Global markets have experienced a turbulent week, with U.S. stocks mostly lower amid AI competition fears and mixed corporate earnings results. Amidst such volatility, investors often seek opportunities in lesser-known areas of the market that may offer unique value propositions. Penny stocks, despite their somewhat outdated name, continue to attract attention for their potential to deliver growth when backed by strong financial fundamentals. In this article, we explore three penny stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.23B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.86 | £471.38M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.65 | £174.08M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.39 | MYR1.09B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$141.28M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$1.12 | HK$710.96M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.22 | £154.81M | ★★★★★☆ |

Click here to see the full list of 5,714 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Bremworth (NZSE:BRW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bremworth Limited manufactures and sells carpets and rugs across New Zealand, Australia, the United States, Canada, and other international markets with a market cap of NZ$39.08 million.

Operations: The company's revenue is primarily derived from its Carpets Sales and Manufacturing segment, which generated NZ$57.08 million, supplemented by NZ$25.55 million from Elco Direct Wool.

Market Cap: NZ$39.08M

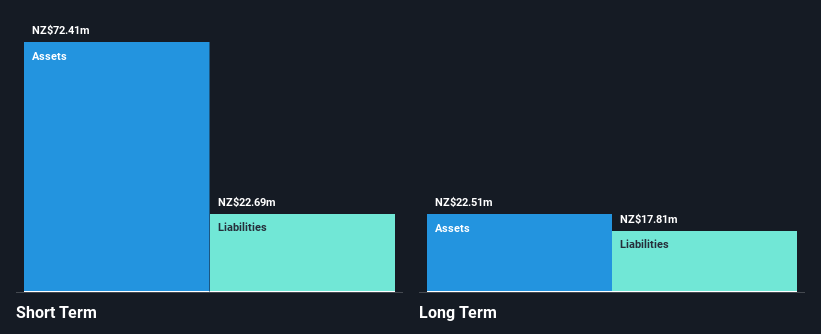

Bremworth Limited, with a market cap of NZ$39.08 million, generates revenue primarily from its Carpets Sales and Manufacturing segment (NZ$57.08M) and Elco Direct Wool (NZ$25.55M). The company is debt-free, which eliminates concerns over interest payments and indicates improved financial stability compared to five years ago when it had a debt-to-equity ratio of 38.4%. Despite stable weekly volatility over the past year, Bremworth's share price has been highly volatile recently. Its Price-To-Earnings ratio of 8.4x suggests better value than the broader NZ market average of 20.1x, although recent negative earnings growth (-56.8%) poses challenges for comparison within its industry.

- Jump into the full analysis health report here for a deeper understanding of Bremworth.

- Gain insights into Bremworth's past trends and performance with our report on the company's historical track record.

NZX (NZSE:NZX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NZX Limited operates a stock exchange in New Zealand and has a market cap of NZ$497.07 million.

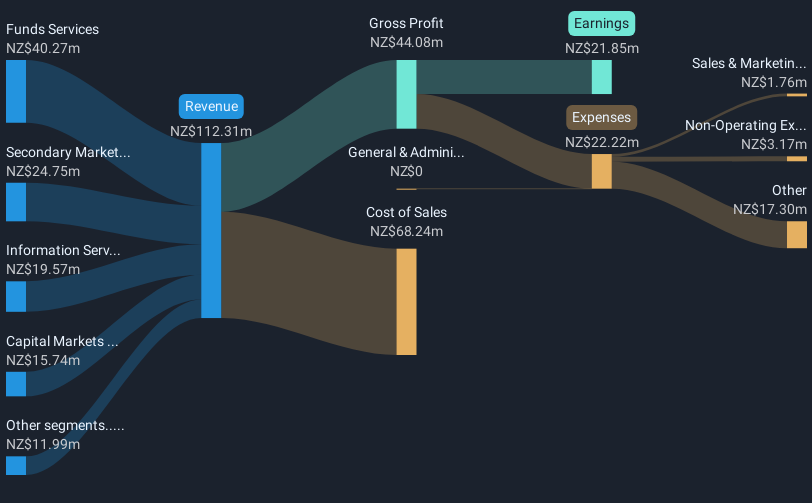

Operations: The company's revenue is derived from several segments: Regulation (NZ$3.89 million), Wealth Technology (NZ$8.01 million), Funds Services (NZ$40.27 million), Secondary Markets (NZ$24.75 million), Corporate Services (NZ$0.10 million), Information Services (NZ$19.57 million), and Capital Markets Origination (NZ$15.74 million).

Market Cap: NZ$497.07M

NZX Limited, with a market cap of NZ$497.07 million, shows stable weekly volatility and satisfactory debt levels, reflected in its net debt to equity ratio of 39.2%. Despite a low return on equity at 17.5%, the company has seen significant earnings growth of 58.9% over the past year, surpassing industry averages and aided by large one-off gains impacting results. While dividends are not well covered by earnings or cash flow, interest payments are well managed with EBIT covering them 6.9 times over. Recent board changes include David Hunt's appointment, bringing extensive governance experience to the team starting January 2025.

- Click to explore a detailed breakdown of our findings in NZX's financial health report.

- Explore NZX's analyst forecasts in our growth report.

Anacle Systems (SEHK:8353)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anacle Systems Limited develops enterprise business and energy management software solutions across Singapore, Malaysia, Thailand, the People’s Republic of China, and internationally with a market cap of HK$293.02 million.

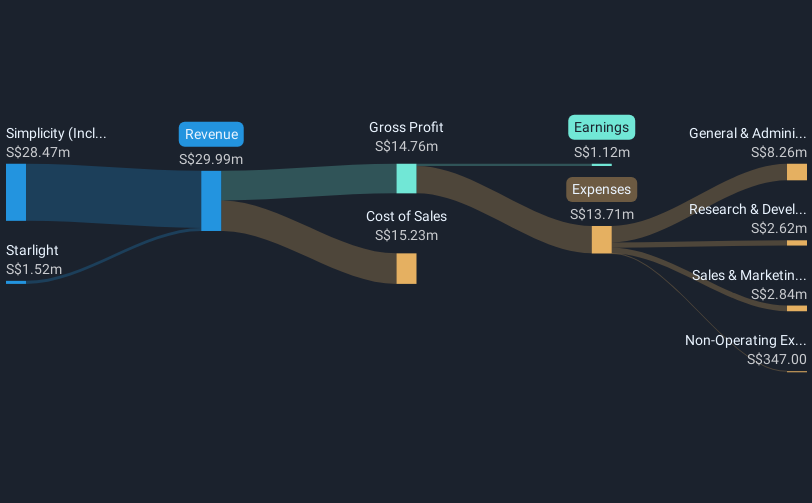

Operations: The company's revenue is derived from two segments: Simplicity (including Spacemonster) contributing SGD 28.47 million and Starlight generating SGD 1.52 million.

Market Cap: HK$293.02M

Anacle Systems, with a market cap of HK$293.02 million, has shown a positive trajectory in its financials despite challenges typical for stocks in its category. The company reported sales of SGD 14.5 million for the first half of 2024, up from SGD 11.22 million the previous year, marking an improvement in profitability with net income reaching SGD 0.089853 million compared to a loss previously. With no debt and sufficient short-term assets covering liabilities, Anacle maintains financial stability while experiencing some volatility and lower profit margins recently at 3.7%, down from last year's 9.3%.

- Click here and access our complete financial health analysis report to understand the dynamics of Anacle Systems.

- Understand Anacle Systems' track record by examining our performance history report.

Summing It All Up

- Unlock our comprehensive list of 5,714 Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:8353

Anacle Systems

Develops enterprise business and energy management software solutions in Singapore, Malaysia, Thailand, the People’s Republic of China, and internationally.

Flawless balance sheet low.

Market Insights

Community Narratives