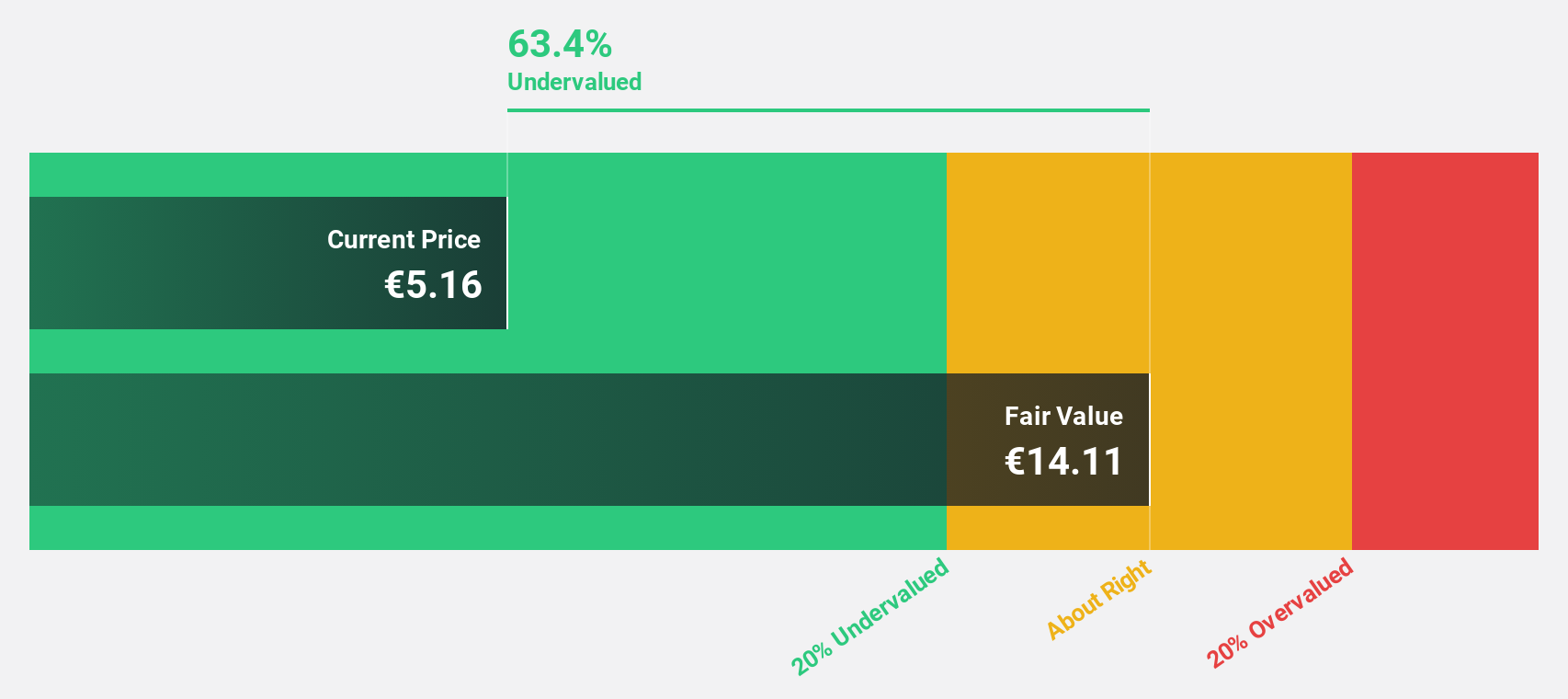

Deutsche Pfandbriefbank (XTRA:PBB)

Overview: Deutsche Pfandbriefbank AG is involved in commercial real estate and public investment finance across Europe and the USA, with a market cap of €708.01 million.

Operations: The company's revenue segments include Real Estate Finance (REF) generating €255 million and Non-Core (NC) contributing €108 million.

Estimated Discount To Fair Value: 21.1%

Deutsche Pfandbriefbank is trading at €5.27, over 20% below its fair value estimate of €6.68, suggesting undervaluation based on cash flows. Despite a slight decline in net income to €74 million for the nine months ending September 2024 and challenges like high bad loans (4.1%) and lower profit margins (17%), the bank's earnings are forecasted to grow significantly at 35.3% annually, surpassing the German market's growth rate of 20.8%.

- Our comprehensive growth report raises the possibility that Deutsche Pfandbriefbank is poised for substantial financial growth.

- Get an in-depth perspective on Deutsche Pfandbriefbank's balance sheet by reading our health report here.

Next Steps

- Click this link to deep-dive into the 886 companies within our Undervalued Stocks Based On Cash Flows screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:DITTO

Ditto (Thailand)

Distributes data and document management solutions in Thailand.

Flawless balance sheet with high growth potential.