- New Zealand

- /

- Food and Staples Retail

- /

- NZSE:MFB

Investors Still Aren't Entirely Convinced By My Food Bag Group Limited's (NZSE:MFB) Earnings Despite 27% Price Jump

My Food Bag Group Limited (NZSE:MFB) shares have had a really impressive month, gaining 27% after a shaky period beforehand. But the last month did very little to improve the 60% share price decline over the last year.

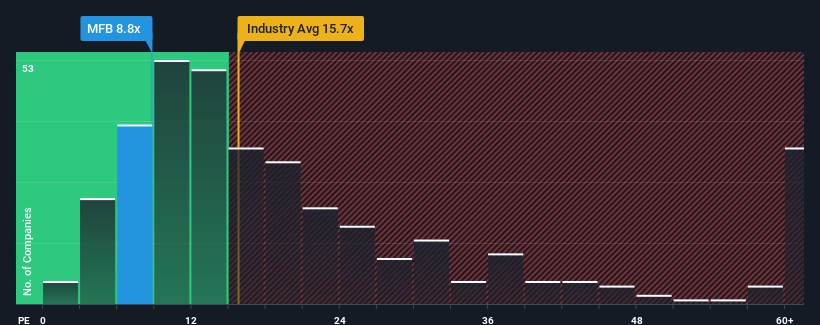

In spite of the firm bounce in price, My Food Bag Group may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.8x, since almost half of all companies in New Zealand have P/E ratios greater than 16x and even P/E's higher than 31x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

My Food Bag Group has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for My Food Bag Group

Is There Any Growth For My Food Bag Group?

There's an inherent assumption that a company should underperform the market for P/E ratios like My Food Bag Group's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 73%. This means it has also seen a slide in earnings over the longer-term as EPS is down 71% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 22% each year over the next three years. Meanwhile, the rest of the market is forecast to expand by 21% each year, which is not materially different.

With this information, we find it odd that My Food Bag Group is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

My Food Bag Group's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that My Food Bag Group currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with My Food Bag Group (at least 1 which doesn't sit too well with us), and understanding them should be part of your investment process.

If you're unsure about the strength of My Food Bag Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NZSE:MFB

My Food Bag Group

Engages in creating and delivering meal kits, pre-prepared ready-to-heat meals, and grocery items in New Zealand.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives