- New Zealand

- /

- Consumer Finance

- /

- NZSE:GFL

Is Now The Time To Put Geneva Finance (NZSE:GFL) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Geneva Finance (NZSE:GFL). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Geneva Finance

How Fast Is Geneva Finance Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. Geneva Finance managed to grow EPS by 5.6% per year, over three years. That might not be particularly high growth, but it does show that per-share earnings are moving steadily in the right direction.

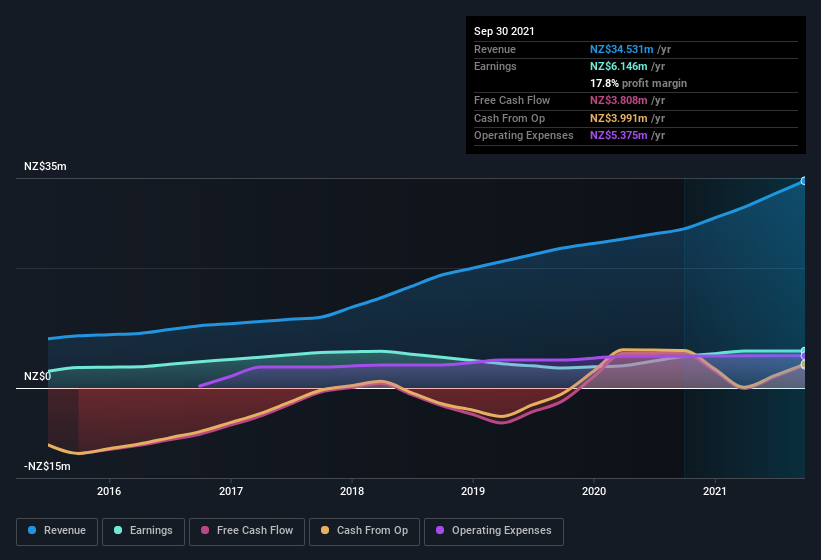

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Geneva Finance's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Geneva Finance maintained stable EBIT margins over the last year, all while growing revenue 30% to NZ$35m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Geneva Finance is no giant, with a market capitalization of NZ$47m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Geneva Finance Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We haven't seen any insiders selling Geneva Finance shares, in the last year. With that in mind, it's heartening that Daran Nair, the Independent Non-Executive Director of the company, paid NZ$9.5k for shares at around NZ$0.73 each.

Is Geneva Finance Worth Keeping An Eye On?

As I already mentioned, Geneva Finance is a growing business, which is what I like to see. While some companies are struggling to grow EPS, Geneva Finance seems free from that morose affliction. The icing on the cake is that an insider bought shares during the year, which inclines me to put this one on a watchlist. It is worth noting though that we have found 3 warning signs for Geneva Finance (1 is a bit unpleasant!) that you need to take into consideration.

As a growth investor I do like to see insider buying. But Geneva Finance isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:GFL

Geneva Finance

Geneva Finance Limited lends money to individuals, companies, and other entities primarily in New Zealand and Tonga.

Medium and good value.

Market Insights

Community Narratives