Exploring Three High Growth Tech Stocks With Exciting Potential

Reviewed by Simply Wall St

As global markets continue to navigate a complex landscape, major U.S. stock indexes have shown mixed results, with growth stocks significantly outperforming value counterparts, reflecting an ongoing rally in sectors like consumer discretionary and information technology. In this dynamic environment, identifying high-growth tech stocks with strong potential can be particularly compelling for investors seeking opportunities that align with current market trends and economic indicators.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| CD Projekt | 24.93% | 27.00% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1292 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

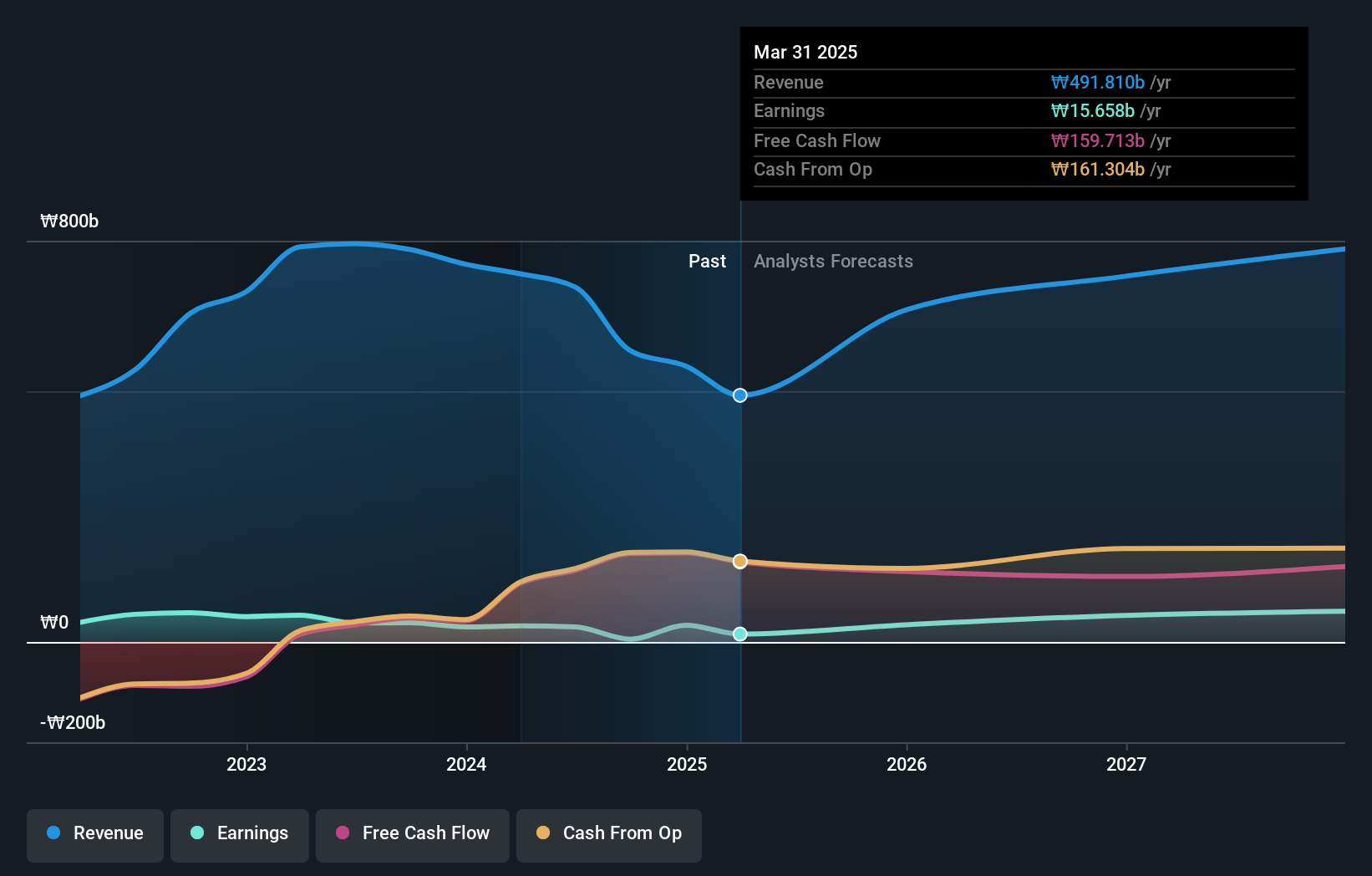

Studio Dragon (KOSDAQ:A253450)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Studio Dragon Corporation is a drama studio that creates and supplies drama content for both traditional and new media platforms, with a market cap of ₩1.43 trillion.

Operations: The company generates revenue primarily through television programming and distribution, amounting to ₩580.61 billion.

Despite a challenging year with earnings down by 85.5%, Studio Dragon is poised for recovery, forecasting revenue growth at 11.6% annually, outpacing the Korean market's average of 9%. This growth is underpinned by significant anticipated earnings expansion at a rate of 39.4% per year, notably higher than the market forecast of 29%. However, it's crucial to note that past financials were impacted by a substantial one-off loss of ₩15.1 billion. Looking ahead, while current profit margins are low at 1%, down from last year’s 4.9%, the company's aggressive focus on content creation and distribution in the highly competitive entertainment sector suggests potential for future revenue streams and market share expansion.

Cal-Comp Electronics (Thailand) (SET:CCET)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cal-Comp Electronics (Thailand) Public Company Limited, along with its subsidiaries, is engaged in the global manufacturing of electronic products and has a market capitalization of approximately THB93.01 billion.

Operations: Cal-Comp Electronics (Thailand) focuses on manufacturing electronic products, with significant revenue contributions from computer peripherals (THB158.81 billion) and telecommunication products (THB20.78 billion). The company's service income adds THB1.56 billion to its revenue stream.

Cal-Comp Electronics (Thailand) has demonstrated resilience and growth, with a notable increase in net income to THB 684.09 million in Q3 2024 from THB 368.11 million the previous year, reflecting an earnings surge of over 80% year-over-year. This performance is anchored by robust sales figures that rose to THB 38.95 billion, up from THB 35.95 billion, underscoring a strong market demand for their electronic products. The firm's commitment to innovation is evident in its R&D investments, crucial for maintaining its competitive edge within the tech sector. Moreover, Cal-Comp's strategic inclusion in the S&P Global BMI Index highlights its growing influence and potential for further expansion in global markets.

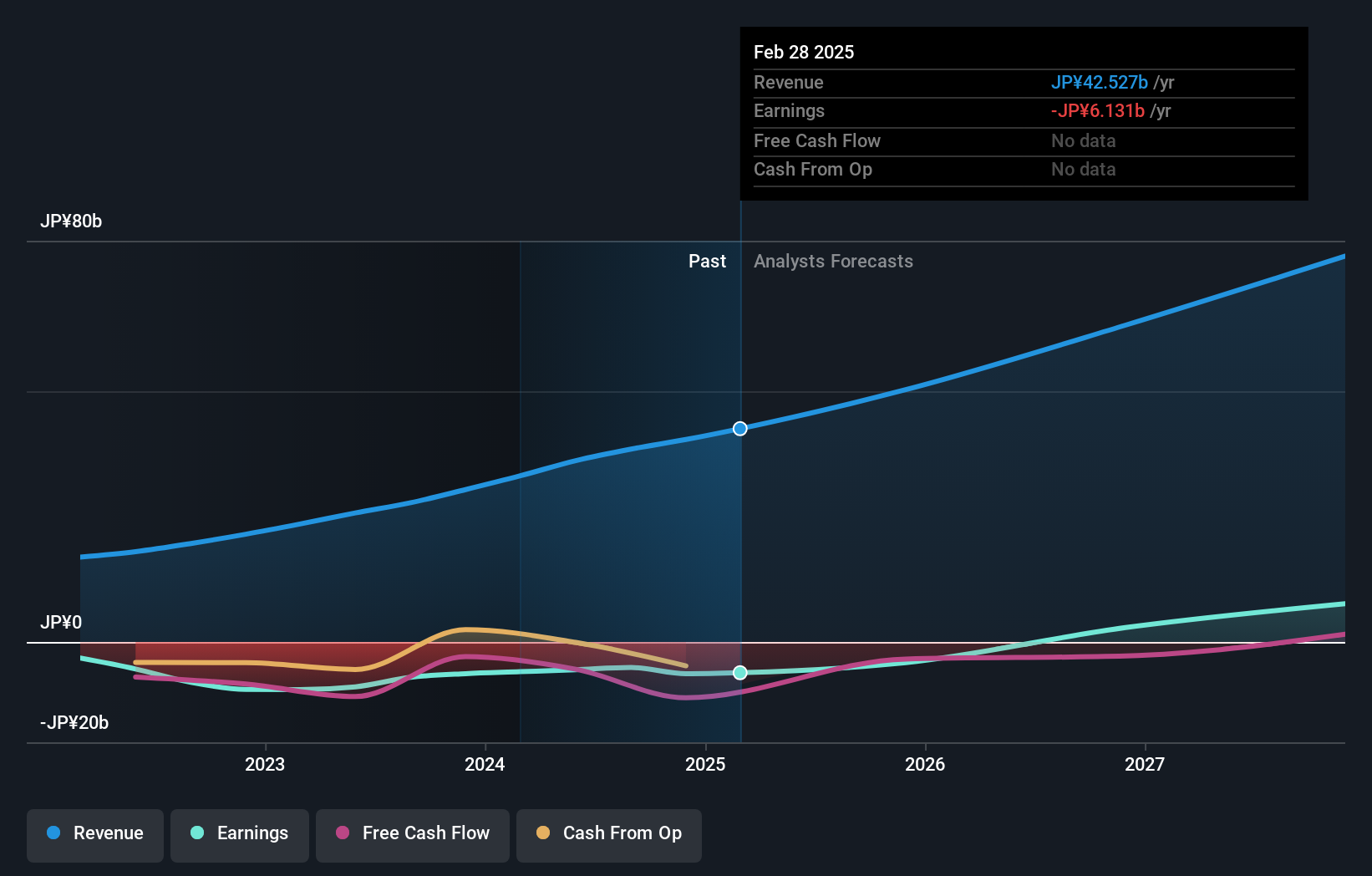

Money Forward (TSE:3994)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Money Forward, Inc. offers financial solutions for individuals, financial institutions, and corporations mainly in Japan, with a market capitalization of ¥275.06 billion.

Operations: The Platform Services Business is a key revenue segment for Money Forward, Inc., generating ¥38.47 billion.

Money Forward, despite its current unprofitability, is poised for significant transformation with an anticipated revenue growth of 19.7% per year, outpacing the broader Japanese market's 4.1% annual expansion. This growth trajectory is underpinned by strategic moves such as the recent conversion of Knowledge Labo into a wholly-owned subsidiary, aimed at consolidating resources and enhancing product offerings. The company's commitment to innovation is further evidenced by its R&D expenditure trends which are crucial in maintaining competitive relevance in the fast-evolving tech landscape. Moreover, a forecasted profit growth rate of 57.5% annually over the next three years underscores potential turnaround prospects, aligning with broader industry dynamics where technological advancements continue to drive market demand and investment priorities.

- Delve into the full analysis health report here for a deeper understanding of Money Forward.

Explore historical data to track Money Forward's performance over time in our Past section.

Make It Happen

- Navigate through the entire inventory of 1292 High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:CCET

Cal-Comp Electronics (Thailand)

Manufactures electronic products worldwide.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives