As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are increasingly seeking opportunities that balance risk with potential reward. Penny stocks, while often considered speculative, can offer unique growth potential when backed by solid financials and fundamentals. Despite being a somewhat outdated term, these smaller or newer companies continue to represent an intriguing area for investors looking to discover promising candidates poised for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.71 | MYR420.07M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.59B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,850 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

YesAsia Holdings (SEHK:2209)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: YesAsia Holdings Limited is an investment holding company involved in the procurement, sale, and trading of Asian fashion and lifestyle products, including beauty, cosmetics, accessories, and entertainment items, with a market cap of HK$1.90 billion.

Operations: The company generates revenue primarily from two segments: $2.56 million from Entertainment Products and $270.65 million from Fashion & Lifestyle and Beauty Products.

Market Cap: HK$1.9B

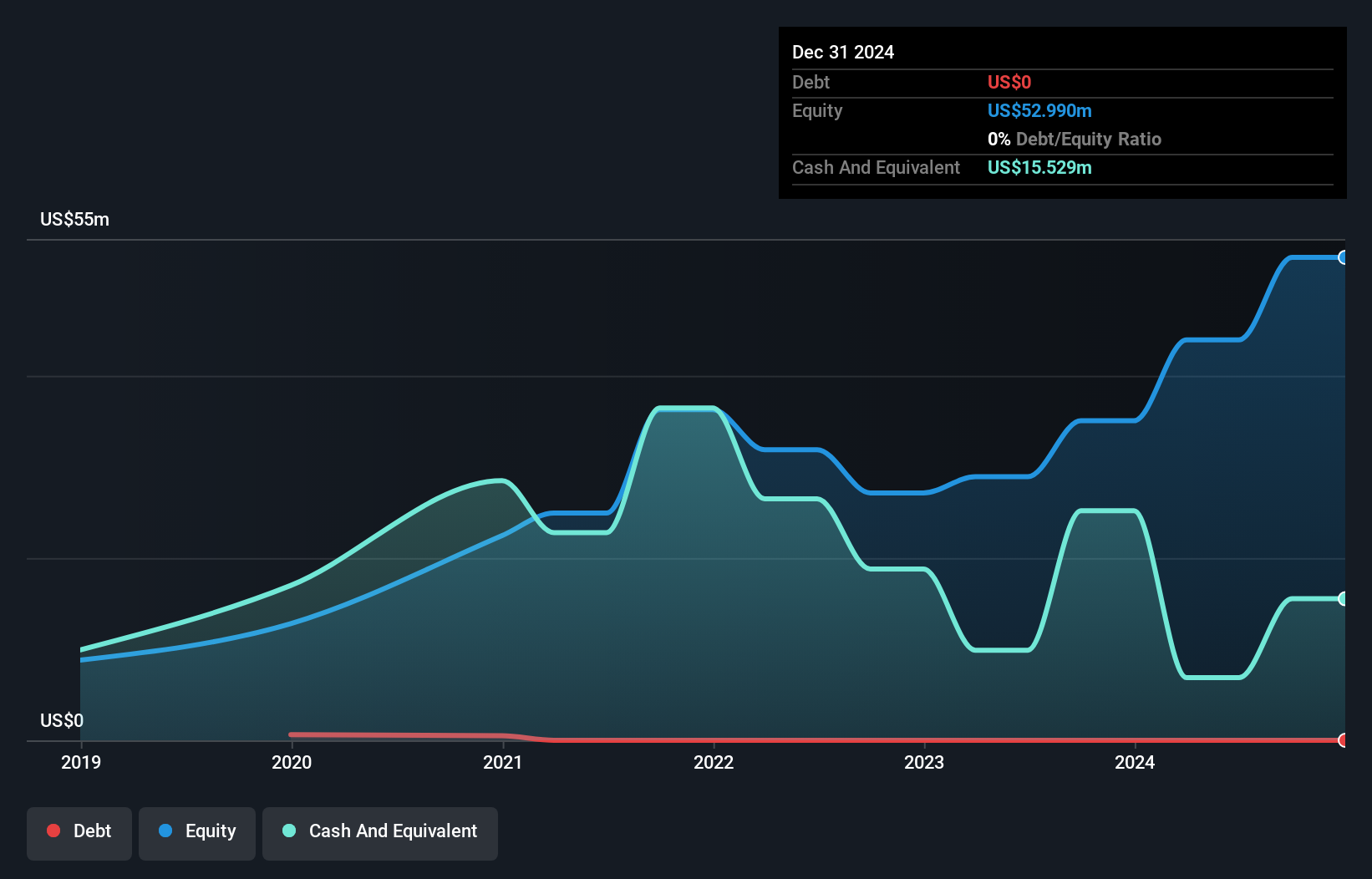

YesAsia Holdings has recently achieved profitability, distinguishing itself from the broader Specialty Retail industry, which faced a downturn. The company is debt-free, enhancing its financial stability and reducing risk. Its short-term assets of HK$71.90 million comfortably cover both short- and long-term liabilities, indicating robust liquidity management. Earnings are forecast to grow significantly at 48.83% annually, supported by a seasoned management team with an average tenure of 27 years. However, shareholder dilution occurred last year with shares outstanding increasing by 3%. Despite this, YesAsia's high return on equity at 39% reflects strong operational efficiency.

- Unlock comprehensive insights into our analysis of YesAsia Holdings stock in this financial health report.

- Explore YesAsia Holdings' analyst forecasts in our growth report.

Better World Green (SET:BWG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Better World Green Public Company Limited, with a market cap of THB2.16 billion, operates in Thailand through its subsidiaries focusing on integrated waste treatment and disposal of industrial waste.

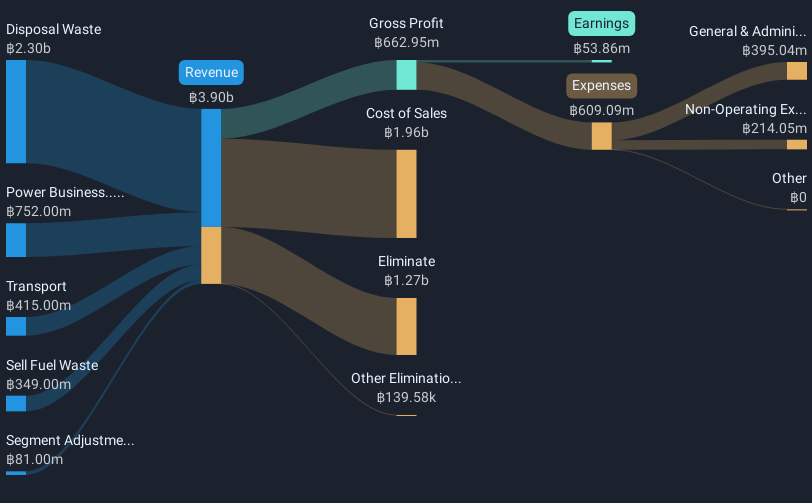

Operations: The company's revenue is primarily derived from its Disposal Waste segment at THB2.30 billion, followed by the Power Business at THB752 million, Transport services at THB415 million, and the sale of Fuel Waste at THB349 million.

Market Cap: THB2.16B

Better World Green Public Company Limited has recently turned profitable, reporting a net income of THB68.68 million for the first nine months of 2024 compared to a loss in the previous year. Despite this turnaround, earnings have been impacted by large one-off gains and shareholder dilution, with shares outstanding increasing by 9.1%. The company's debt situation shows improvement with a reduced debt-to-equity ratio from 79.2% to 48.3% over five years, though interest coverage remains low at 1.3 times EBIT. Short-term assets of THB3 billion exceed both short- and long-term liabilities, indicating solid liquidity management amidst high share price volatility.

- Navigate through the intricacies of Better World Green with our comprehensive balance sheet health report here.

- Examine Better World Green's past performance report to understand how it has performed in prior years.

Starflex (SET:SFLEX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Starflex Public Company Limited manufactures and distributes flexible packaging products in Thailand, with a market cap of THB2.27 billion.

Operations: The company's revenue is primarily derived from Non-Food Packaging, which accounts for THB1.55 billion, followed by Food Packaging at THB293.01 million.

Market Cap: THB2.27B

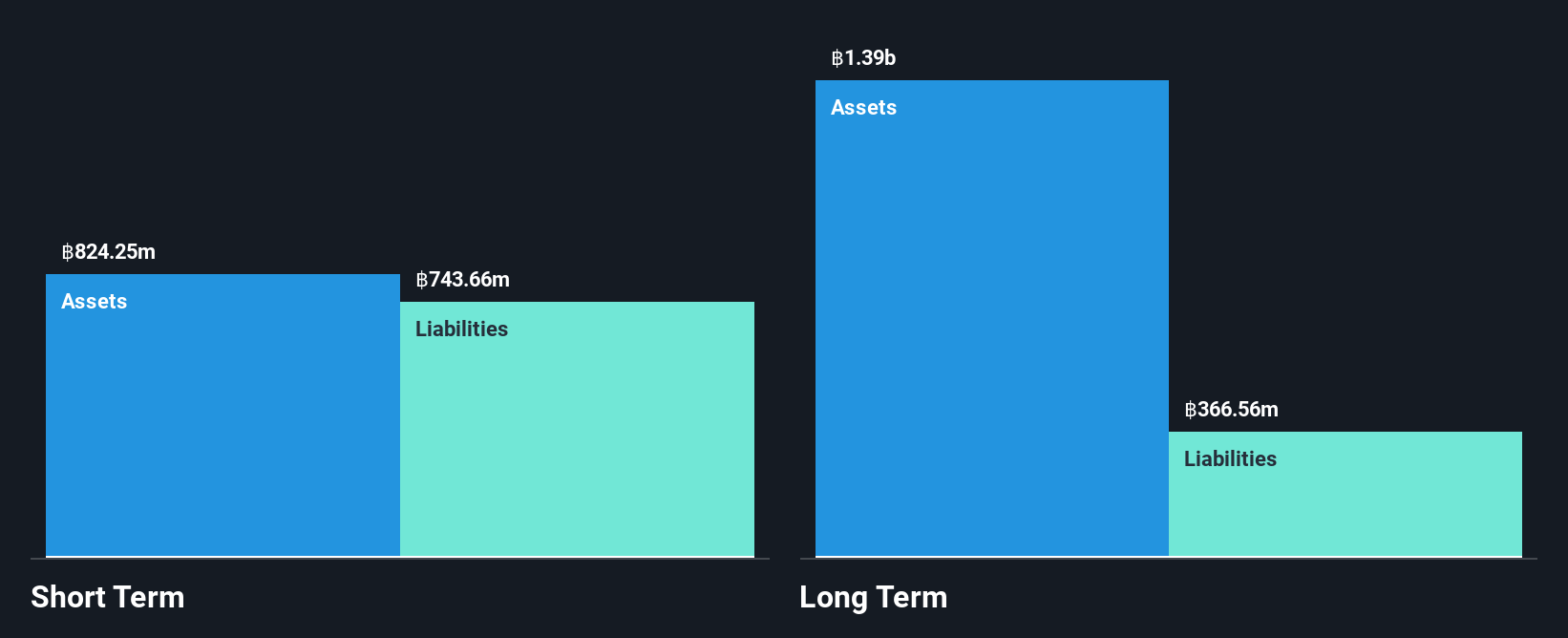

Starflex Public Company Limited has shown robust earnings growth, with a 43.4% increase over the past year, surpassing its five-year average of 15.1% and outperforming the packaging industry. The company's net profit margins improved to 13.3%, supported by high-quality earnings and strong interest coverage at 8.2 times EBIT. Despite these strengths, Starflex carries a high net debt to equity ratio of 56.3%, though short-term assets exceed liabilities, indicating manageable liquidity risks. Recent earnings for Q3 showed increased sales and revenue compared to last year, reflecting ongoing operational momentum despite an unstable dividend track record.

- Click to explore a detailed breakdown of our findings in Starflex's financial health report.

- Understand Starflex's earnings outlook by examining our growth report.

Make It Happen

- Take a closer look at our Penny Stocks list of 5,850 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:SFLEX

Starflex

Manufactures and distributes flexible packaging products in Thailand.

Outstanding track record and good value.

Market Insights

Community Narratives