- New Zealand

- /

- Food and Staples Retail

- /

- NZSE:MFB

Market Might Still Lack Some Conviction On My Food Bag Group Limited (NZSE:MFB) Even After 26% Share Price Boost

My Food Bag Group Limited (NZSE:MFB) shares have had a really impressive month, gaining 26% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 9.0% in the last twelve months.

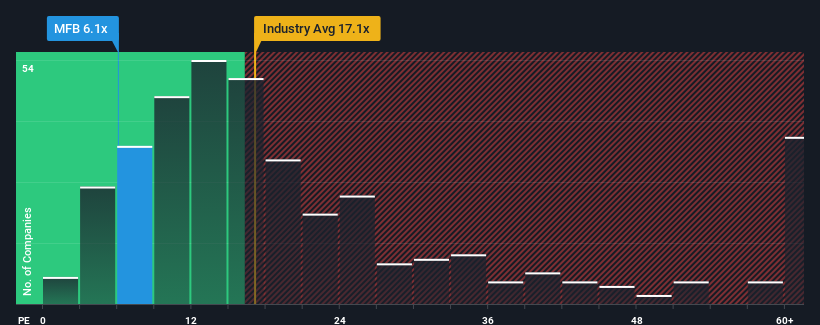

In spite of the firm bounce in price, My Food Bag Group may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.1x, since almost half of all companies in New Zealand have P/E ratios greater than 16x and even P/E's higher than 30x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times haven't been advantageous for My Food Bag Group as its earnings have been falling quicker than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for My Food Bag Group

Is There Any Growth For My Food Bag Group?

The only time you'd be truly comfortable seeing a P/E as depressed as My Food Bag Group's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 38%. Even so, admirably EPS has lifted 148% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 18% per year as estimated by the only analyst watching the company. With the market predicted to deliver 18% growth per annum, the company is positioned for a comparable earnings result.

With this information, we find it odd that My Food Bag Group is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From My Food Bag Group's P/E?

My Food Bag Group's recent share price jump still sees its P/E sitting firmly flat on the ground. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of My Food Bag Group's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for My Food Bag Group (1 shouldn't be ignored!) that you need to be mindful of.

If these risks are making you reconsider your opinion on My Food Bag Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:MFB

My Food Bag Group

Engages in creating and delivering meal kits, pre-prepared ready-to-heat meals, and grocery items in New Zealand.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026