Fu Shou Yuan International Group Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

As global markets respond to a cautious Federal Reserve and political uncertainties, investors are reevaluating their strategies amid fluctuating indices. In this context, the appeal of penny stocks—traditionally smaller or newer companies—remains significant due to their potential for growth and affordability. Despite being an outdated term, penny stocks continue to attract attention as they can offer opportunities when backed by strong financials and a clear growth path.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.71 | MYR420.07M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.48B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,835 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Fu Shou Yuan International Group (SEHK:1448)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fu Shou Yuan International Group Limited, with a market cap of HK$8.70 billion, operates in the People's Republic of China offering burial and funeral services through its subsidiaries.

Operations: The company's revenue is primarily derived from burial services (CN¥1.78 billion) and funeral services (CN¥357.97 million), with additional income from other services (CN¥73.22 million).

Market Cap: HK$8.7B

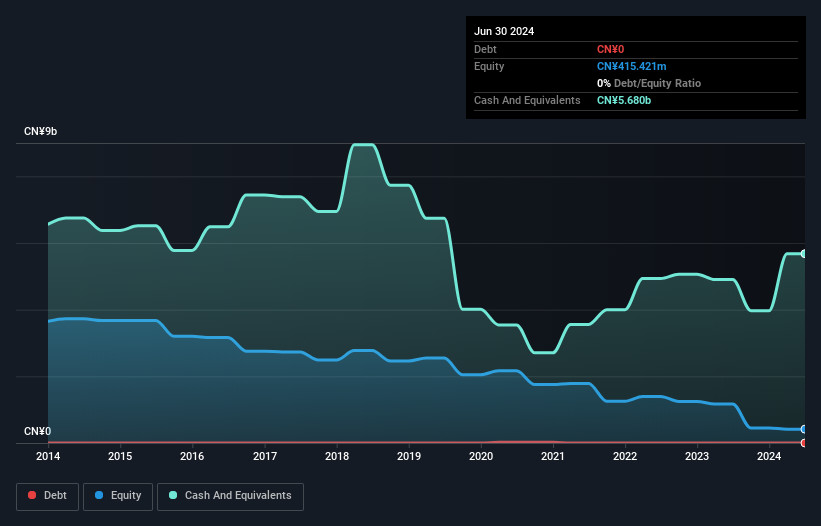

Fu Shou Yuan International Group, with a market cap of HK$8.70 billion, derives significant revenue from burial (CN¥1.78 billion) and funeral services (CN¥357.97 million). The company's debt is well-covered by operating cash flow, and it holds more cash than total debt, indicating strong financial health. Short-term assets exceed both short-term and long-term liabilities, further supporting its stability. However, the management team is relatively inexperienced with an average tenure of 1.3 years. Despite negative earnings growth last year (-27.5%), earnings are forecast to grow at 13.43% per year going forward.

- Unlock comprehensive insights into our analysis of Fu Shou Yuan International Group stock in this financial health report.

- Examine Fu Shou Yuan International Group's earnings growth report to understand how analysts expect it to perform.

Lianhua Supermarket Holdings (SEHK:980)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lianhua Supermarket Holdings Co., Ltd. operates hypermarkets, supermarkets, and convenience stores mainly in eastern China, with a market cap of HK$330.28 million.

Operations: The company generates revenue from hypermarkets (CN¥10.12 billion), supermarkets (CN¥10.95 billion), and convenience stores (CN¥1.57 billion).

Market Cap: HK$330.28M

Lianhua Supermarket Holdings, with a market cap of HK$330.28 million, operates in eastern China and faces challenges due to its unprofitability and negative return on equity. Despite this, the company remains debt-free and has a significant cash runway exceeding three years, supported by positive free cash flow growth. The board's average tenure of 3.8 years indicates experience, while recent executive changes aim to strengthen leadership with Ms. Wang Xiao-yan's appointment as general manager bringing extensive retail management expertise. However, short-term liabilities exceed assets by CN¥7.4 billion, presenting financial risks despite long-term liabilities being covered by short-term assets.

- Jump into the full analysis health report here for a deeper understanding of Lianhua Supermarket Holdings.

- Examine Lianhua Supermarket Holdings' past performance report to understand how it has performed in prior years.

Eastern Polymer Group (SET:EPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eastern Polymer Group Public Company Limited, with a market cap of THB10.86 billion, operates through its subsidiaries to manufacture and distribute rubber insulation, automotive products, and plastic packing both in Thailand and internationally.

Operations: The company's revenue is primarily derived from three segments: Rubber Insulation, generating THB4.33 billion; Automotive Plastics, contributing THB7.28 billion; and Packaging Plastics, adding THB2.38 billion.

Market Cap: THB10.86B

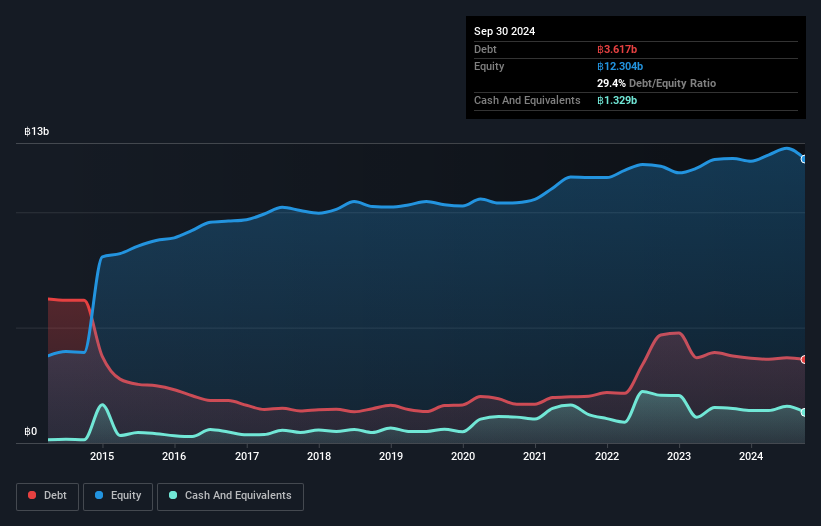

Eastern Polymer Group, with a market cap of THB10.86 billion, shows mixed performance indicators within the penny stock domain. While the company benefits from stable weekly volatility and satisfactory debt levels, its profit margins have declined to 5.9% from last year's 9.7%, and earnings growth was negative over the past year at -30.3%. Despite this, short-term assets comfortably cover both short- and long-term liabilities, reflecting financial stability. Analysts anticipate a price increase of 57.5%, suggesting potential investor optimism despite low return on equity (7%) and an unstable dividend history marked by recent payouts like THB0.06 per share in November 2024.

- Get an in-depth perspective on Eastern Polymer Group's performance by reading our balance sheet health report here.

- Gain insights into Eastern Polymer Group's future direction by reviewing our growth report.

Seize The Opportunity

- Access the full spectrum of 5,835 Penny Stocks by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastern Polymer Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:EPG

Eastern Polymer Group

Through its subsidiaries, engages in the manufacture and distribution of rubber insulation, automotive, and plastic packing products in Thailand and internationally.

Excellent balance sheet with moderate growth potential.