As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are keenly observing potential opportunities in various sectors. Penny stocks, often associated with smaller or emerging companies, continue to capture attention due to their affordability and growth potential. Despite the term's vintage feel, these stocks can offer significant value when backed by strong financials and a clear path for growth.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.71 | MYR420.07M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.59B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,853 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Winton Land (NZSE:WIN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Winton Land Limited is a land developer specializing in creating integrated and master-planned neighborhoods in New Zealand and Australia, with a market cap of NZ$563.57 million.

Operations: The company's revenue is derived from three segments: Residential (NZ$162.53 million), Commercial (NZ$11.02 million), and Retirement (NZ$0.06 million).

Market Cap: NZ$563.57M

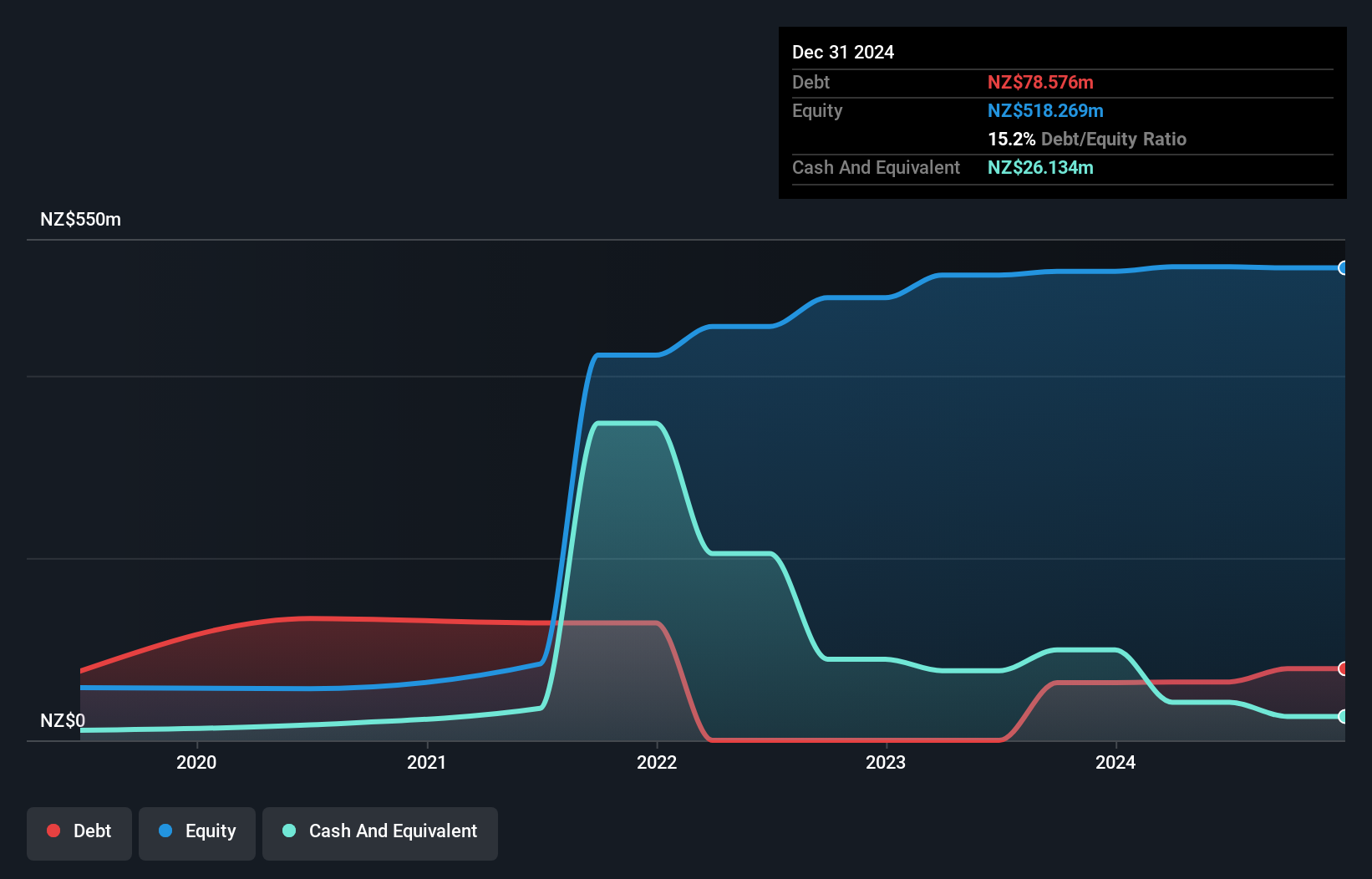

Winton Land Limited, with a market cap of NZ$563.57 million, shows financial resilience as its short-term assets (NZ$126.6 million) exceed both short-term (NZ$30 million) and long-term liabilities (NZ$104.5 million). The company has high-quality earnings and its debt is well covered by operating cash flow (22.2%). Despite negative earnings growth over the past year (-75.6%), it is forecasted to grow 54.81% annually in the future, indicating potential recovery prospects. The board and management are experienced, though recent profit margins have declined to 9.1% from 29.2%. Recent changes include a new registered office address in Auckland effective October 2024.

- Get an in-depth perspective on Winton Land's performance by reading our balance sheet health report here.

- Evaluate Winton Land's prospects by accessing our earnings growth report.

Eureka Design (SET:UREKA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eureka Design Public Company Limited, along with its subsidiaries, is involved in the production and distribution of water and raw materials both in Thailand and internationally, with a market cap of THB1.93 billion.

Operations: The company's revenue is derived from two main segments: producing and selling plastic pellets, which generated THB173.60 million, and producing and selling drinking and raw water, contributing THB96.71 million.

Market Cap: THB1.93B

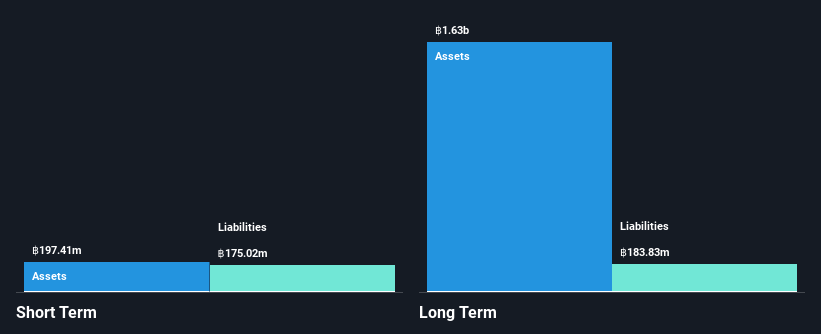

Eureka Design Public Company Limited, with a market cap of THB1.93 billion, faces challenges as its recent earnings report revealed a decline in sales to THB63.3 million for Q3 2024 and a net loss of THB3.01 million. Despite negative earnings growth over the past year, the company has shown profitability over five years with robust profit margins at 18.6%. Its financial stability is supported by short-term assets exceeding liabilities and satisfactory debt levels, while interest payments are well covered by EBIT (3.2x). However, high volatility persists in its stock price recently despite no significant shareholder dilution last year.

- Take a closer look at Eureka Design's potential here in our financial health report.

- Gain insights into Eureka Design's past trends and performance with our report on the company's historical track record.

Founder Technology GroupLtd (SHSE:600601)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Founder Technology Group Co., Ltd. offers hardware and software solutions in China with a market cap of CN¥18.18 billion.

Operations: Founder Technology Group Co., Ltd. does not report distinct revenue segments.

Market Cap: CN¥18.18B

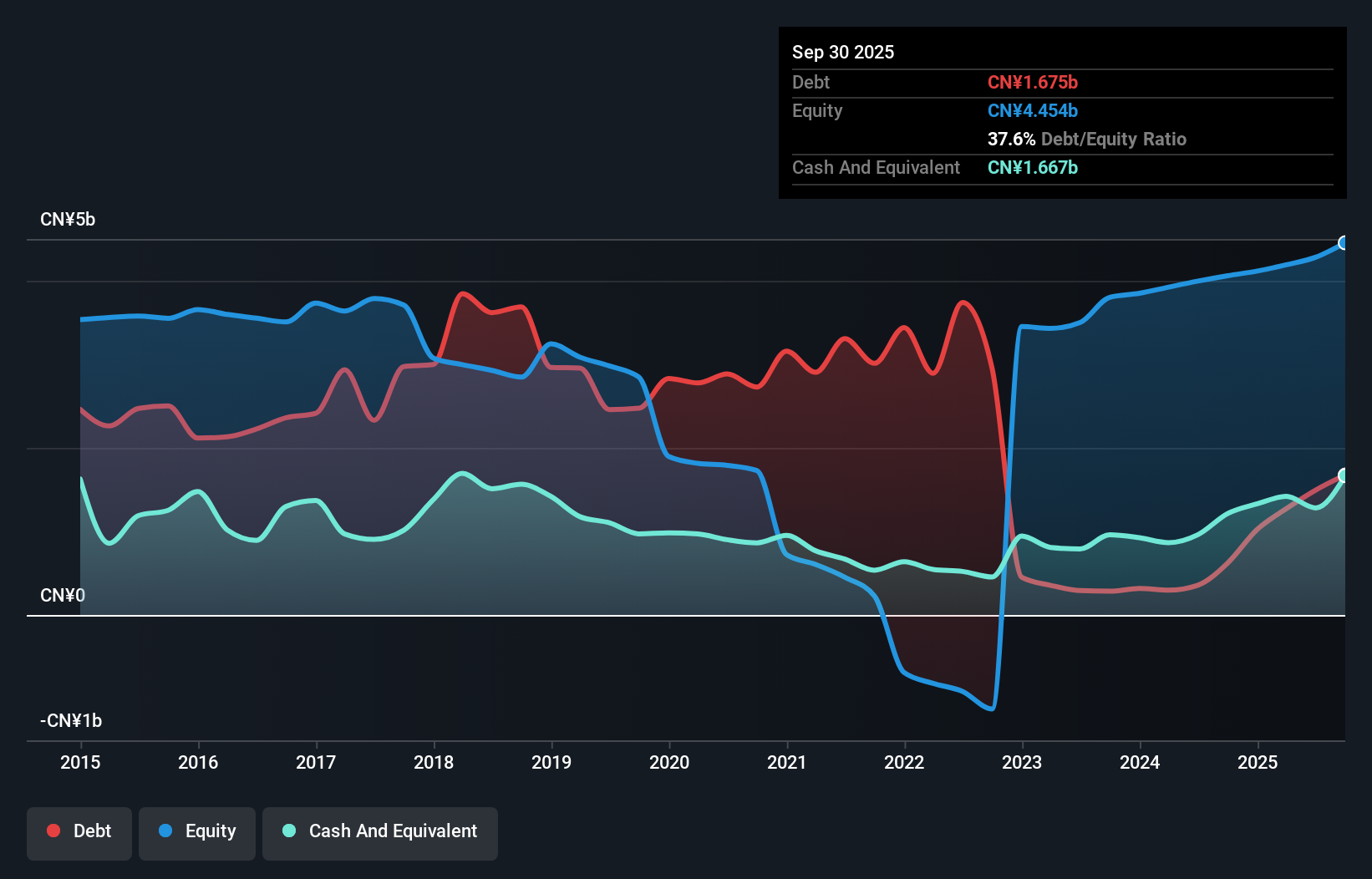

Founder Technology Group Co., Ltd., with a market cap of CN¥18.18 billion, has shown solid financial performance, reporting sales of CN¥2.45 billion and net income of CN¥209.93 million for the first nine months of 2024, marking growth from the previous year. The company has effectively reduced its debt-to-equity ratio to 15.3% over five years and maintains more cash than total debt, ensuring robust financial health with short-term assets surpassing liabilities. Despite low return on equity at 5.6%, profit margins improved to 6.8%. However, the board's average tenure suggests limited experience which may affect strategic decisions.

- Jump into the full analysis health report here for a deeper understanding of Founder Technology GroupLtd.

- Review our historical performance report to gain insights into Founder Technology GroupLtd's track record.

Where To Now?

- Access the full spectrum of 5,853 Penny Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eureka Design might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:UREKA

Eureka Design

Engages in the production and distribution of tap water in Thailand and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives