- Thailand

- /

- Electronic Equipment and Components

- /

- SET:PLANET

Watania International Holding PJSC And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are increasingly seeking opportunities that offer both potential growth and stability. Penny stocks, while often associated with higher risk due to their smaller market capitalization or newer market presence, can still present valuable prospects for those willing to explore beyond the mainstream indices. By focusing on companies with solid financial foundations and clear growth trajectories, these investments can provide an intriguing mix of affordability and potential upside.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.74 | MYR437.82M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.59B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,851 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Watania International Holding PJSC (DFM:WATANIA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Watania International Holding PJSC is an investment holding company that provides takaful services in the United Arab Emirates, with a market cap of AED195.12 million.

Operations: The company's revenue segments consist of Investments (AED7.85 million), Takaful - Family (AED46.96 million), Takaful - General Takaful (AED747.78 million), and Takaful - Group Life (Employee Benefits) (AED120.68 million).

Market Cap: AED195.12M

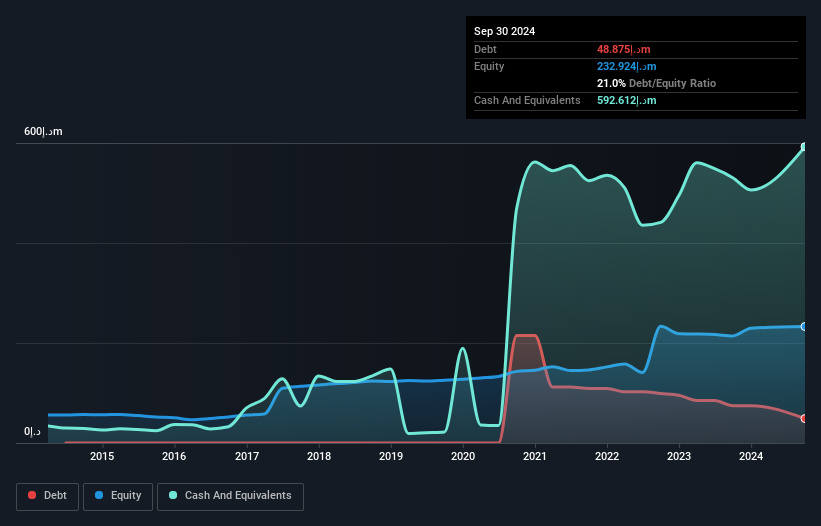

Watania International Holding PJSC has recently transitioned to profitability, reporting a net income of AED 9 million for the first nine months of 2024, reversing a previous net loss. Its price-to-earnings ratio is attractively low at 6.8x compared to the broader AE market. The company maintains more cash than total debt and covers interest payments well with EBIT. However, its return on equity remains low at 12.4%, and operating cash flow is negative, indicating potential financial challenges ahead despite stable weekly volatility and high-quality earnings. The seasoned management team adds operational stability amidst these dynamics.

- Dive into the specifics of Watania International Holding PJSC here with our thorough balance sheet health report.

- Evaluate Watania International Holding PJSC's historical performance by accessing our past performance report.

Planet Communications Asia (SET:PLANET)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Planet Communications Asia Public Company Limited operates in the distribution, installation, maintenance, and servicing of telecommunication equipment in Thailand and Myanmar, with a market cap of THB1 billion.

Operations: The company's revenue is derived from sales income of THB460.34 million, service income excluding that from service providers amounting to THB81.48 million, and income from service providers totaling THB19.75 million.

Market Cap: THB1B

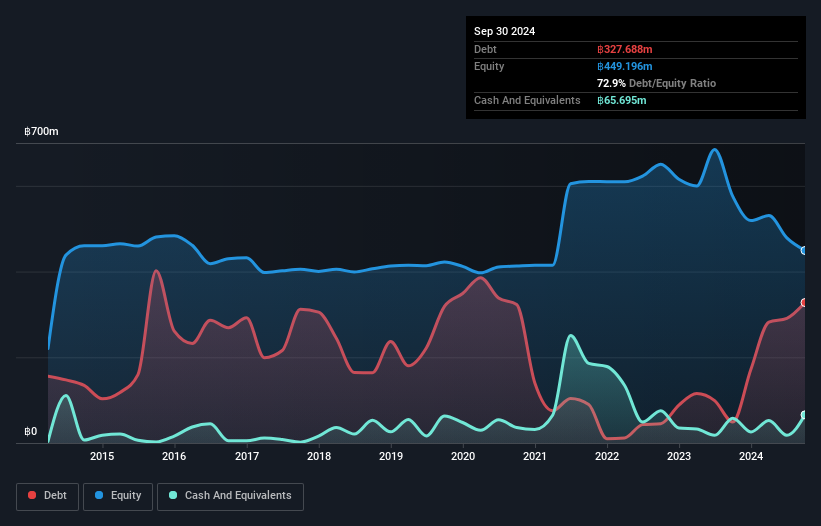

Planet Communications Asia Public Company Limited faces financial challenges, with its high net debt to equity ratio of 58.3% and unprofitable status. Despite recent efforts to bolster capital through a follow-on equity offering and board-approved borrowing from a major shareholder, the company's short-term liabilities of THB541.3 million exceed its short-term assets by a significant margin. The company has experienced increased losses over the past five years, though it has managed to reduce its debt to equity ratio slightly over this period. Recent amendments in company objectives suggest strategic diversification into areas like air defense systems and UAVs, potentially broadening future revenue streams amidst current volatility concerns.

- Click here and access our complete financial health analysis report to understand the dynamics of Planet Communications Asia.

- Gain insights into Planet Communications Asia's historical outcomes by reviewing our past performance report.

Rex International Holding (SGX:5WH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Rex International Holding Limited is an investment holding company engaged in oil exploration and production, with a market capitalization of SGD158.88 million.

Operations: The company generates revenue primarily from its Oil and Gas segment, amounting to $258.28 million, with a minimal contribution from Non-Oil and Gas activities.

Market Cap: SGD158.88M

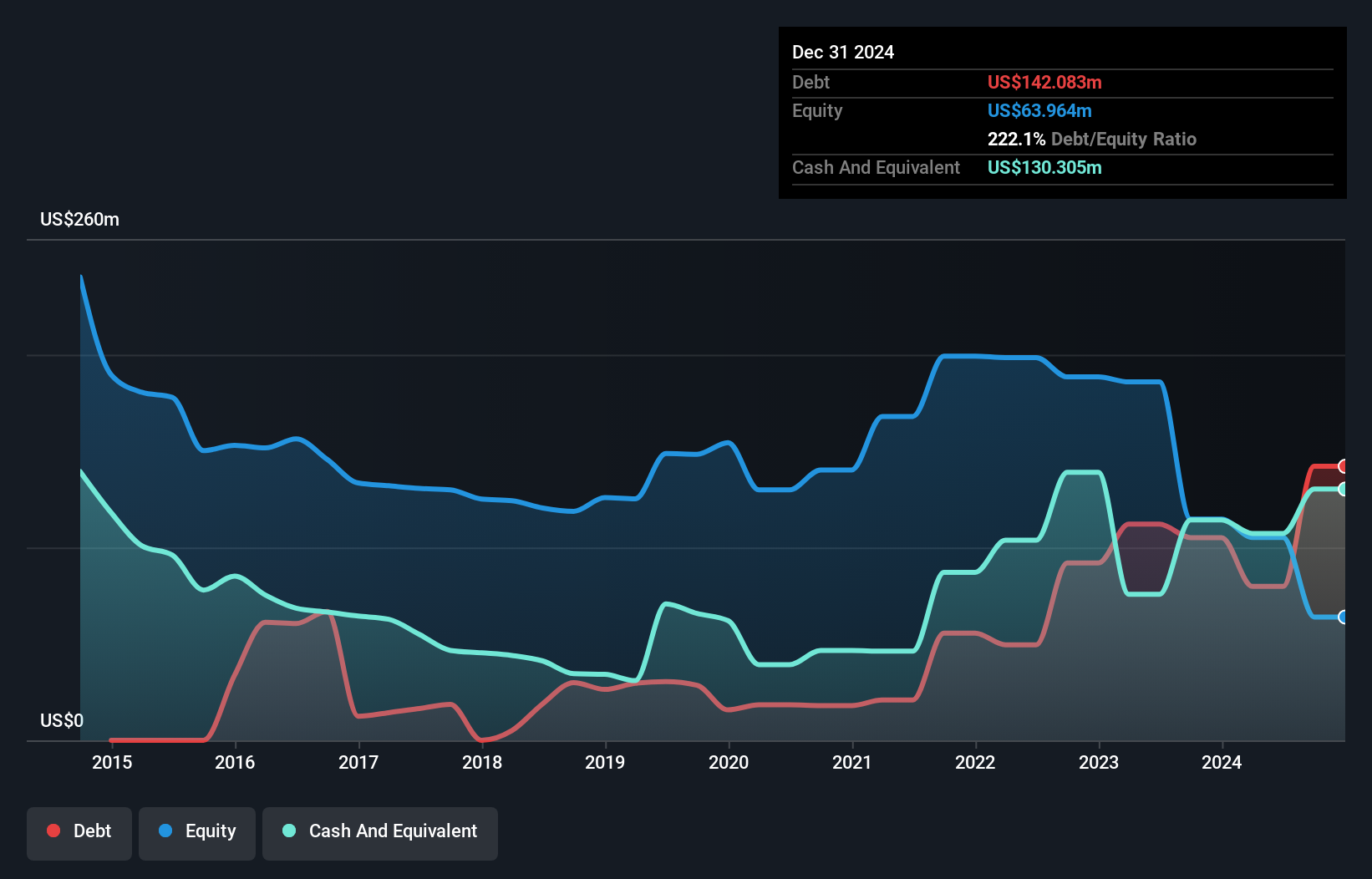

Rex International Holding Limited, with a market capitalization of SGD158.88 million, is unprofitable but holds more cash than its total debt, providing a sufficient cash runway for over three years due to positive free cash flow. The company's short-term assets exceed short-term liabilities; however, they fall short of covering long-term liabilities. Despite trading at a good value compared to peers and the industry, Rex's share price has been highly volatile recently. Its management team is experienced with an average tenure of 9.2 years, though the board remains relatively inexperienced with an average tenure of 2.6 years.

- Take a closer look at Rex International Holding's potential here in our financial health report.

- Examine Rex International Holding's earnings growth report to understand how analysts expect it to perform.

Key Takeaways

- Click this link to deep-dive into the 5,851 companies within our Penny Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:PLANET

Planet Communications Asia

Engages in the distribution, installation, maintenance, and servicing of telecommunication equipment in Thailand and Republic of the Union of Myanmar.

Adequate balance sheet low.

Market Insights

Community Narratives